Aeriel picture of Keane’s hydraulic fracturing operations in the Marcellus Shale. Combined, C&J and Keane will have a footprint that includes the Permian, Appalachia, Eagle Ford, Rockies, Bakken, Midcontinent and California regions. (Source: Keane Group Inc.)

Pressure pumpers C&J Energy Services Inc. and Keane Group Inc. agreed on June 17 to combine in what analysts are calling a “true merger of equals.”

In the all-stock transaction, valued at roughly $745.7 million, is set to create the third largest pressure pumper in the U.S., better positioning the Houston-based companies to endure tough market conditions faced by the oilfield service sector.

Jim Wickland, research analyst with Stephens Inc., noted during an industry event in Houston earlier this year that the oilfield service index in February was “dead flat” to where it was 15 years ago in 2004. Comparatively, the E&P index saw a 300% increase even with the current weakness in the public markets.

RELATED: From OGI Editor-In-Chief: Depleting The OFS Sector

The challenged environment for oilfield service providers has led to calls for consolidation and the C&J-Keane merger could be an indicator of consolidation heating up for the sector’s pressure pumping industry, according to analysts with Tudor, Pickering, Holt & Co. (TPH).

“Consolidation certainly nice to see, but we’ll need [much] more to notably enhance pressure pumping industry structure,” TPH analysts said in a research note on June 17 noting the transaction is a “true merger of equals.”

Among pressure pumpers in the U.S., TPH analysts said, merged, the companies will be behind only Halliburton Co. and Schlumberger Ltd. in terms of size.

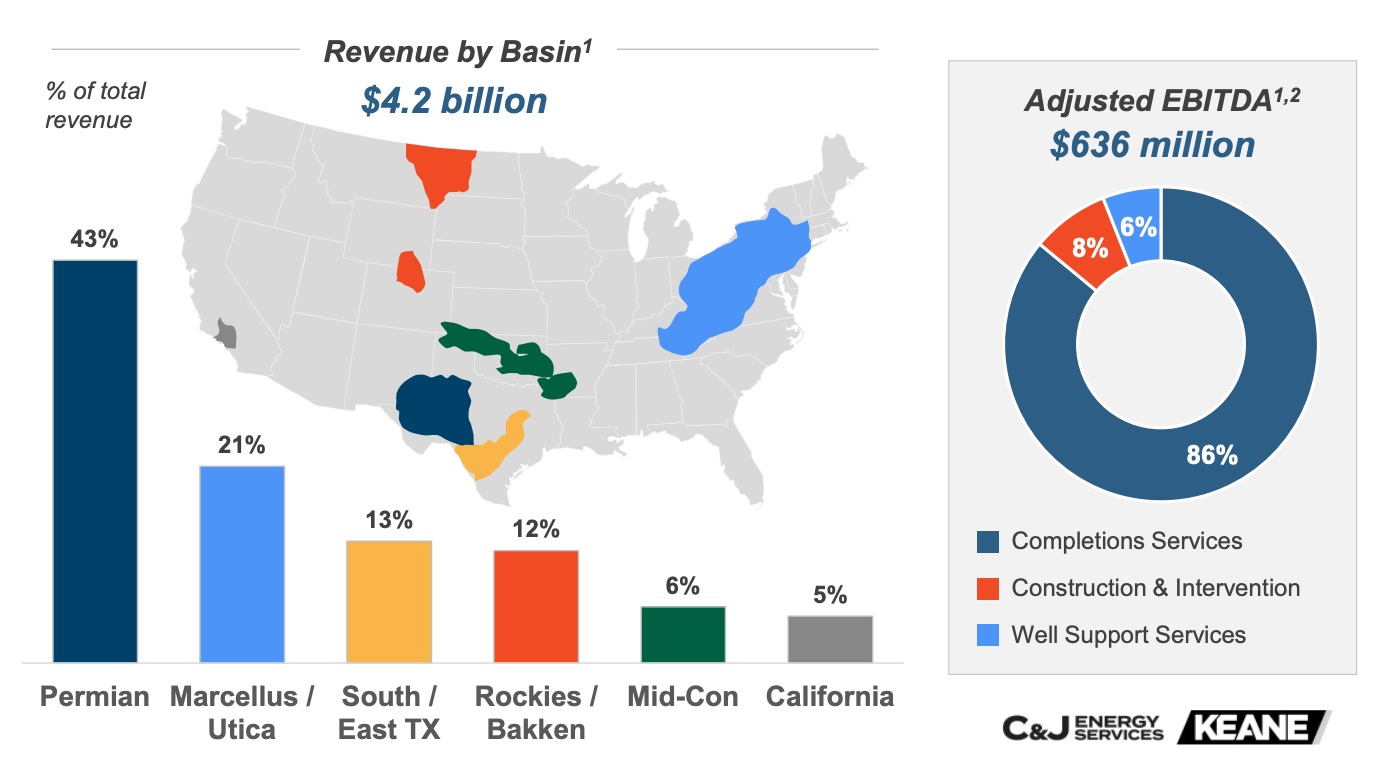

Combined, the companies have 2.3 million hydraulic fracturing horsepower (HHP) consisting of about 50 frac fleets, 158 wireline trucks, 81 pumpdown units, 28 coiled tubing units, 139 cementing units and 364 workover rigs. The combined company’s footprint will also cover several of the most active U.S. shale plays including the prolific Permian Basin.

(Source: C&J Energy Services Inc./Keane Group Inc. June 2019 Investor Presentation)

1) LTM ending March 31, 2019. 2) Pro-forma adjusted EBITDA before $100 million

of gross annualized run-rate synergies.

Additionally, the companies said the combination will provide for $100 million of synergies, which analysts with Capital One Securities Inc. called “compelling.”

“The geographic overlap makes sense along with both having a higher-quality frac customer base than many of their peers,” the analysts said in a June 17 research note. “Logical question is what’s next? Could a well service/fluid management company be folded in at a later date that would provide further synergies?”

Additionally, Capital One analysts questioned which service provider could be the next in a potential wave of mergers in the oilfield services sector.

“[Superior Energy Services] HHP fleet remains ripe for consolidation with the money that was invested in the fleet, Texas-only presence, and the large-cap customer base,” the analysts added.

C&J and Keane expect to complete the combination in fourth-quarter 2019. As part of the agreement, C&J shareholders will receive about 1.6 shares of Keane for each C&J share. Additionally, current C&J shareholders will receive a $1 cash dividend.

Shareholders of C&J and Keane will own roughly 50% of the new company. The enterprise value of the combined company is projected to be roughly $1.8 billion, including $255 million of net debt.

At closing, Keane CEO Robert Drummond will stay on as president and CEO of the combined company. Meanwhile, Patrick Murray, chairman of the C&J board of directors, will serve as chair of the combined company’s board.

In a statement on June 17, Drummond said: “With two strong teams, enhanced and diversified operations, a strong balance sheet, ample liquidity, attractive free cash flow and a legacy of successful R&D, the combined company will be well positioned to further invest in technology and innovation, as well as the career development of our employees to drive sustainable growth in our dynamic industry. In C&J, we’ve found a partner who is equally committed to our strong employee culture with a focus on safety and customers, with whom we are eager to join forces to leverage our combined resources and strengths.”

The merger requires C&J and Keane shareholder approval, regulatory approvals and receipt of other customary closing conditions. The combined company’s corporate headquarters will remain in Houston.

Citi is financial adviser to Keane for the transaction. Schulte Roth & Zabel LLP is the company’s legal adviser. The special committee of the Keane board is receiving financial advice from Lazard and Simpson Thacher & Bartlett is serving as the committee’s legal adviser. Meanwhile, Morgan Stanley & Co. LLC and J.P. Morgan Securities LLC are financial advisers to C&J, with Morgan Stanley as lead advisor. Kirkland & Ellis is legal adviser to C&J.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

E&P Highlights: March 25, 2024

2024-03-25 - Here’s a roundup of the latest E&P headlines, including a FEED planned for Venus and new contract awards.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.