Part of TC PipeLine’s Gas Transmission Northwest LLC’s 1,353-mile pipeline is constructed in Oregon. Source: TC PipeLines

Houston-based TC PipeLines LP (TCP) traces its corporate ancestry to Canada, a land of layered clothing that supplies 80% of the world’s maple syrup.

Like their northern kin who move tree-borne thick liquids, TCP’s executives rely on a strategy of patience, stability, consistency and growth. The rewards to investors who believe in the company have been similar to rewards bestowed upon the syrup faithful: sweet.

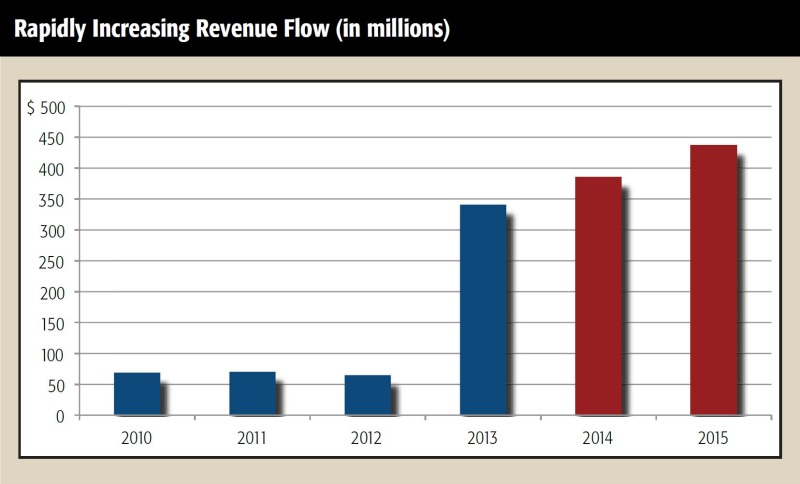

In addition to delivering oil and gas to customers, TCP delivers steadily increasing dividends to unitholders. The company’s second-quarter distribution totaled $52 million, a 3.7% increase over first-quarter 2014, and its distribution for the first six months, $103 million, is 21.2% above the $85 million paid during the same period of 2013. Its earnings have exceeded analyst predictions for three straight quarters.

Expect more of the same. TCP operates natural gas lines that keep revenues flowing even when the gas isn’t.

“The partnership generated cash flows of $77 million in the second quarter and net income of $37 million,” said Steve Becker, the company’s chairman and president, during the second-quarter earnings call with analysts. “These results reflect the strong performance of our portfolio of pipeline assets, where our customers pay for the capacity reserved regardless of their utilization.”

They also reflect a company’s ability to deliver increased dividends to investors for 15 consecutive years.

Stable strategy

TCP owns and operates pipeline assets in the U.S. Its general partner, Calgary, Alberta-based TransCanada Corp., boasts a market capitalization of around $43 billion and a capital project list worth $38 billion that it plans to complete by 2020.

The list includes $13 billion in natural gas facilities to connect new product with domestic and overseas markets, and $25 billion in crude oil pipeline and power generation. To fund this ambitious project, TransCanada expects to drop down substantial U.S. gas pipeline assets to TCP over the next few years.

In 2013, dropdowns included a $1.05 billion deal to expand TCP’s interest in Gas Transmission Northwest LLC and Bison Pipeline LLC to 70%. These pickups, along with increased earnings from its Great Lakes Gas Transmission LP unit, are behind the increased distribution.

“The major driver this quarter for the $3 million increase in net income was the higher equity earnings from Northern Border and Great Lakes,” Nathan Brown, controller and principal financial officer, said during the second-quarter call.

TCP’s strategy is to generate longterm, stable and predictable cash flow to investors, so the stubbornly low price of natural gas is not really much of a hindrance when it’s the capacity that is being sold.

“TC PipeLines holds partial and full interests in six Federal Energy Regulatory Commission-regulated natural gas pipelines that have a total capacity to move 8.9 billion cubic feet per day (Bcf/d) of natural gas, or approximately 10% of North America’s average daily use, from a diversified portfolio of supply basins and geographies,” Davis Sheremata, a spokesman for the company, told Midstream Business. “These pipelines are well connected into the markets they serve and are essential infrastructure in their regions.

“Currently, five of our six assets are secured with long-term, ship-or-pay contracts, which means that our shippers pay us regardless of whether or not they ship gas on our pipelines,” he said. “These contracts therefore act to limit our commodity price exposure.”

Expansion options

TCP’s growth will follow its general partner’s capital program, one that is predicated on a continental approach. TransCanada is the largest developer in Mexico and is positioned to engage in future natural gas pipeline projects as the Mexican government builds up its infrastructure of gas power plants and pipelines to feed them.

“There is a lot of growth potential in both western Canada and Mexico,” Becker said. “We see abundant natural gas growth due to the shale gas revolution in North America, growing oil supply from U.S. shale plays and rapidly growing oil sands developments in northern Alberta in Canada.”

Much of the growth centers on the Marcellus area in the northeast U.S., where swift expansion of natural gas production has pushed pipeline capacity to saturation levels.

“The gas is now trying to move out of the Northeast into storage areas in Michigan as well as down to the Gulf Coast, where there are LNG and petrochemical projects,” Becker said. “This is creating opportunities for pipeline companies, and TransCanada recently signed up capacity on its ANR pipeline to flow up to 2 Bcf/d of gas and is looking at additional opportunities to expand and grow.”

Becker noted other opportunities to branch out:

- Western Canada: “The Montney Play in northeast British Columbia is very similar to Marcellus in terms of geology, and TransCanada is involved in this area with its large NGTL System,” Becker added. “This gas will serve both Alberta markets and downstream markets through TC PipeLines’ assets;”

- Exports: Several proposed LNG projects would ship gas from Canada’s west coast. TransCanada is involved with three projects that would move gas from the Montney region to LNG plants on the West Coast; and

- Northern Alberta: This region is home to the world’s second-largest reserves of oil sands. “Natural gas is an important part of the oil production process,” Becker said, “and TransCanada is the only supplier of natural gas into the oil sands region, which creates a lot of capital expansion opportunity for growth in this gas business as well as the oil business.”

Source: Bloomberg

Big pipes

The oil sands’ growth makes the area particularly promising.

“Looking at the oil production out of the oil sands, which has been growing at approximately 200,000 to 300,000 barrels [bbl] per year, major pipeline extensions are required to move the oil to market,” he said. “One of these projects is TransCanada’s Keystone XL project, which would move the oil down to the Gulf Coast, and another is TransCanada Energy East project, which would move the oil across Canada to the East Coast of the country.”

Though the U.S. Energy Information Administration ranks Canada fourth in the world in proved petroleum reserves with 173.2 billion bbl, the concentration of oil plays in the western part of the country forces the import of crude into the eastern side. The 2,860-mile Energy East is designed to resolve this problem with its ability to carry 1.1 million bbl/d of crude from Alberta and Saskatchewan to refineries in eastern Canada.

Both the Keystone XL Pipeline extension and the Energy East project have encountered regulatory hurdles. The Keystone project requires approval by the U.S. State Department, which is waiting for litigation to work its way through Nebraska’s state courts before announcing its decision. Keystone has encountered opposition from environmentalists who cite concerns over the potential damage from a leak of tar sands crude and from property owners objecting to land acquisition.

“Obviously a [State Department] decision isn’t going to be made until after the November elections, and it may not be made until considerably into next year when the new Congress comes in,” John Kneiss, Washington-based director, Stratas Advisors, a Hart Energy company, told Midstream Business. “Litigation, state litigation, has to work its way through courts, and I think they’ve delayed the decisionmaking until the Nebraska [Supreme Court] decision is done.”

The court began hearing arguments in September.

“I’m starting to lean toward a decision by the President to kill it,” said Kneiss.

The Energy East project faces opposition from various native First Nation groups in Canada. TCP, however, is not concerned that the future dropdown of assets will include a dropdown of political headaches.

“In its earnings call in July, TransCanada noted that the U.S. portion of the existing Keystone Pipeline, which has delivered more than 610 million bbl of oil since going into service in 2010, could potentially be a candidate for dropdown to TCP at some point in the future but not in the near term,” said Sheremata. “It has been TransCanada’s preference to drop down mature assets to TCP, and it has a sizable portfolio of U.S. natural gas pipeline assets that it will consider as drop-down candidates first. As a pipeline that will be located entirely within Canada, Energy East is a non-qualifying asset for U.S. MLP purposes.”

Sheremata was also unconcerned about the size of the dropdowns, which carry an EBITDA larger than TCP’s $297 million.

“TransCanada has indicated that the assets will be dropped down over the next few years, which will allow the LP time to adjust to its increased asset base,” he said. “Essentially, though, the assets will continue to be operated and managed by TransCanada.”

TCP’s Great Lakes Gas Transmission LP connects natural gas supplies in western Canada with the U.S. Midwest via a 2,115-mile pipeline. Source: TC PipeLines

Challenge 1: winter

With the apparent strengthening of El Niño, which is warming waters from the eastern Pacific Ocean’s equatorial region to northeast Australia, the southern jet stream could be expected to pull more moisture toward the U.S. in the next few months. Warmer water in the northeast and northern Pacific supports warmer and drier weather. If western Canada is affected, cold air could be pushed into the U.S.

Several winter forecasts indicate a repeat of 2013 to 2014, with one website, the satirical EmpireNews.net, alarming unsuspecting readers with the unlikely projection of “50 times the amount of snow you’ve had in the past.” The same site also “reported” the Canadian Parliament’s decision to abandon hockey as the country’s “thing.”

But a cold winter, while potentially a breeding ground for profits both for movers of Polartec fleece and natural gas, requires preparation. TCP believes it is ready.

“With the results of the summer here, where we have some pretty substantial production growth out of the U.S., we have seen some significant injections back into storage,” said Stuart Kampel, the company’s vice president and general manager, during the earnings call. “I think we exited the winter season pretty depleted on the storage inventories. I think there are projections now that we’re going to come back somewhere closer to the five-year range.”

Storage component

TCP does not hold interests in storage assets, but the Great Lakes Pipeline, owned jointly by TCP and TransCanada, provides direct pipeline access into Michigan storage fields owned by TransCanada’s ANR Pipeline. That makes a critical component of the upper Midwest gas supply, as evidenced by the recent bitter winter.

“Storage levels were drawn down considerably during the past very cold winter and, although storage levels are refilling during the current injection season, there is still available capacity for storage as storage levels in the U.S. in aggregate, as at the end of August, are estimated to be approximately 500 Bcf below the five-year average,” added Sheremata.

“Weather fluctuations in the upcoming winter could put Michigan storage and Great Lakes in a position to provide a critical balancing role for gas supply and demand, including for the northeast U.S.,” he said.

TCP’s role is to be primed to move it.

“I think all of our pipelines are competitive in their markets,” said Kampel. “We’re seeing a lot of dock filling on the Northern Border Pipeline, for example, with Bakken gas and gas coming out of the Bison Pipeline.”

Challenge 2: environment

“The Bakken situation is very interesting to us, as the State of North Dakota has recently made efforts to curtail some of the flaring activities that are going on with relation to associated gas or solution gas in that state,” Kampel continued. “So that’s putting some pressure on for increased capacity into the Northern Border Pipeline.”

And that spells opportunity.

“Northern Border is very well-positioned geographically to capture growing associated gas supply in the Bakken region,” Sheremata said. “The efforts to reduce flaring of natural gas are providing incentive to producers in the region to ensure their continued production of oil by finding an outlet for the associated natural gas being produced.”

Northern Border Pipeline Co., jointly owned by TCP and Tulsa, Okla.-based ONEOK Partners LP, operates a 1,407-mile interstate natural gas pipeline system that stretches from the Montana-Saskatchewan border to North Hayden, Ind. The pipe has a design capacity of about 2.4 Bcf/d, making it an important connection between the Western Canadian Sedimentary Basin and the U.S. Midwest.

Northern Border transports natural gas from the Williston Basin of Montana and North Dakota, and the Powder River Basin in Wyoming and Montana, and synthetic gas produced at the Dakota Gasification plant in North Dakota.

Northern Border currently has about 400 million cubic feet per day of natural gas receipts from the Bakken Shale flowing onto its system.

“With a number of new gas processing plants in the area under development, we would expect the volume of natural gas receipt onto the Northern Border system from the Bakken area to double over the next five to seven years,” said Sheremata.

Challenge 3: pace

Investors can see the $38 billion in TransCanada growth projects (Becker hinted that the sum will grow) and anticipate—perhaps even virtually taste—the dropdowns heading TCP’s way, but analysts covering TCP betrayed some impatience with the process. They wanted to know when it would all happen.

Becker assured them that the program was on track, but “It’s just a bit lumpy, and I think people have to be a wee bit patient. But it certainly is coming.”

To finance its future, TCP implemented a $200 million at-the-market equity issuance program in August.

“The shelf was filed for up to $200 million, and this mechanism provides an excellent way for interested unitholders to buy into our low-risk business model,” said Sheremata. “Also, it provides a cost-efficient mechanism to help fund TCP’s expected growth as TransCanada drops down assets over time.”

Company executives were unapologetic about their refusal to alter a fundamental strategy of solid and steady, if unspectacular growth to appease the market’s short-term desires.

“We expect most of this capital to be spent by 2020, and so the program will reflect that spend,” said Becker. “And so it may come in lumps of specific transactions, but an investor who is looking to say, ‘Where will I be? I’m going to end up with an LP that will have doubled in size, has done accretive transactions.’ We’ll be able to grow our distribution as a result of that and gain a much broader, more solid portfolio.”

“You may want to choose to go to somewhere else that’s growing faster,” Becker said to an imaginary investor. “What we’re offering is a very solid, long-term platform with a varied program growth profile. And so we have people that are interested in that getting a 6% yield and a 3% to 4% growth rate and be able to look at it with very solid, low risk. And that’s basically what we have.”

Joseph Markman can be reached at jmarkman@hartenergy.com or 713-260-5208.

Recommended Reading

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Murphy Oil Names Eric Hambly as President, COO

2024-02-08 - Murphy Oil has promoted Eric M. Hambly to president and COO and E. Ted Botner to executive vice president. Both will continue to report to CEO Roger W. Jenkins.

EOG Resources Wildcatting Veteran Billy Helms to Retire

2024-04-02 - Joining an EOG Resources predecessor in 1981, Helms is among the pre-1986-oil-bust generation who later found success in shale.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.