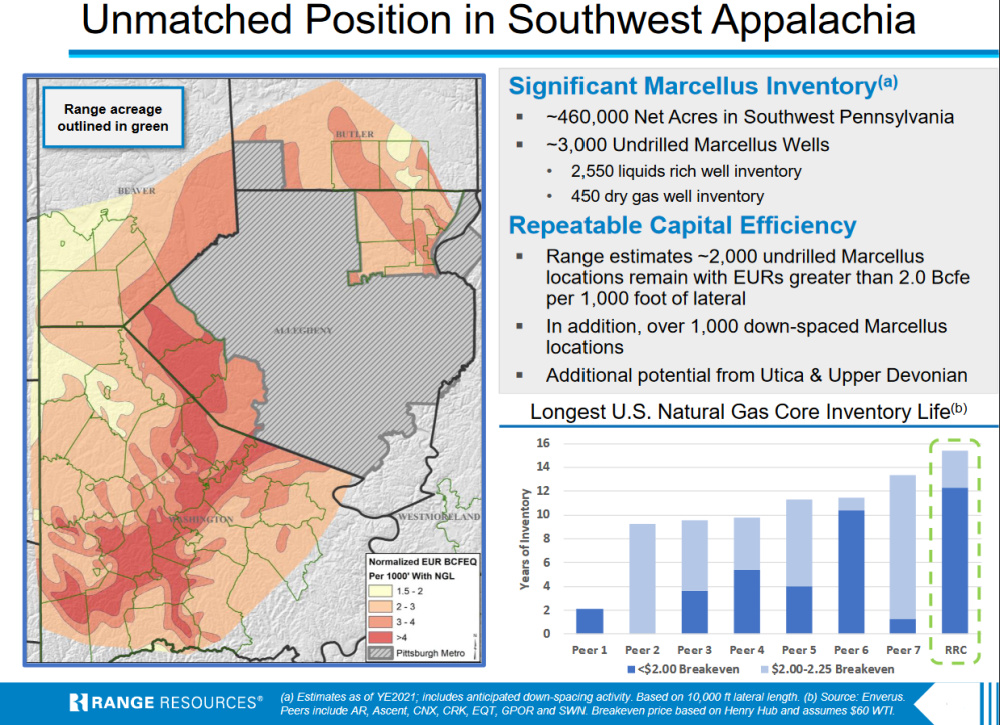

Based in Fort Worth, Texas, Range Resources retains significant Marcellus inventory on 460,000 net acres in southwestern Pennsylvania. (Source: Hart Energy, Range Resources logo by rafapress / Shutterstock.com)

Range Resources Corp. took advantage of the market’s undervaluation of its stock to repurchase 4.5 million of its shares while staying on track to lower its leverage to 1x by the third quarter, the company said in its July 25 earnings report.

In the report, Range Resources CEO Jeff Ventura, said the company continues to view share repurchases as a compelling investment, “given what we see as a significant disconnect between Range’s share price and the underlying value of our assets at current commodity futures pricing.”

Some analysts were surprised that the company, based in Fort Worth, Texas, had spent about $130 million in the quarter repurchasing shares at an average price of $28.85 per share.

“The company was much more aggressive with the buyback than was anticipated,” said Mark A. Lear, senior research analyst at Piper Sandler Co.

In first-half 2022, Range Resources repurchased about $146 million in shares, leaving it with another $354 million to spend. Tudor, Pickering, Holt & Co. (TPH) analysts wrote July 26 that the company had made no changes to its authorization to buy back $500 million in shares.

“The quicker pace [is] a positive in our view … [demonstrated] potential upside to our estimated $100 million per quarter” in the second half of the year, the TPH analysts said.

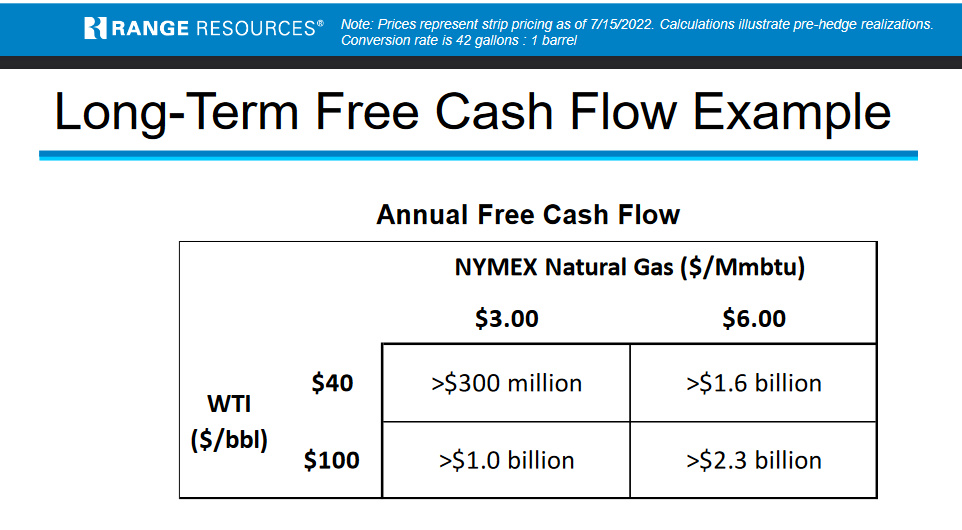

Range said its free cash flow in 2022 is forecast to exceed $1.5 billion at strip pricing, allowing for a fifth consecutive year of debt reduction. Its forecasted leverage improves to about 0.6x by year-end 2022 at strip. At the end of the second quarter, Range’s leverage ratio was a record low 1.2x, it said.

Its outlook for 2023, which includes $5.30 natural gas, $81 WTI and $31 NGL, produces free cash flow of more than $1.3 billion.

“At strip pricing, long-term balance sheet targets are met over coming quarters, allowing for further increases to shareholder returns program over time,” the company said in its earnings report.

“Range is well positioned to serve and benefit from this call on American natural gas supply given our access to multiple domestic and international markets for natural gas and NGL and, more importantly, our multi-decade core inventory life in Appalachia.”—Jeff Ventura, Range Resources Corp.

The company also reported receiving $29.5 million in contingency payments related to its North Louisiana divestiture.

In 2020, Range agreed to sell its North Louisiana Terryville Field assets for about $335 million, whch included an additional $90 million contingent on future commodity prices. Range has the potential to receive an additional $45.5 million in contingent payments based on commodity prices in 2022 and 2023, which at the end of the second quarter had a fair value of about $34.8 million.

David Decklebaum, an analyst at Cowen, said Range Resources’ second-quarter capex was 7% below expectations. He reiterated Range’s 2022 capex with between $460 million to $480 million, “but now expected at the upper end” of guidance.

Range Resources earned $385 million in free cash flow in the second quarter. Cowen models the company to generate $1.45 billion for the year, with an effective 18% free cash flow yield (16% on enterprise value).

The company reported GAAP revenues for second-quarter 2022 of $1.23 billion, with net cash of $325 million and net income of $453 million ($1.77 per diluted share). Range still has about 70% of its gas volumes hedged at an average floor of $3.29 per Mcf to $3.72/Mcf with slightly higher prices for 2023, Decklebaum wrote in a July 26 report.

Range said its second-quarter earnings results include a $240 million mark-to-market derivative loss due to the increases in commodity prices.

The company retains significant Marcellus inventory on 460,000 net acres in southwestern Pennsylvania. In the northeast, Range plans to drill and complete nine wells in 2022, with well returns expected to be competitive with the company’s southwest Marcellus development program.

Ventura said that in the midst of a global energy crisis, the need for U.S. oil and gas production is vital.

“In order for U.S. supply to meet growing domestic and global demand, however, there must be support for the required infrastructure, including permit approvals and construction of pipelines, compression, processing facilities and LNG export terminals,” he said. “Range is well positioned to serve and benefit from this call on American natural gas supply given our access to multiple domestic and international markets for natural gas and NGL and, more importantly, our multi-decade core inventory life in Appalachia.”

Recommended Reading

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.