The PropShield proppant flowback control additive is injected directly into the blender tub. (Source: Hexion)

Proppant flowback presents a prevalent and costly challenge to the oil and gas industry. Concerns with this challenge have increased as the industry moves toward higher proppant intensity, longer laterals and smaller mesh size proppants. Proppant flowback can lead to additional hauling and disposal costs, equipment damage and decreased oil and gas production due to loss of wellbore connectivity and decreased fracture width. There may also be downtime and significant costs associated with remedial treatments and equipment replacement. Although many solutions to proppant flowback exist, they are often considered uneconomical.

Liquid additives

In 2018 Hexion released the PropShield flowback control additive that has since been used successfully in more than 100 wells in various basins throughout North America. This additive is a liquid that is added directly to the blender tub. It has an affinity for sand, so it coats the proppant and not the equipment. The coating on the proppant allows grain-to-grain bonding once it is placed in the formation. This network of bonded sand grains holds the proppant in place once the well is put on production.

The additive is applied to frac sand in the blender tub using a standard liquid additive pump. Isotainers or totes can be used, depending on the job size. The percentage of coating on the proppant can be adjusted for different formation characteristics, well flowback plans, proppant mesh size and anticipated sand production.

Laboratory testing results

Unconfined compressive strength testing was used to determine the effectiveness of the coating during development. This is the same testing that is used to measure bond strength for conventional resin-coated proppants. After internal unconfined compressive strength testing demonstrated that adequate bond strength was achieved to control proppant flowback, third-party testing was employed to further prove the concept.

Critical flow-rate testing was conducted by a thirdparty laboratory to determine the maximum flow rate before proppant flowback occurs. The treated proppant was placed in a modified conductivity cell with an open slot on the end. Nitrogen flow was ramped up until proppant flowed out of the open-end slot. Sand treated with the PropShield additive had a critical flow rate that was eight times higher than the rate observed for uncoated frac sand control.

Third-party conductivity testing also was conducted to ensure the PropShield additive coating did not have a negative impact on the proppant pack’s permeability. Test results showed that the sand coated with the liquid additive had a conductivity curve within the error bars of the uncoated frac sand control.

Permian Basin case studies

An initial field trial was conducted to evaluate the performance of the product. The operator compared a tail-in of 100 mesh frac sand coated with the PropShield additive to the existing design of a tail-in of traditional resin coated 100 mesh frac sand. These wells were direct offsets in the same formation. All other completion details were virtually identical. During drillout, 50% less proppant was returned for the PropShield additive well. After the wells were put on production, the liquid additive well had 80% less proppant flowback after 12 days. These results led to additional evaluation and further incorporation of the liquid additive into the operator’s job designs.

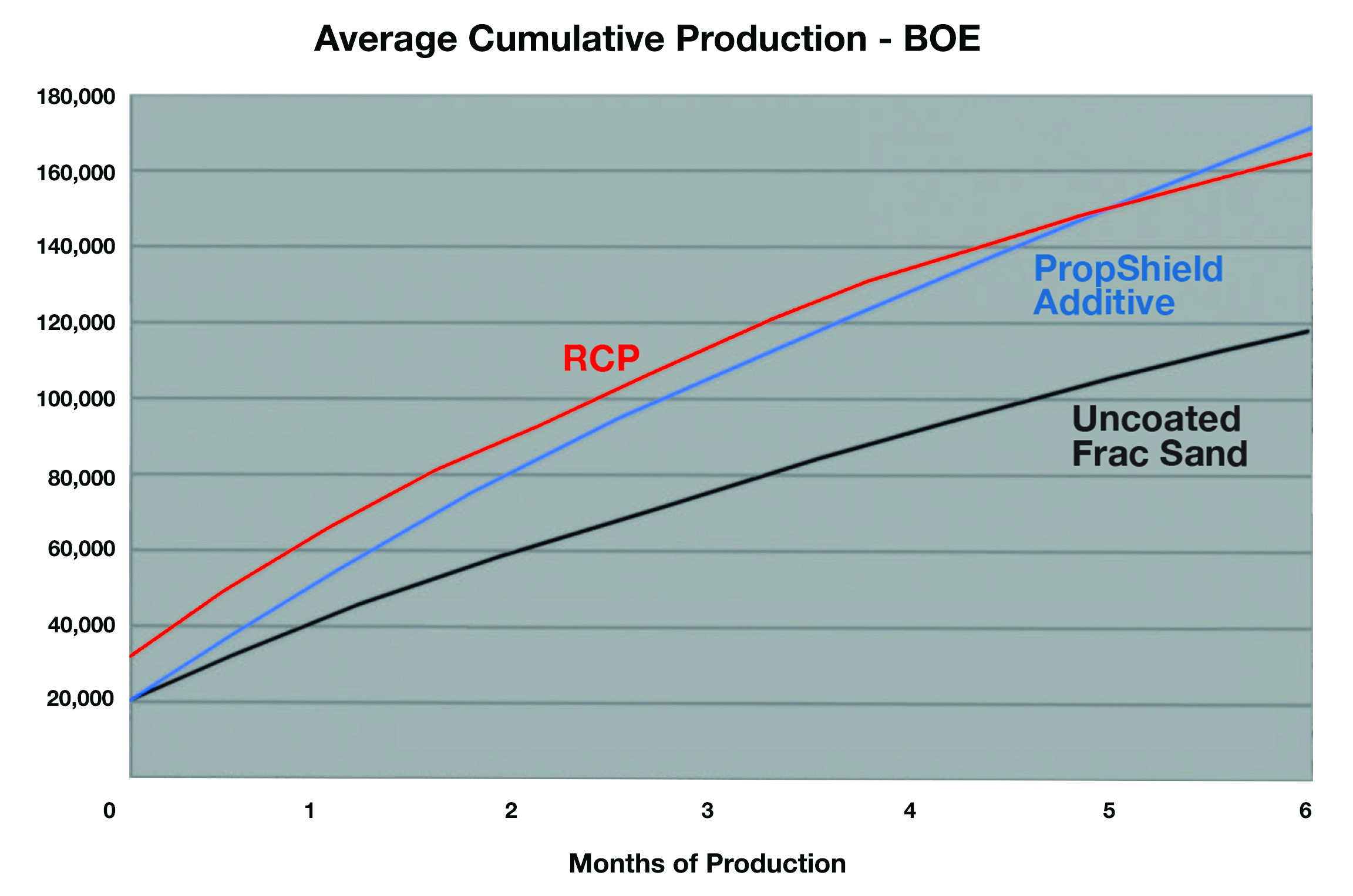

It is generally understood that by controlling and reducing proppant flowback, better oil and gas production can be achieved. Since proppant stays in the formation, fracture width and wellbore connectivity are maintained. An operator in the Permian Basin utilized the new additive to increase its well production. In this case study, production data from 47 wells were evaluated. All wells were completed by the same operator in the same formation. True vertical depth, lateral length and proppant volume were all similar for the wells in the dataset. Of the wells that were evaluated, 22 wells used a tail-in of the PropShield additive on 100 mesh frac sand, 20 wells used a tail-in of traditional resin-coated 100 mesh frac sand and five wells used only uncoated 100 mesh frac sand.

Average cumulative production for the PropShield additive wells surpassed the traditional resin-coated frac sand wells by 3% after six months. This was after lagging behind the traditional resin-coated frac sand wells for the first five months. Compared to the wells that used only uncoated frac sand, the liquid additive wells had an increase in barrel of oil equivalent of 44%.

Because the PropShield additive was less expensive than the traditional resin-coated proppant, upfront costs were lower. The lower upfront costs combined with the 3% production increase after six months resulted in an increase in revenue of about $500,000 per well in favor of the PropShield additive.

While the PropShield additive is an increased upfront expense when compared to the uncoated frac sand wells, the 44% improvement in production after six months resulted in an average of about $2 million in added revenue for each of the liquid additive wells.

Recommended Reading

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.