The proliferation of unconventional production in North America is creating many new opportunities throughout each of the various sectors of the oil and gas industry. The most obvious for readers of Midstream Business is the vast buildout taking place in the sector in the past decade. At the same time, it has become more difficult to delineate upstream, midstream and downstream as these segments grow closer.

This closing of the gap between the midstream and downstream fueled the development of Stone Bridge Energy Partners. Founded in 2014, the company is designed to form a firm connection between shale gas and chemical producers on a more specialized basis than typically had been offered in the past.

The Stone Bridge leadership team saw equity flowing from the upstream to the midstream and now toward the downstream space.

“If it’s in the midstream space, I’ve been involved with it, developed it and grown it to fruition. Most of my colleagues at Stone Bridge come from a similar background. We are bringing the principles developed in the midstream, but applying them closer to the downstream side of the market,” Bruce Bernard, chairman and CEO of Stone Bridge Energy Partners told Midstream Business.

Closer to downstream

Utilizing these principles includes a group of investors they’ve worked with in the past to finance and develop the company on a grassroots level.

“So far, we’ve been funded solely on that basis and it’s our intention to stay that way. We’ve had folks from institutional sources interested in investing in us, but we haven’t found the perfect fit. We don’t think that such an arrangement is inevitable, and we’re perfectly happy being financed as we are currently,” he said.

While many midstream developers are focused on what Bernard calls stage one development of taking production a step closer to the market, many downstream companies are focused on the very end of that product chain. “We see ourselves in the middle, but further down and not as close to the midstream. Rather we see ourselves forming a ‘stone bridge’ between the midstream and downstream,” he said.

Bernard added that the company doesn’t yet see much competition in this particular space, though he anticipates it will become more crowded as the market evolves.

“We expect other companies to file into this space doing similar projects to what we’re developing, but it’s not yet crowded like in the pure midstream sector. That’s one of the aspects that make it so attractive to us. Once this space becomes more crowded, we are prepared to make the next move,” Bernard said.

Tolling-plus concept

Bernard’s extensive experience in the midstream comes from being part of the founding teams for two companies that led the way in the midstream—Cheniere Energy with LNG and Tejas Power with natural gas storage. While at Tejas Power, he developed the tolling-plus concept, which is being extended into the downstream as part of Stone Bridge’s strategy.

The concept goes one step beyond tolling, or paying a basic fee for facility usage. It involves creating opportunities around the marginal capacity of a project in a way that benefits both the project owner and the project offtaker. “In a petrochemical plant, there is a nameplate capacity that can be contracted to offtakers in a tolling fashion. If the plant can produce quantities beyond the nameplate, these additional capacities can be made available to offtakers at pricing that is advantageous to both parties,” Bernard said.

Although the projects that Stone Bridge will seek to develop are much different than what Cheniere developed with LNG terminals, Bernard said there are similar reasons why both companies were created. He noted that the throughout their careers, the Stone Bridge executive team has always sought out spaces where a disparity exists between international markets and U.S. markets in order to be the first in line to connect these gaps.

“When Cheniere was formed, that was a clear example of a Btu convergence and a Btu conversion happening that was connecting U.S. markets to global markets for natural gas. There were only a handful of ways to connect them—either through CNG or LNG—and we chose LNG as the preferred route. We’re seeing similar things occurring today with chemicals. The shale gas phenomenon is causing U.S. petrochemical producers and refiners to be more competitive on the global market.

Grassroots movement

While the company is funded on a grass-roots level, its projects are funded by larger capital sources that include both private equity and institutional investors. Stone Bridge is designed to develop projects that range in size from $100 million to slightly more than $500 million.

Stone Bridge’s project strategy is to begin the development of these projects on their own up to an investable level once permits and contracts are secured. At that point, the company turns to larger investors to fully develop the project.

Though a private entity, the company is not structured the same as a private equity-backed company. Most notably, Stone Bridge does not have a fixed notion on an exit strategy for its projects but considers each on a case-by-case basis.

“We’ve looked at every exit scenario. We’re open to long-term operation or considering a sale at the right price. We’re set up to operate these assets and are happy to operate them in perpetuity. The investment that comes alongside the project usually has a preference one way or the other. This will be a joint decision between us and our project investors,” Bernard said.

Creating the perfect barrel

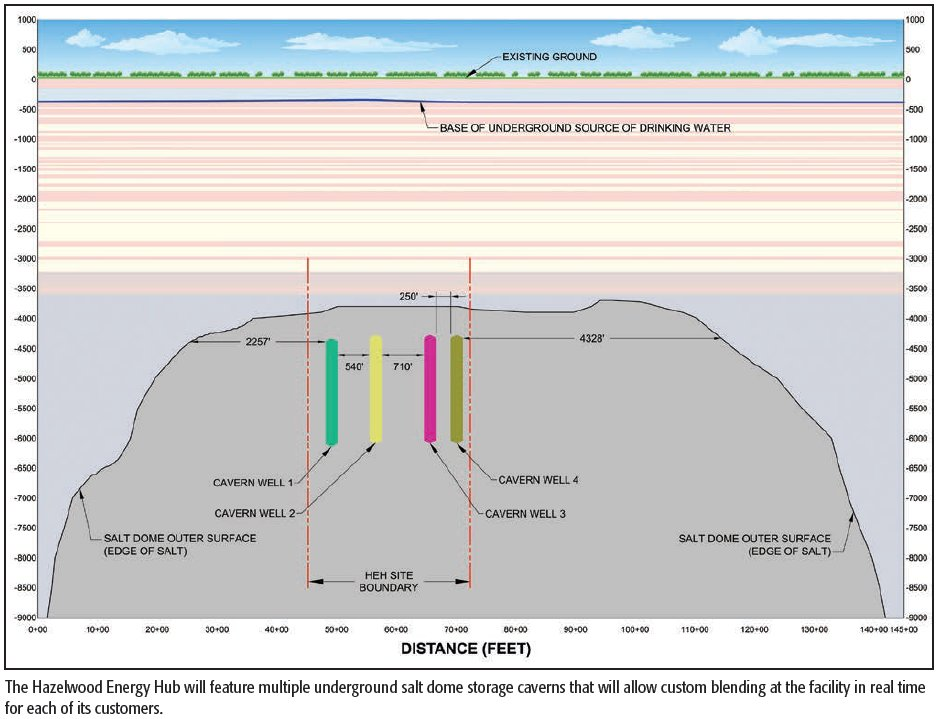

The first of these projects is the Hazelwood Energy Hub, which will be located adjacent to Spectra Energy Corp.’s Bobcat natural gas storage facility at Port Barre in St. Landry Parish, La. Originally developed by Bob Edmundson, one of Hazelwood’s developers, the hub will be designed to help Gulf Coast refiners take in the “perfect barrel” for their operations.

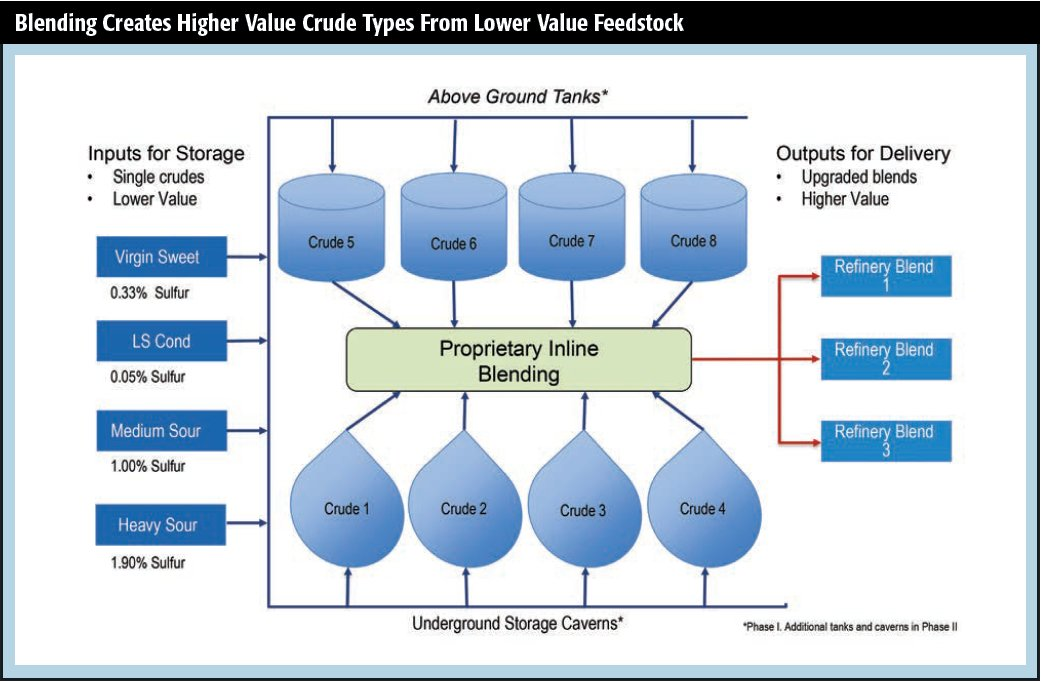

The hub will feature multiple underground salt dome storage caverns as well as supplemental above ground tanks for various types of crude oil and liquids. This will allow the company to custom-blend multiple types of crude at the facility in real time for each of its customers. The facility will have the capacity to house 10 to 12 different types of crude in various specifications, which can be combined in any possible configuration.

“U.S. refiners are making a lot of money these days because unconventional crude oil is relatively inexpensive compared to crude produced elsewhere. On the other hand, these refiners are not particularly well set up to handle light sweet crude. They were built in a world where it was expected that the type of crude they would receive would be from international sources that are increasingly heavier and more sour,” Bernard said.

Changing feedstocks

He added that Stone Bridge will work closely with refiners to meet their different needs based on circumstances, which changes from refinery to refinery as well as month to month. “This has been done in the past, but in a more rudimentary way such as taking three or four different crude types and blending them into a single type of crude or a small variety of crudes. We’re taking that model and putting it on steroids by having more variety and diversity in our crude types.”

The company will not be sourcing crude, instead operating at their customers’ behest to store, blend and distribute products. The facility will be accessible to multiple modes of transportation, including barges, ships and pipeline. Bernard said that Stone Bridge will also contemplate adding trucking and rail access to Hazelwood in the future.

Current U.S. crude storage capacity is at around 90% capacity, which makes the project attractive as not only a storage facility, but one that allows for a greater variety of crude types to be made available to the Louisiana market.

“Blending is nothing new, storage is nothing new, but it is unique to combine the two. We’re using inline blending compared to the traditional in-tank blending offered elsewhere. This will give Hazelwood a more precise and real-time adjustable ability to essentially create an infinite variety of crude types,” he said.

Naturally hedged project

The downturn in commodity prices has not deterred Stone Bridge Energy in its development of this project as Bernard said that the facility will serve a need in the market whether prices are high or trend down.

“We believe that more opportunities are created with different types of production—gas, liquids, crude—that come together at a single location and are stored and distributed from that location,” he said.

In the current low price environment, storage is especially attractive as a way to smooth pricing by storing it and selling it when prices improve in the future. When prices improve, the facility will be able to improve its customers’ margins through its blending options.

In terms of location, the Louisiana market has always been a premium market for crude, which makes the project especially attractive to both refiners as well as the Stone Bridge team. Bernard stated that because of the improved netbacks found in the region, producers are seeking relevancy in this marketplace.

“Blend margins increase with high crude prices and get reduced somewhat, but not dramatically, during low price conditions. Contango opportunities are higher in a low priced crude environment. Together this forms a naturally hedged condition so our customers make money irrespective of crude prices,” Bernard said.

Both marketers and refiners are interested in this project. Because of the present contango environment, storage is especially attractive to marketers because volumes can be stored at cash prices and sold when prices improve in the future. Refiners are interested in the project since the blending option creates a way for them to improve margins by operating more efficiently and effectively.

More projects

In addition to the Hazelwood project, Stone Bridge is also working on one other mature development project in Texas and two other projects that are being considered for future development, with a likely final investment decision coming in late 2016. The company anticipates that it can develop two, and possibly three, projects at a time with an 18 to 24 month build cycle.

“We have a very narrow definition of what we do and customers are asking us to work on multiple projects because we are offering something pretty unique,” Bernard said.

The Texas project is a plant that will produce an intermediate chemical that will allow petrochemical companies to be integrated into shale gas economics on a tolling basis. This facility will provide an intermediate chemical that isn’t available to U.S. petrochemical companies, aside from larger vertically integrated companies producing it for their own internal use.

Stone Bridge Energy may be a young company, but as it expands its portfolio of more projects, it’s also adding new partners. The company recently added three new members to its leadership team: John Hopper, Tim Sullivan and Ashok Gupta. Hopper will serve as executive vice president, commercial structuring; Sullivan as executive vice president, projects and business development; and Gupta as executive vice president, finance. These three new members were added to help expand the company’s understanding of global energy and financial markets. They join a veteran leadership that besides Bernard also includes Robert Toker, president; Thomas Suffield, executive vice president, business development; and Eric McCabe, executive vice president, strategy.

“We place a big emphasis on seasoned, top-notch people. Many on this team have worked together for years and each person brings something different to the table with respect to their specialties, personalities, skills and experience. We are big believers that there is not one person who makes a project work, but rather a team of folks that bring indispensable parts to the project,” Bernard said.

The development of shale production has created many opportunities for various companies and Bernard anticipates that the team at Stone Bridge Energy can further monetize opportunities presented by shale play development while filling a market niche.

“We see ourselves uniquely positioned to provide important services while weathering any changes in the market. Shale gas allows end users of refined products, the refiners, producers and petrochemical players to be well positioned compared to their global counterparts, and we see ourselves being directly connected to their success,” he said.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.