Established in 1969, privately held Henry Resources has been an industry leader in the Permian Basin for over 50 years. (Source: Henry Resources LLC)

MIDLAND, TEXAS—Privately held operators in the greater Permian Basin area are turning more proved undeveloped reserves into proven developed reserves in a hold-for-longer mode.

This among other developments have been key to operating in the current state of the industry, said executives from private operators Caza Oil & Gas Inc., Henry Resources LLC and Zarvona Energy LLC during a panel at Hart Energy’s recently-held Executive Oil Conference.

Caza Oil & Gas

Caza Oil & Gas, as CEO Mike Ford explains, is focused on its Delaware Basin acreage in Lea County (approximately 5,100 net acres) and Eddy County (approximately 2,100 net acres) in New Mexico. Most of Caza’s acreage is 89% operated with 90% HBP on primarily state leases, and to a lesser degree, federal leases with 237 locations.

“Our philosophy at Caza is keep our head down, execute in all the operating disciplines to turn those returns to make those distributions back to our partners to reduce debt,” Ford told conference attendees.

“When we came into the play in 2014, there were about six ‘recognized’ pay zones including Lower Brushy Canyon, Avalon, Bone Spring and Wolfcamp C. Now there are more than 13 including multiple Bone Springs, Avalon and Wolfcamp horizons. It’s a play that just keeps on giving.”

Because of Caza’s small size, Ford said the company couldn’t compete at state and federal sales. In 2015, the company looked for a geologically sound place to get a foothold in complicated acreage, then take the time to build that into a significant position. Caza’s original position was about 11,054 gross acres and currently, the company has about 16,000 acres and have acquired 3,800 net acres through transactions with other operators.

“Our goal has been to increase Caza net acres around our best acreage positions and trade nonop positions for operated positions, while monitoring acquisition costs,” he said. “This will allow us to execute and control a preferred drilling plan on pads with longer-length laterals, leading to better economics.”

Caza currently operates about 38 wells and has participated in 28 wells since they were acquired by Talara Capital Management LLC in 2015. Since the acquisition by Talara, according to Ford, the total PDP PV-10 valuation increased from $22 million to $184.7 million. Caza’s total proven PV-10 valuation increased from $88 million to $380 million and the company is currently producing about 7,200 barrels of oil equivalent per day.

One of the costs that Caza has cut has been the lifting costs, which have been reduced from $9.60 to $6.40 per barrel of oil equivalent. Ford said: “We’ve done that primarily through waste and water management and saltwater disposal agreements. When we first started drilling these wells, we were trucking water and we’ve been able to build the takeaway to reduce costs at all of our properties.”

During the next year, Caza will have one or two rigs running and will focus on the company’s key properties with the highest internal rate of return, with pad site development in northern Lea County. Ford said that they don’t plan to make any large acreage block purchases. “We plan to focus on where our key properties are,” he said. “We might be interested in new acreage if it adjoins us and if it doesn’t, we’re probably not interested.”

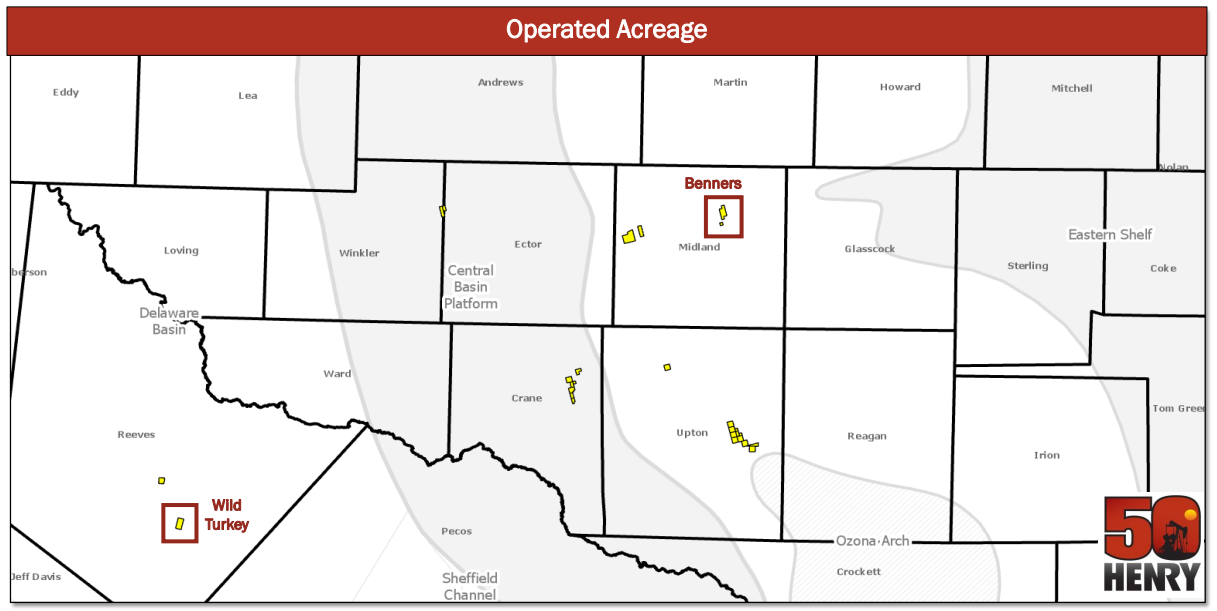

Henry Resources

Henry Resources, according to President David Bledsoe, has been a long-term Wolfberry developer and drilled and average of 80 vertical wells per year. In 2008, the company had a major transaction with Concho and they sold about 85% of their assets. However, since 2014, the company has turned its attention to horizontal drilling in the Midland and Delaware basins.

“Since that time, we’ve run one to two horizontal rigs and now drill 15-30 horizontal wells per year,” Bledsoe said.

Now that Henry Resources is drilling only horizontal wells, he said the company has a new set of “problems” compared to the vertical completions.

“We now focus on low geological risk and you have to know on-lease or off-lease drilling and spacing and how you’re going to develop the prospect,” he said. “You also have to know where your water is coming from and if you’ll have enough, and how to truck wastewater. All of this means that you have to have lots of cash available before you even drop a bit. Cash flow management is certainly an issue.”

Henry’s plan is to test an area and zone first, then drill the tranches to determine bench performance and co-development, spacing assumptions, landing points and stimulation design. When drilling the tranches, the company drills as many wells as possible within cash flow, reserve timing and peak production guidelines, then come back and drill remaining wells on the drilling spacing unit, according to Bledsoe.

Zarvona Energy

Meanwhile, Zarvona Energy opened in 2010 and they bought their first operated asset in 2012, said Rob MacAskie, the company’s CFO and vice president of acquisitions.

Zarvona manages about 21,000 barrels of oil per day and operate more than 400 producing wells in three core basins—East Texas/Louisiana in the Austin Chalk play, the Permian Basin and in Caddo and Grady counties in Oklahoma.

MacAskie said: “We directly invest limited partnership funds on behalf of our investors in oil and gas assets and all of those assets are managed and operated by a single entity, Zarvona LLC. This direct-investment approach allows us to stay at a lower cost basis from an operating perspective than a lot of our private and public competitors. The majority of private companies are sponsored by private equity firms, which is less efficient than us because we are both the sponsor and the operating entity in one. We cut out a layer of expenses and by using a single operating entity.”

The company’s long-term focus is to manage their budget out of cash flow. Growing out of cash flow, according to MacAskie, is by “buying right and developing right. We target foot-hold acquisitions and look for high-margin existing cash flow and this is important so we can really re-deploy into our highest return capital projects.” Zarvona also looks for development drilling and for workover programs, cost-reduction opportunities, enhanced recovery—“anything that can add value to the assets we’ve acquired,” MacAskie added.

Zarvona recently entered the Lower Barnett Permian play in mostly Andrews and Ector counties in Texas. “We’ve drilled more than 20 horizontal wells with an average lateral length of more than 7,500 feet,” he said

The company is also exploring other emerging opportunities like the Hoxbar in Oklahoma, and the Woodbine and Austin Chalk in East Texas. MacAskie said Zarvona will also be looking at Wolfcamp developments in the Permian Basin.

“But you still have to pace yourself,” he said, “and stay within what your budget allows.”

Recommended Reading

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Geothermal ‘Could Save the World,’ but Faces Familiar Subsurface Risks

2024-03-20 - CERAWeek panelists discussed hurdles to widespread use of Earth’s heat to generate power — problems familiar to oil and gas operators.

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.