Most of us can’t help checking what the oil price is doing. Up? Down? Did my marginal project just become subeconomic and on the backburner?

With the Brent crude price dropping below $80/bbl as I write (since yesterday it fell a further $3/bbl to $77/bbl, a four-year low), it is suddenly the dominating factor for the industry. Since June the price has plunged by nearly a third. Combined with cost concerns, suddenly things don’t feel so good.

How does this impact the E&P sector? Nearly 3% of global oil production (now at 94.2 MMbbl/d) is vulnerable to cuts if a sub-$80/bbl price continues, according to the International Energy Agency (IEA). Oil demand, meanwhile, is forecast by the IEA to continue its growth curve, with figures for 2014 and 2015 put at 92.4 MMbbl/d and 93.6 MMbbl/d, respectively. By 2025 it is forecast to hit 99.1 MMbbl/d.

The projected growth will rise from a five‐year annual low of 680 Mbbl/d this year to an estimated 1.1 MMbbl/d in 2015 as the macroeconomic backdrop is expected to improve.

All this brings breakeven points sharply into focus. With 2.6 MMbbl/d of oil estimated to come from projects with a breakeven price of more than $80/bbl, this represents 2.8% of the 93.2 MMbbl/d produced in third-quarter 2014. According to the IEA, some Canadian production has the highest breakeven rates, but there are other high-breakeven price “offenders” out there too, from China, Malaysia and Nigeria to onshore U.S., onshore Russia and the U.K. North Sea.

In the U.S., more than 4% of shale oil production needs $80/bbl to break even, says the IEA, while 8% of deepwater oil is the same (representing some 1.05 MMbbl/d).

But the picture is mixed, and it depends on individual project characteristics. For example, the IEA points out that for ultradeepwater (more than 1,500 m [4,921 ft]), the results are—“perhaps surprisingly”—that little of that current output (less than 1%) requires an $80/bbl price.

It also is worth remembering that to meet the forecast growth in global oil demand and replace declining output from existing conventional fields, up to 30 MMbbl/d more conventional oil needs to be found and produced by 2025.

I also came across an illuminating chart from a presentation by Seadrill that illustrates the breakeven situation is not quite as dire as some say. Some details are not so surprising—Middle East onshore, for example, has an average breakeven price of $27/bbl, while offshore shelf projects are on a $41/bbl average and heavy oil projects at $47/bbl.

But onshore Russia, onshore rest of the world and deepwater breakeven prices sit at $50/bbl, $51/bbl and $52/bbl, respectively, with ultradeepwater slightly higher at $56/bbl. At the higher end, North American shale sits at $65/bbl, oil sands at $70/bbl and Arctic projects at $75/bbl.

These are averages, and there are instances that are higher or lower. But as always, in times of rising price panic, a little perspective is always advisable…

Recommended Reading

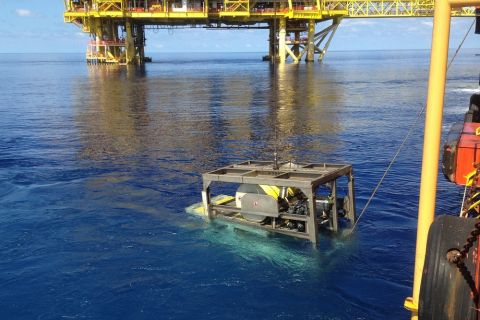

Sapura Acquires Exail Rovins’ Nano Inertial Navigation System

2024-02-01 - Exail Rovins’ Nano Inertial Navigation System is designed to enhance Sapura’s subsea installment capabilities.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

AI Advancing Underwater, Reducing Human Risk

2024-03-25 - Experts at CERAWeek by S&P Global detail the changes AI has made in the subsea robotics space while reducing the amount of human effort and safety hazards offshore.

PGS Wins 3D Contract Offshore South Atlantic Margin

2024-04-08 - PGS said a Ramform Titan-class vessel is scheduled to commence mobilization in June.