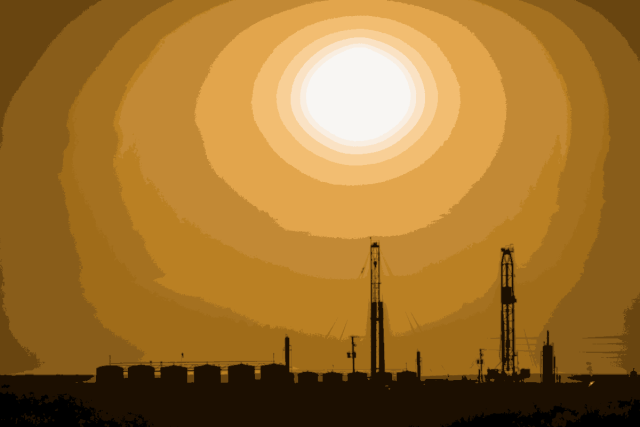

Oil and Gas Investor explores the why and how to transform producers’ DNA in this issue’s cover story. But it’s all for naught if producers do not buy in. (Source: Hart Energy)

[Editor's note: A version of this story appears in the October 2020 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

Jefferies analyst Jason Gammel pegs second-quarter 2020 as the most difficult in the history of the U.S. shale industry. That’s probably no surprise to those of you who lived it, but the chasm that was 2Q20 may become the catalyst for everlasting change. That is, changing the E&P business model from growth to value oriented.

Gammel asks, “Have U.S. E&Ps found religion?”

The road from cash-burn growth to shareholder-return value is littered with false starts, he noted in an August research report, but this time could be different, he dared surmise. “2Q transcripts indicate recognition that a change in business model is existential.”

Oil and Gas Investor explores the why and how to transform producers’ DNA in this issue’s cover story. But it’s all for naught if producers do not buy in (at their own peril). Earnings calls post-2Q indicate the pivot to profit is on.

A long way from Wall Street, Midland, Texas-based Permian pure-player Concho Resources Inc. indicated in its 2Q call that it sees the light. CEO Tim Leach said, “We believe the future of our industry requires better capitalized companies, more capital discipline, less leverage and being more aware of market signals for growth.”

Growth for growth’s sake, he said, “isn’t going to work in the future.” After 2Q, “very few business plans were viable in our industry, so I think that forces the industry to re-evaluate itself.”

Concho began the pivot a year ago, now exhibiting four straight quarters of free cash flow, which it did by lowering costs, which it used to pay down debt and pay a dividend. Its cash flow reinvestment rate is about 75%, and that’s significant. Free cash flow is the litmus test for investors.

“We think the building blocks are falling into place as comments on Q2 conference calls highlight the industry’s commitment to put down guideposts that will likely set equities on healthier footing over the next few years,” noted Tudor, Pickering, Holt & Co. (TPH) analysts in an August research note. Specifically, committing to lowering capital allocation toward 70% to 80% of cash flow through the cycle.

“This should help ease investor concerns that free cash flow generation isn’t something they will need to wait for on the horizon, but something that will be clear and present year in and year out at strip pricing.”

Leading the pack and a model to others, per TPH: Pioneer Natural Resources Co., Devon Energy Corp., Marathon Oil Corp., Cimarex Energy Co. and Parsley Energy Inc.

Devon CEO Dave Hager, in the 2Q call, said, “We understand the maturing demand dynamics for our industry and recognize the traditional E&P growth model of the past is not a viable strategy going forward. To win in the next phase of the energy cycle, a successful company must deploy a highly disciplined, financially driven business model that prioritizes cash returns directly to shareholders.”

Devon is modeling the 70% to 80% re-investment target with a 5% or less “growth aspiration.” With that excess cash it will pay a quarterly and special dividend along with opportunistic share buybacks. It is targeting debt reduction down to 0.5x to 1.0x debt-to- EBITDA. The Oklahoma City producer is making the hard turn away from the iceberg.

Parsley Energy, too, is four consecutive quarters into an “unwavering commitment” to free cash flow generation.

“Our mindset is that growth capital is not needed nor justifiable in a world with significant excess spare capacity,” Matt Gallagher, CEO, said on its call. “Allocating growth capital into a global market with artificially constrained supply is a trap our industry is falling into time and time again. At Parsley we will avoid that trap and are committed to delivering healthy and sustainable free cash flow again in 2021.”

Marathon Oil pivoted in 2018 with a reinvestment rate topping at 80% over the past two years. CEO Lee Tillman reiterated that commitment even as midcycle oil pricing trends lower. The company can deliver free cash flow breakeven at $35/bbl, he said in second-quarter comments.

“Even in a $40 per barrel oil case, our reinvestment rate would likely trend no higher than 80%. At prices north of $40 per barrel, our reinvestment rates would be well below 80%, and that incremental free cash flow would be taken to the bottom line.”

The larger cap independents are in the midst of making the turn and messaging that strongly to investors. It remains to be seen if the mid-, small-and microcap E&Ps will follow suit. Their paths to success are murkier.

Nonetheless, the world is awash in their hydrocarbons. TPH said, “A cap on growth at higher prices is starting to finally hit home as the U.S. upstream space has realized the negative effect the U.S. has had on the global macro environment.”

Jefferies’ Gammel said, if true, this change of model is “probably the last and best chance to attract investment into the sector,” but it will only work if U.S. E&Ps “have finally had their come to Jesus moment.”

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.