Mitsubishi Power Americas is working with Utah-based energy hub owner Magnum Development to build what could become the largest hydrogen gas and storage hub in the U.S.

The Advanced Clean Energy Storage hub in Delta, Utah, (ACES Delta) will produce up to 100 metric tons per day (mt/d) of hydrogen using electrolyzers for delivery to the Western U.S., supporting Intermountain Power Agency’s (IPA) 840-megawatt (MW) IPP Renewed Project.

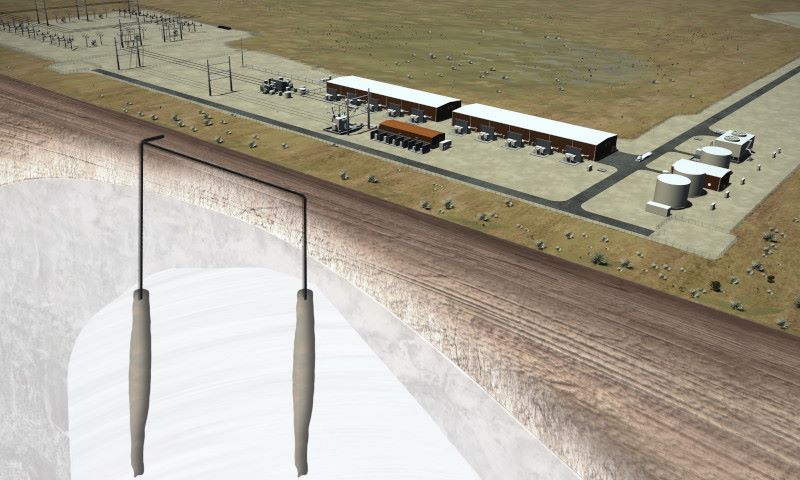

ACES Delta plans to initially store 150 gigawatt (GW) hours of green hydrogen in two enormous salt caverns, providing a long-duration energy storage option needed for excess renewable power that can be dispatched to the grid when needed.

The project marks a first-of-its-kind market application, combining green hydrogen production and storage in salt caverns at a scale not yet seen by the electrolyzer industry.

“The great news is the technologies we’re dealing with are not first-of-the-kind technologies,” Mike Ducker, senior vice president of hydrogen infrastructure for Mitsubishi Power Americas and COO of ACES Delta, told Hart Energy. Electrolyzers have been around for nearly a century, and storing hydrogen in salt caverns has been done since the 1980s, he said. “What is unique and novel here is the application and the integration of that scale.”

Hart Energy sat down with Ducker at CERAWeek by S&P Global to discuss the project.

Velda Addison: Why green hydrogen, why Utah and why now?

Mike Ducker: Looking at the grid right now, and particularly in [the] western United States, everyone’s familiar with the duck curve—middle of the day sun, late day peak—and that’s where batteries play a very important role in supporting that intraday energy imbalance. We’re starting at just 30% renewables today in the West. We’re no longer looking to solve just that issue; it’s now this seasonal imbalance. To put it in perspective, California on average over the past few years in the winter and spring months, is curtailing 300 [GW] to 600 gigawatt-hours [GWh] every month. This is solar and wind that’s being thrown away because there’s nowhere to put it. Yet in 2020, in the summer, they saw the first rolling blackouts in two decades. We have a dynamic where we’ve got way over production in certain seasons of the year and then way under production—and that’s just at 30% renewables. As we go toward 100%, that problem is going to be exacerbated.

So why green hydrogen? This project goes to that exact issue of, we now need different technologies, different ways to integrate renewables more cost effectively, more reliably. This is where hydrogen plays a role—to basically take all that excess into the winter and spring months, store that in these massive salt caverns under the ground. When IPA wants firm, reliable, dispatchable energy that’s also zero carbon, they are able to run it in the summer and fall months, for example.

VA: What makes salt caverns ideal for hydrogen storage?

MD: Hydrogen has been stored in salt caverns as early as the 1980s. Salt caverns can also store other hydrocarbon gases. They can store helium. They are great at storing tiny particle gas molecules… We engineer and design these caverns. What exists today is a block of salt beneath the earth. We’re actually drilling and doing a process where we control the creation of this cavern by adding water that dissolves the salt. Depending on how long we let the water sit in there, where we inject the water, we can actually intentionally grow this cavern vertically and horizontally. There are engineering designs around how we do that, so we’re able to keep mechanical integrity of the cavern. The salt itself has a lot of very unique characteristics. They say salt is self-healing. So, if there is any cracks or fissures, it actually heals itself. It’s impermeable. So again, for gases like helium or hydrogen, that’s inescapable through the salt. Those two main factors make it very attractive. From a recovery standpoint, every molecule you put in, you can get that molecule back out. With an abandoned oil and gas field, once you put hydrogen in there, you have no idea where it goes. With a salt cavern, it’s in that vacuum container basically.

VA: How much hydrogen are you planning to store?

MD: We will be able to store over 11,000 mt of hydrogen. We relate that more into the dispatchable energy potential. So, each cavern can store about 150 GWh’ worth of dispatchable energy. That’s 300 GWh total. To put it in perspective, in 2021, the entire United States had just under 3 GWh worth of batteries installed. Our one site will be 100 times the entire U.S. installed base of batteries as of 2021.

VA: How long can you store the hydrogen in the salt caverns?

MD: Day, week, a month, a year—however long IPA wants as it looks at seasonal energy imbalances and desires to store it. When we inject that hydrogen, it will tend to be a continuous injection through [those] winter and spring months and then tend to be a continued withdrawal through the summer and fall. But if we need to inject, stop and bottle it up and hold for two months, we could do that as well.

VA: Does the movement of salt impact volume of the hydrogen at all? During recovery, could some of the hydrogen be lost?

MD: We will always maintain a minimum pressure in the caverns because like I said, salt has that self-healing aspect. If you have nothing in that void, it’s going to want over time to heal itself. As far as losing hydrogen, it’s impermeable. There is nowhere for that hydrogen to go other than up through your wellhead, and we’ve got constant monitoring and multiple layers of these casings. We’re also required to do constant testing. Mechanical integrity tests [to check pressure and for leaks] are required. It is a very regulated process. At the end of the day, when you look at the caverns, that is what makes them so attractive here. There is no opportunity for leaks. There are no losses here.

VA: What challenges have you faced with the project?

MD: When we started bidding this project back in 2020, the electrolyzer industry had only ever known [to] sell, say, a 5-MW or 2-MW cell stack to a food grade beverage or to a university. They’re one-offs. When we said we need 220 MW, they said ‘OK, well, here’s all the equipment. You put all this stuff together.’ We realized nobody had ever designed a plant where electrolyzers were the main energy infrastructure. Electrolyzers have always historically been kind of an ancillary on another infrastructure project. So, we had to look at what was the best way to design and put together the facility, optimize our own cost and reliability where the electrolyzers were really the focal point.

The other biggest thing I’d point out is the commercial negotiations. With the Intermountain Power Agency, our ultimate offtaker here, it doesn’t have a whole repository of contracts for energy storage and conversion of hydrogen. They have it for solar, they have it for wind and they had for gas turbines. How do you get that customer comfortable in knowing that we’re putting forward a credible, de-risked offer? That required an immense amount of collaboration and coordination between the teams… We really had a blank piece of paper to work from. Pulling together contracts and agreements was a really huge undertaking. It was about a year-long negotiation at the end of the day.

VA: Recurring themes at the CERAWeek conference have been hydrogen and the Inflation Reduction Act [IRA]. How do you anticipate the IRA impacting the company?

MD: Gamechanger. It really is a huge impact. When we look at the pricing of clean hydrogen versus gray or unabated hydrogen, that’s where we see it [green hydrogen] is the same or a lower cost. The question really now comes more on the offtake side. We’ve got existing industries that are using hydrogen: refineries to agriculture to steelmakers. So, there are existing uses for it, but it will take some time to start looking at existing applications.

But how do you look at new growth and new opportunities? That’s where we’re spending most of our time now. We’ve got the cost to be where it’s attractive. How do we look at all these different industries from there? But in short, yes, it’s been a very big impact in a positive way for what we were projecting. Success rates and probabilities for projects change pretty dramatically in the positive sense since its passing.

Recommended Reading

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.