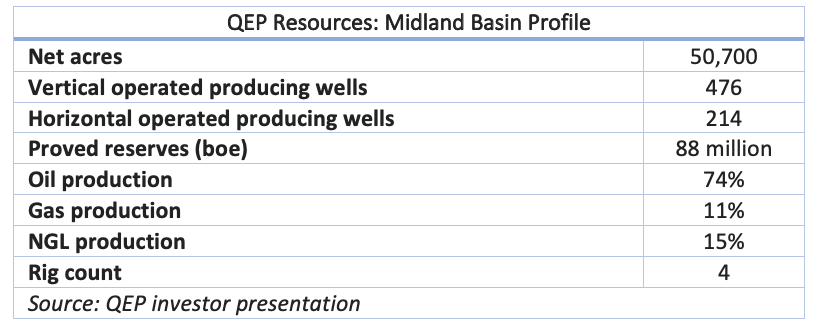

QEP Resources owns about 50,700 net acres in the Midland Basin and holds 97% working interests and 73% net revenue interests. (Source: QEP Resources Inc.)

With the $735 million Haynesville Shale divestiture closed, QEP Resources Inc. (NYSE: QEP) has engaged Evercore Inc. to explore a sale following a surprise takeover bid by activist investor Elliott Management Corp. in early January.

Elliott’s takeover offer of $2 billion to $2.5 billion was premised on QEP’s Permian Basin assets being undervalued.

The offer, a 44% premium on QEP’s stock price, was contingent on the company closing the sale of its Haynesville asset to Aethon Energy Management LLC’s Aethon III. QEP is also in the process of selling its Williston Basin assets, though Elliott put no conditions on that sale closing, as it winnowed down its company into a Permian Basin pure-play.

RELATED: QEP Resources Receives $2 Billion Takeover Offer From Elliott Management

Elliott’s offer is likely to set off a bidding war for the company, analysts said. QEP is now working with Evercore on the sale of its assets in the Permian Basin, Bloomberg reported Jan. 14. QEP owns about 50,700 net acres in the Midland Basin and holds 97% working interests and 73% net revenue interests.

Rystad Energy analysis estimated the Midland Basin properties are worth up to $4 billion at a price of $50 per barrel of West Texas Intermediate (WTI) crude.

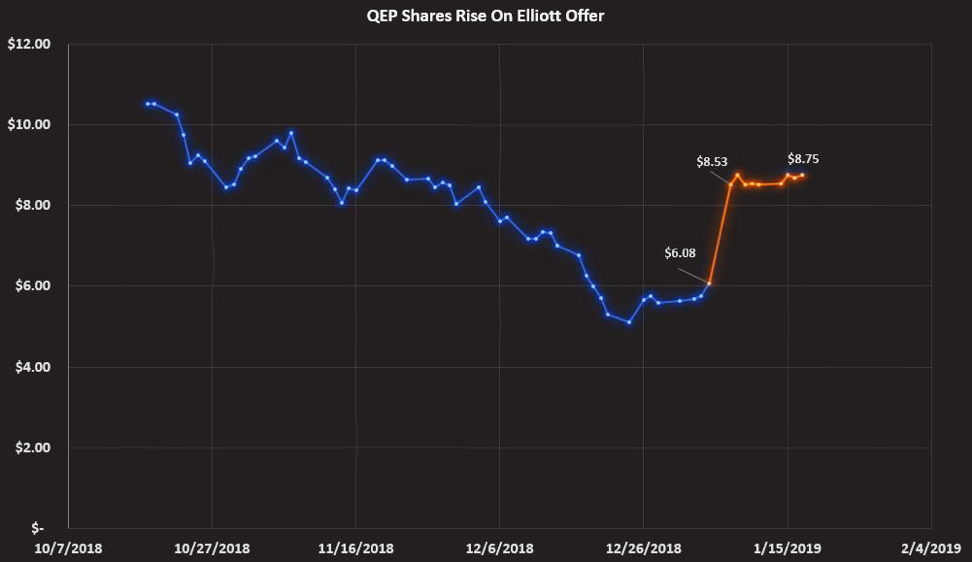

Following the publication of Elliott’s proposal, QEP shares rose 40%, “which signals to us that the market views the deal as a likely outcome,” according to analysts with Capital One Securities Inc. The offer “an opening volley that could draw other would-be acquirers into the negotiations,” Capital One analyst Brian Velie wrote in a Jan. 8 research note.

“The 44% premium in Elliott's offer is substantial, but we would not be surprised if other bidders enter the fray before letting core, contiguous, HBP and high-working-interest acreage be acquired at a price that still represents a significant discount to recent deal flow,” Velie said.

Cowen & Co. LLC analysts similarly puzzled at the price, which equates to about $25,000 per acre in Martin and Andrews counties, Texas. “Some could argue [that price] is still too cheap relative to the opening of a Permian data room” that might pique the interest of a Diamondback Energy Inc. (NASDAQ: FANG) or Concho Resources Inc. (NYSE: CXO), the Cowen analysts wrote.

Artem Abramov, partner at Rystad Energy, said QEP’s wells have lagged behind peers such as Diamondback, Encana Corp. (NYSE: ECA) and Pioneer Natural Resources Co. (NYSE: PXD) with an average 50% to 60% higher initial productivity. However, QEP’s tank-style development leads to cost savings on a per-well basis, “so its strategy could still be viewed as an attempt to maximize recovery and NPV per acre. We do not think the market has fully accounted for this potential.”

Even using conservative assumptions without further technological advancement and a flat learning curve, QEP’s underlying value is “in the region of $4 billion, given $50 WTI and a 10% discount rate,” Abramov wrote.

QEP is still in the process of selling its Williston Basin asset sale. In November, QEP agreed to sell the North Dakota and Montana acreage to Vantage Energy Acquisition Corp. and other parties for $1.7 billion.

QEP has said it received Elliott’s Jan. 7 offer and that it would “carefully consider the proposal.”

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.