Frac pump trailers with Universal Pressure Pumping’s “daisy chain” supplies gas for dual fuel operations. (Source: Universal Pressure Pumping)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

In today’s challenging market conditions, both E&P and service companies are continuously looking for opportunities to reduce costs. In hydraulic fracturing operations, diesel fuel is a significant expense. Higher pumping rates and pressures increase the amount of fuel required to perform the work. Even idling between stages consumes a lot of fuel; these large engines consume about 10 gal/hr while idling. With varying efficiencies and stage lengths, diesel fuel usage can exceed 20,000 gal/d for the frac pumps on one fracturing spread of equipment. A proven way to significantly reduce fuel consumption is to use dual fuel operations. Properly executed dual fuel operations can reduce the amount of diesel fuel a fracturing spread uses by as much as 55%.

For this discussion, “dual fuel” means operating a diesel engine on a combination of both diesel fuel and natural gas simultaneously. A diesel engine cannot run solely on natural gas because it needs the diesel burn to act as a spark plug in the engine to ignite the natural gas. This is because the auto-ignition temperature of natural gas is higher than what can be achieved in a diesel engine.

Caterpillar, Cummins and MTU all offer conversion kits for their Tier II engines. These engines can provide up to 70% diesel substitution when operated within given engine speeds and load parameters. They do not operate on natural gas during idle and low power conditions. These engines can switch seamlessly between diesel-only and dual fuel operations, preventing unwanted disruptions and downtime if there is a problem with the natural gas system on the engine or an interruption in the natural gas supply.

The following conditions must exist for optimal, cost-effective dual fuel operations:

• A single frac spread converted for dual fuel operations needs to have a minimum of eight pumping units able to operate with natural gas;

• Adequate natural gas supply in both pressure and available volume; and

• The quality of the natural gas, on which engines can operate, needs to be generally between an 800-Btu and 1,250-Btu lower heating value.

Cost savings factors

There are several factors that can impact the amount of savings experienced. Primarily, these factors are having an adequate gas supply, gas quality on which the engines can operate and engine condition.

Depending on how the equipment is configured, a natural gas source will need to be able to deliver a pressure of 60 psi to 150 psi at a rate of 3,681 cu. m/hr to 4,247 cu. m/hr (130,000 cf/hr to 150,000 cf/hr) to ensure adequate natural gas for each engine to operate. If the natural gas pressure drops too low, the engines will revert to full diesel operations.

Today’s dual fuel engines can operate on a variety of fuels ranging from raw field natural gas to processed pipeline natural gas. The key property that determines the suitability of the natural gas for use is its resistance to pre-ignition and detonation in the engine. Pre-ignition and detonation are the abnormal, uncontrolled burning of the fuel-air mixture in the engine. Pre-ignition is the premature ignition of the fuel-air mixture before the diesel injection cycle has started. Detonation is the spontaneous combustion of remaining unburned fuel-air in the cylinder after normal combustion of some of the fuel-air mixture. Both of these conditions are potentially damaging to the engine due to the very high increases in temperature and pressure within the cylinders. These conditions can cause broken piston rings, holes in pistons, damaged cylinder heads and more.

The fuels’ resistance to pre-ignition and detonation is measured as methane number (MN). The minimum required MN is specific to each engine’s manufacturer. If the available natural gas cannot meet the minimum MN, there are third-party services available that can reduce the excessive heavy hydrocarbons, which will increase the MN and decrease the Btu content of the fuel.

Pre-ignition and detonation are the limiting factors regarding how much natural gas can be used in the engines. As preignition or detonation increases, while operating on natural gas, the engines reduce the amount of natural gas introduced into the engine, thus limiting substitution up to the point that the natural gas is shut off.

The overall efficiency of the job can have an impact on the overall substitution achieved. This is because these engines do not use natural gas during idling, and low power operation pad efficiency impacts overall substitution and the resulting savings. Therefore, more time spent pumping results in more natural gas being used and less diesel being burned, which subsequently results in greater diesel savings.

Engine condition also plays a role in how well an engine substitutes gas for diesel. Dual fuel engines are more sensitive to abnormal engine conditions than an engine running only on diesel. Additionally, numerous components, sensors, switches and valves have been added to the engines, which require additional attention and maintenance.

Personnel requirements

Alert and well-trained personnel are vital to the success of dual fuel operations. The added complexity of the dual fuel engines requires the field personnel to pay more attention to the engines and to address issues as they arise to maintain good substitution rates.

Universal Pressure Pumping requires that manual and remotely activated emergency shutdown (ESD) valves be employed and activated from the data van. Universal Pressure Pumping also requires the use of hard barriers, such as 600-lb concrete blocks, to be used to protect exposed natural gas lines from vehicle traffic. The company also requires that specific Authorization to Work procedures are completed prior to commencing dual fuel operations. These procedures consist of verifying that the ESDs work, ensuring that all barriers and signage are in place and that the required leak checks have been completed prior to the beginning of the job and at the beginning of every shift after the start of pumping operations.

Universal Pressure Pumping began dual fuel operations in 2012 with one fracturing spread and currently has five spreads converted for dual fuel operations. To date, the company has completed more than 10,300 dual fuel fracturing stages and has saved customers more than 7.3 MMgal of diesel fuel. With diesel prices hovering at $3.45/ gal, this equates to saving more than $25.1 million to customers.

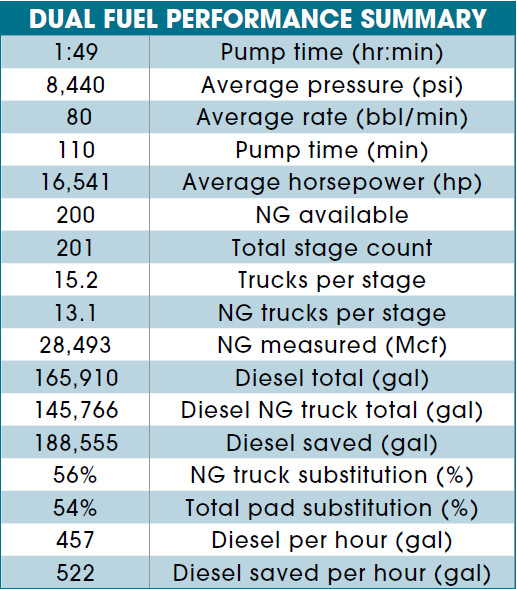

In April a Universal Pressure Pumping crew operating in Pennsylvania completed a 201-stage pad with an average of 54% total substitution, which saved the customer about 450 gal/hr during pumping. Over the course of the job, this amounted to diesel fuel savings exceeding 188,000 gal of diesel fuel equating to more than $650,000.

In summary, dual fuel operations offer the potential to reduce diesel consumption. With the U.S. Energy Information Administration projecting that retail diesel prices will remain relatively flat through 2020, it is unlikely that the industry will see reduced diesel costs. Universal Pressure Pumping has demonstrated that well-executed dual fuel operations can result in significantly reduced diesel consumption, reducing costs for customers.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.