Areas considered ultra-core are typically the deepest, highest pressure and lowest GOR parts of the Permian Basin, according to Wood Mackenzie. (Source: GB Hart/Shutterstock.com)

With expectations that service cost concessions will disappear as oil and gas companies work to survive, the search may be on for hidden opportunities with low breakevens.

Analysts at energy research firm Wood Mackenzie pinpointed what they say is left standing in basins across in the U.S., including in the best zip codes of the Permian Basin. These areas, they say, can still make money—even at today’s low oil prices. Players not already in the game still have a shot to get off the bench because some cash-strapped companies are looking to get out.

Brandon Myers, a geoscientist and senior analyst with Wood Mackenzie’s Lower 48 research team, turned attention to ultra-core areas of the 2nd Bone Spring Sand and Wolfcamp A Northeast Extension in the Delaware sub-basin during a webinar this week.

Some wells in the basin can clear a “10% half-cycle hurdle rate even with WTI below US$30/bbl,” according to Wood Mackenzie.

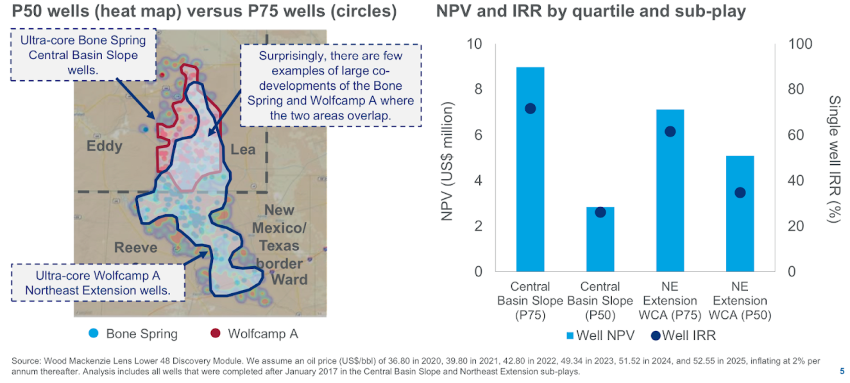

Looking at petrophysical properties, geological attributes and other research using its integrated data analytics platform, Myers said companies want to be “hugging that border between the black oil and volatile oil,” which runs through the area of New Mexico’s Lea and Eddy counties and Reeves County, Texas. Too far west, he said, there’s lower quality product while heading into the condensate window. Too far east in the Wolfcamp, one could run into the hydrogen sulfide corridor or mass wasted carbonates off the Central Basin Platform.

Areas considered ultra-core, producing the most with high oil cuts, are typically the deepest, highest pressure and lowest gas-oil ratio parts of the basin.

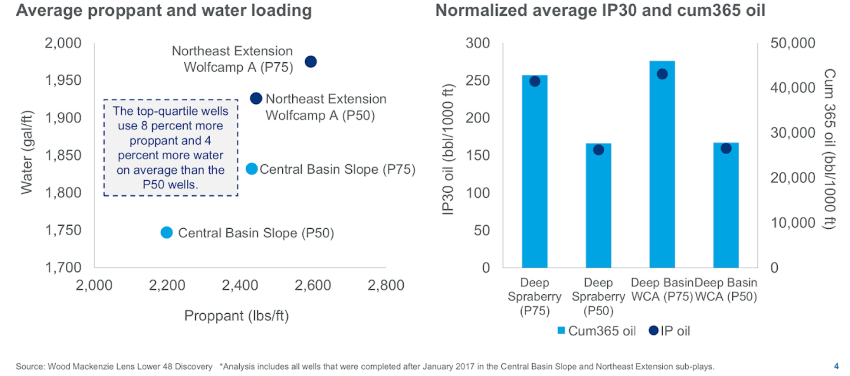

The firm also incorporated completion and engineering designs, noting more intense completions resulted in more production per foot, in these ultra-core areas. Research showed the top-quartile wells used on average 8% more proppant and 4% more water than P50 wells, according to Myers’ data.

In the Delaware, especially the Bone Spring, “there is a huge spread between your median operator in the best sub-play and your top quartile operator in the best sub-play,” compared to other plays, Myers said. This reinforces the concept that being in the best rock is not good enough in today’s price environment, he added.

To determine the top quartile within the top two core sub-plays, the top 25% of well results using the P75 case were ranked by cumulative 180-day oil per foot, the firm said.

Location within the zip code matters.

“It’s usually two to three companies making up 40% to 60% of those top quartile wells,” Myers said.

With geologic and petrophysical cutoffs mapped along with completion designs, analysis pointed to an area that could probabilistically create a distribution around that P75 case, Myers said.

“There are about 8,400 two-mile locations left in what we consider that defensive strategy ultra-core,” compared to about 300 locations in the Bakken, he said.

He added that, “there is not a defensive fortress in every basin where operators will retreat to and keep production up. It just doesn’t exist anymore. We’ve drilled through it. But it does exist here” in the Permian.

Outside from small sections of the Meramec, for example, he doesn’t believe there are any ultra-core areas left in the SCOOP/STACK, where the rig count has plummeted to the single digits from more than 130.

The rig count has dropped dramatically in the Permian Basin as well; however, there are still some rigs operating in this ultra-core area, Myers noted.

He called it no surprise that companies like Devon Energy Corp. had opted to drop rigs in the SCOOP/STACK and high-grade capital into the Permian.

“It makes sense for them to do that because they can actually still generate returns through this year,” he said.

For those not already in the ultra-core areas, the best way to gain access is to become a working interest partner, according to Robert Clarke, vice president of upstream research for Wood Mackenzie. Budget constraints are causing some existing partners to back out, so “with the right network, I think there’s a good chance you can get into some of these wells nonop.”

Wood Mackenzie’s data show Devon, EOG Resources Inc. and Concho Resources Inc. have drilled more than half of the P75 wells in the ultra-core areas of the Bone Spring Central Basin Slope and Wolfcamp A Northeast Extension.

Such wells produce 85% more oil than P50 wells, translating to a $6.14 million increase in NPV10 and 175% jump in IRR, the firm’s data showed for the Bone Spring.

However, it may not be in an operator’s best interest to bring ultra-core wells online now.

“If you’re not starved for cash flow today [and] you can afford to wait, there is a little bit of asset preservation that you can achieve by waiting,” Myers said.

Waiting until 2021 could improve the payback period by 21%, according to Wood Mackenzie.

There are, however, exceptions.

“If you drill a top quartile well in the Bakken ultra-core in 2021 instead of Q1 2020, …you’d actually break even on that 2021 well before your 2020 well paid out,” Myers said. “And we did not have an aggressive price deck when we walked through that.”

Recommended Reading

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.