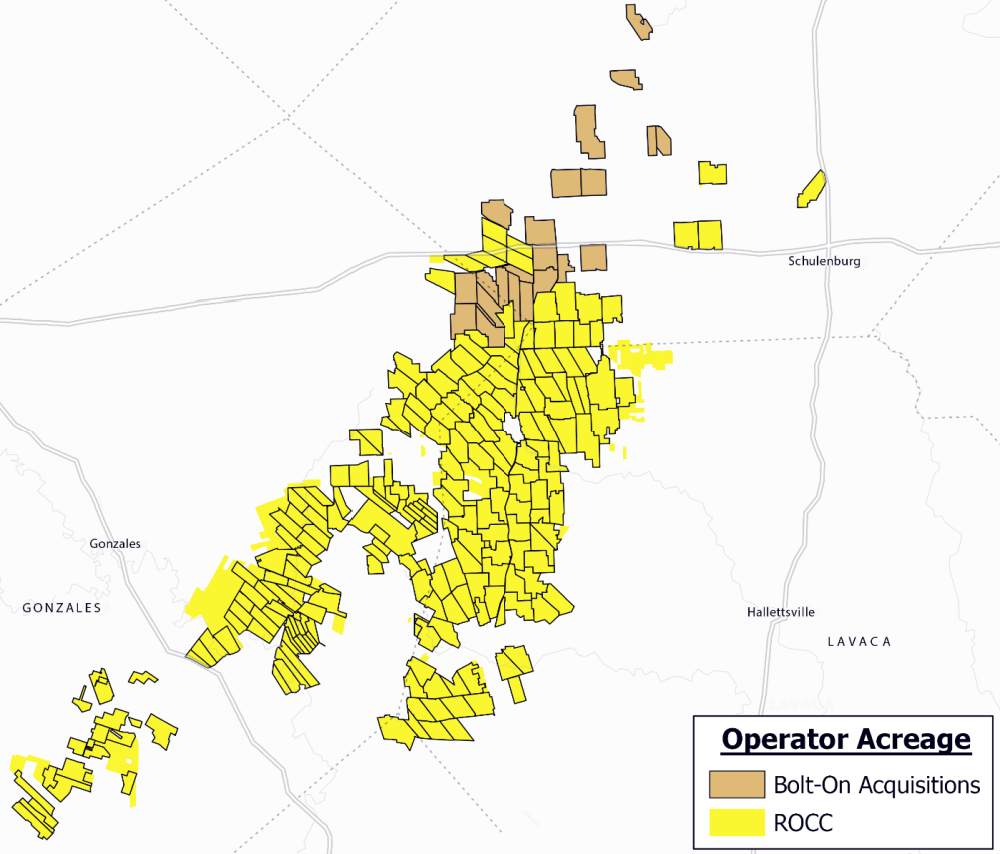

Ranger Oil Corp. agreed to add 17,000 net acres to its Eagle Ford position through three “bolt-on” acquisitions for a total purchase price of roughly $64 million in cash, the pure-play Eagle Ford Shale producer said on May 3.

“As consolidation in the Eagle Ford continues, we see additional attractive opportunities that, at the right valuation, could add both immediate and long-term value to shareholders,” Darrin Henke, Ranger’s president and CEO, commented in a company release.

Based in Houston, Ranger Oil is a pure-play independent oil and gas company engaged in the development and production of oil, NGL and natural gas, with operations in the Eagle Ford Shale in South Texas. Previously known as Penn Virginia, the company rebranded last October following an all-stock combination with Lonestar Resources US Inc.

On May 3, Ranger Oil said it signed separate agreements to acquire the three “bolt-on” oil producing properties in the Eagle Ford Shale contiguous to Ranger’s existing assets. With the addition of approximately 17,000 net acres at closing, Ranger will have more than 155,000 net acres, a greater than 10% increase from year-end 2021, according to the company release.

Ranger noted it had identified significant and highly economic near-term development opportunities in the bolt-on acquisitions with approximately 19 miles of shared leaselines with Ranger's current acreage enhancing existing development plans through longer-lateral wells and increased working interest. The substantial operational synergies also mitigate the need for additional rigs and services, further strengthening capital returns, the company added.

“These strategic and accretive acquisitions of adjacent oil-weighted assets further demonstrate the strength of our business and our strategy of delivering shareholder value through a variety of avenues,” Henke said.

Last month, Ranger launched a $100 million share repurchase program after reducing its leverage to the company’s previously stated target of less than 1.0x. Ranger’s plans to fund the total purchase price of $64 million in cash for the three acquisitions using free cash flow will help maintain its strong balance sheet, according to its release.

“We are firmly committed to disciplined capital allocation, the preservation of our strong balance sheet and using internally-generated cash flow to bolster our portfolio and grow shareholder value,” Henke added.

The acquisitions are expected to close early in the third quarter, subject to customary closing conditions. The sellers involved were not disclosed.

Upon closing, Ranger expects a low decline, stable production of approximately 1,000 boe/d (65% oil / 87% liquids) that it said creates a solid free cash flow profile, maintaining its strong capital structure and enhancing Ranger’s framework to return cash to shareholders.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.