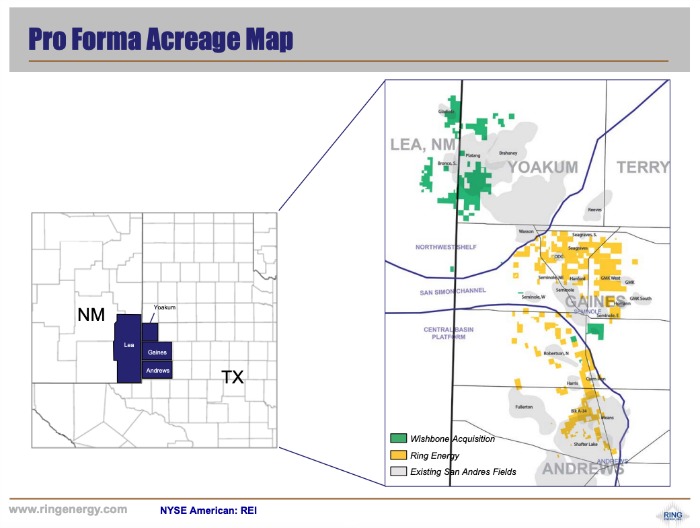

Wishbone’s North Central Basin Platform assets consist of 49,754 gross (37,206 net) acres of mostly contiguous leasehold adjacent to the prolific Wasson and Brahaney fields. (Source: Hart Energy/Shutterstock.com)

Ring Energy Inc. (AMEX: REI) added to its Central Basin Platform position in the Permian Basin on Feb. 26 with the $300 million cash and stock acquisition from private-equity backed Wishbone Energy Partners LLC.

Ring said it agreed to acquire Wishbone’s North Central Basin Platform assets for $270 million cash and $30 million of Ring common stock. The Midland, Texas-based company plans to fund the acquisition through an increased $1 billion senior credit facility led by SunTrust Robinson Humphrey.

Based in Houston, Wishbone was founded in 2013 with backing from Quantum Energy Partners to focus in select onshore conventional and unconventional reservoirs, with emphasis on the Permian Basin, East Texas and the Midcontinent, according to the company’s website.

Wishbone’s North Central Basin Platform assets consist of 49,754 gross (37,206 net) acres of mostly contiguous leasehold located primarily in Southwest Yoakum County, Texas, and East Lea County, N.M. The assets also include a base of 127 gross wells currently producing an average daily net production of 6,000 barrels of oil equivalent.

The acquisition includes a 77% working interest and a 58% net revenue interest in the assets, which are roughly 96% operated by current production volume. Ring will be the operator.

“The future is very bright based on the great results from its existing wells combined with the exceptional results we are experiencing with our on-going drilling and development program,” Ring CEO Kelly Hoffman said in a statement on Feb. 26. “This acquisition doubles our daily production, adds another 37,000 prime acres to our horizontal footprint and nearly doubles our proved reserves.”

In addition, Ring is also picking up from the Wishbone deal current infrastructure including 1,385 acres of owned surface rights, 21 saltwater disposal wells, 15 source water wells, five frac ponds and three caliche pits for road material and new locations.

Pro forma the acquisition, Hoffman added that Ring will also have more than 20 years of San Andres horizontal drilling inventory using a two-rig development program.

“We believe this acquisition is a major step toward achieving our stated goals to continue to generate strong annualized production growth and to become cash flow neutral/positive by the second half of 2019,” he said.

SunTrust Bank provided a financing commitment letter for the increased $1 billion senior credit facility, which has a borrowing base of $425 million. SunTrust Robinson Humphrey will act as lead arranger and book manager for the financing.

SunTrust Robinson Humphrey is also Ring’s exclusive financial adviser for the transaction and Baker Hostetler acted as legal counsel to Ring. Law firm Vinson & Elkins advised Wishbone Energy Partners in the sale of its North Central Basin Platform assets.

Ring said in the release that it expects to close the Wishbone acquisition early in second-quarter 2019. The transaction will an effective date of Nov. 1.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Solar Sector Awaits Feds’ Next Move on Tariffs

2024-04-25 - A group of solar manufacturers want the U.S. to impose tariffs to ensure panels and modules imported from four Southeast Asian countries are priced at fair market value.