The agreement between QatarEnergy and Shell also fits into the U.K.-based company’s energy transition business strategy. Pictured, Shell CEO Ben van Beurden and Minister of State for Energy Affairs Saad Sherida Al-Kaabi. (Source: QatarEnergy)

State-owned QatarEnergy has selected Shell Plc as its fifth and final international partner in the $28.8 billion North Field East (NFE) expansion development, the world’s single largest LNG project, which will see Qatar solidify its position as the world’s top LNG exporter.

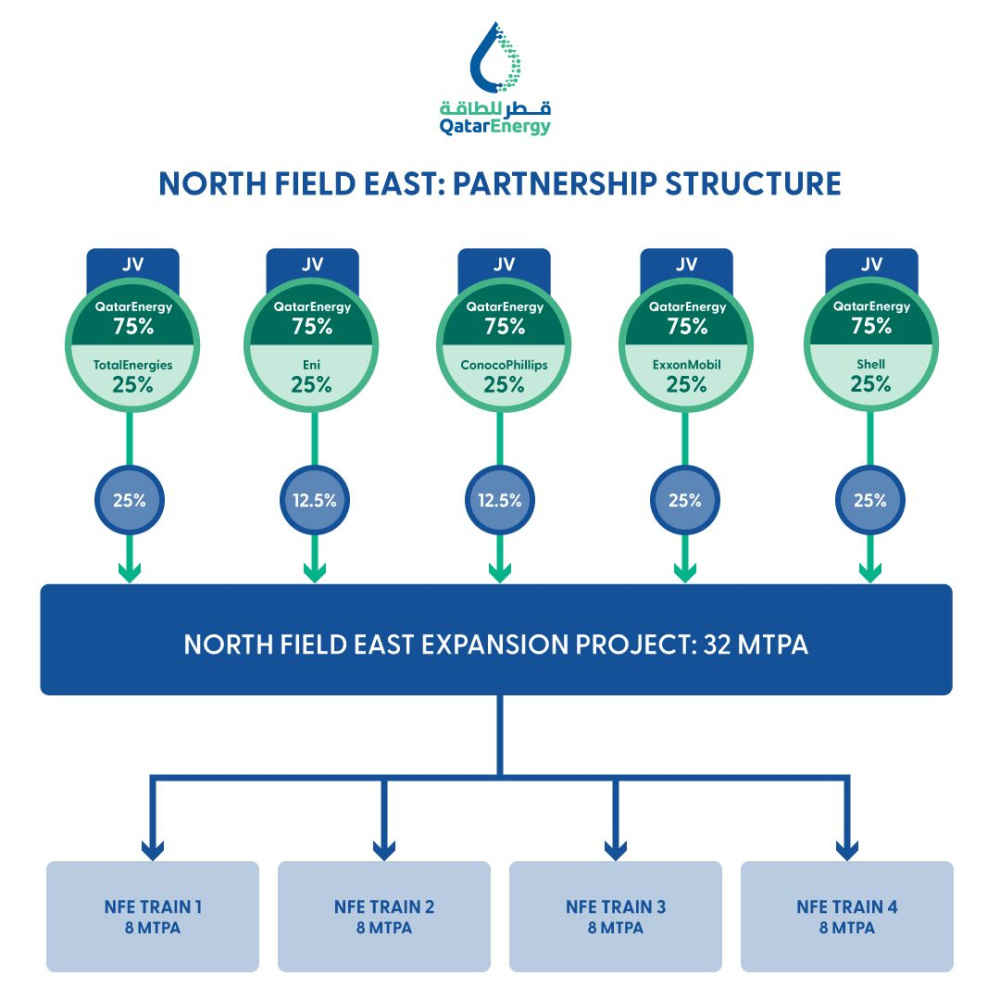

Per the agreement, QatarEnergy and Shell will team up in a new joint venture (JV) company with the former holding a controlling 75% working interest and the latter holding the remaining 25%, QatarEnergy announced July 5 in a press statement. The JV will hold a 25% in the entire NFE development, which will consist of four LNG trains with a combined nameplate capacity of 32 million tons per annum (mtpa). Initial gas shipments from the development are expected in early 2026.

“Today’s announcement marks the successful conclusion of the selection of our international energy company partners in the North Field East project, through which QatarEnergy and its partners reaffirm their commitment to the energy transition and to the safe and reliable supply of cleaner energy to the world,” the Minister of State for Energy Affairs Saad Sherida Al-Kaabi said.

The agreement is the final in a series of partnership deals signed in June between QatarEnergy and TotalEnergies SE, Eni SpA, ConocoPhillips Co., and Exxon Mobil Corp. for the mega NFE expansion development set to boost Qatar’s LNG export capacity to 110 mtpa from around 77 mtpa. A planned expansion at North Field South could add another 16 mtpa of capacity.

QatarEnergy’s announcements this month and last related to the NFE expansion project come as global energy markets scramble to boost energy supply impacted by Russia’s invasion in the Ukraine amid a global decarbonization push that favors natural gas as a so-called “transition fuel.”

The agreement between QatarEnergy and Shell also fits into the U.K.-based company’s energy transition business strategy and plans to maximize value in Qatar’s LNG industry.

“Lower carbon natural gas is a key pillar of our powering progress strategy and will also help us achieve our target of becoming a net-zero emissions business by 2050,” Shell CEO Ben van Beurden said in a separate press statement.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.