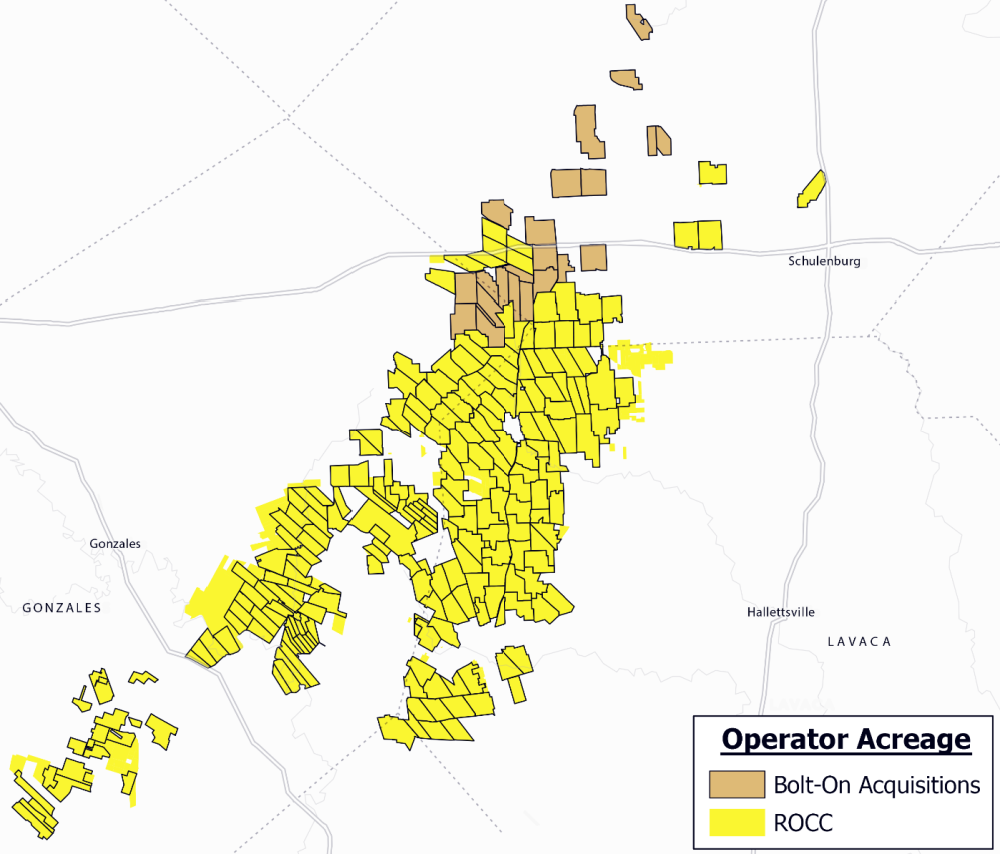

The bolt-on acquisitions announced June 30 are largely composed of additional working interests in existing Ranger Oil-operated wells along with contiguous producing assets and undeveloped acreage in the Eagle Ford Shale. (Source: Hart Energy, Shutterstock.com)

Ranger Oil Corp. announced additional “bolt-on” acquisitions in the Eagle Ford Shale on June 30, bringing the total purchase price of transactions signed in the second quarter to approximately $110 million.

The combined all-cash transactions are part of a strategy to “relentlessly build” long-term value for the company’s shareholders through accretive transactions that are adding premium scale and increasing overall efficiencies, according to Darrin Henke, president and CEO of Ranger Oil.

“In the second quarter alone, we executed six ‘bolt-ons’ in the Eagle Ford,” Henke said in a June 30 release, “demonstrating our ability to identify attractively-priced, strategic transactions where we can leverage our operational expertise to create significant synergies and optimize cash-on-cash returns.”

“We are first-and-foremost focused on creating differential value for our shareholders through continually improving our existing operations, and I believe our recent record setting well results demonstrate the quality of Ranger's exceptional assets and team.”—Darrin Henke, President, CEO and Director, Ranger Oil Corp.

Ranger Oil is a pure-play independent oil and gas company with operations in the Eagle Ford Shale in South Texas. Previously known as Penn Virginia, the company rebranded in October 2021 following an all-stock combination with Lonestar Resources US Inc.

The company’s bolt-on acquisitions announced June 30 are largely composed of additional working interests in existing Ranger-operated wells along with contiguous producing assets and undeveloped acreage. The transactions will add approximately 1,600 boe/d (about 79% oil / 92% liquids) of production, primarily associated with low-decline, legacy wells.

The announcement follows the three bolt-on acquisitions Ranger Oil unveiled in May that added approximately 17,000 net acres of oil producing properties contiguous to Ranger’s existing assets for a total purchase price of roughly $64 million in cash.

Further details of the six transactions and the identity of the sellers were not disclosed.

All the transactions are expected to close on or before July 5 and set to result in significant identified cost, marketing and operational synergies through efficient long lateral developments and the use of shared facilities and existing infrastructure, according to the company release.

Ranger Oil also said it expects the bolt-on acquisitions to be immediately accretive on all key financial metrics, adding that the purchase price of each transaction is at a discount to management’s estimated PDP PV-10 value. Further, the all-cash consideration maximizes accretion to shareholders, while funding through free cash flow maintains the company’s strong balance sheet.

Given the accretive nature of the recent acquisitions plus recent strong organic performance, Ranger Oil plans to initiate a redetermination of its borrowing base.

“We are first-and-foremost focused on creating differential value for our shareholders through continually improving our existing operations,” Henke said, “and I believe our recent record-setting well results demonstrate the quality of Ranger’s exceptional assets and team.”

On June 30, Ranger reported it had brought online a number of wells during the second quarter at IP24 rates greater than 2,500 bbl/d of oil and 3,200 boe/d. These include new company records exceeding 2,800 bbl/d and 4,100 boe/d.

Overall for the second quarter, Ranger expects to produce near the high-end of the previously announced guidance range. The company anticipates exiting the second quarter producing more than 30,000 bbl/d of oil and 42,000 boe/d, pro forma for the transactions.

Recommended Reading

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

FERC Again Approves TC Energy Pipeline Expansion in Northwest US

2024-04-19 - The Federal Energy Regulatory Commission shot down opposition by environmental groups and states to stay TC Energy’s $75 million project.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.