An illustration of what shale drillers could be expected to reveal in their quarterly results came in January, when leading oilfield services providers reported weakening shale activity in the U.S. (Source: Hart Energy)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Earnings season is underway, and leading independents in the Permian Basin are preparing to release their fourth-quarter results for 2019 through the end of February. The upcoming results are broadly expected to show a cautious approach in an operating environment that remains tough. Even though production continues to hit new highs, growth is expected to slow, and operators could cut back their capex plans for 2020.

Warning Signals

An illustration of what shale drillers could be expected to reveal in their quarterly results came in January, when leading oilfield services providers Schlumberger Ltd. and Halliburton Co. reported their earnings. Schlumberger’s fourth-quarter profit fell 38% year on year, to $333 million from $538 million. Halliburton, meanwhile, announced a net loss of $1.7 billion, down year on year from a profit of $608 million.

Both services firms cited weakening shale activity in the U.S. as a reason for the downturn in their performance. They expect North American customer spending to fall again in 2020. Indeed, Schlumberger’s CEO, Olivier Le Peuch, expects the 2020 shale market to decline by high single-digit or low double-digit percentages.

Other warning signs include the steady decline in rig counts. Although in the Permian Basin the drop was fairly limited—from 415 rigs at the start of the fourth quarter to 405 at year-end, according to data from Baker Hughes Co.

Crude prices have also stayed weak, with WTI falling back into the low $50s despite briefly rising into the low $60s per barrel at the end of 2019. Additionally, the Dallas Federal Reserve reported in late November that employment in the Permian Basin was lagging Texas-wide job growth for the first time since 2016.

Bright Spots

It is not all bad news, however. Shale drillers have been under an increasing amount of pressure from shareholders to show more financial discipline and focus on returns, and for some of the better-positioned players in the Permian Basin, this approach is paying off. Efficiency gains are allowing output growth to continue even as producers are treading more cautiously.

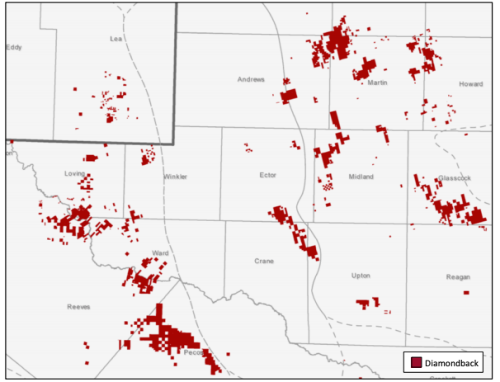

Diamondback Energy Inc. has already pre-announced its fourth-quarter production, which averaged 301,300 boe/d—or 195,000 bbl/d. The Midland, Texas-based company’s production marked an increase of 5% from third-quarter average output of 287,100 boe/d and was also up 65% from the 182,800 boe/d that the company produced in fourth-quarter 2018.

Investment firm Raymond James said it was “encouraged” by Diamondback’s fourth-quarter production figures after a scare in the previous quarter related to offset frac interference. However, it noted in an earnings preview that the producer’s oil mix had declined from around 68% in first-half 2019 to roughly 65% in the second half.

The trend toward a gassier production mix could continue, as Raymond James expects Diamondback’s initial 2020 activity to be focused on gassier assets in the Delaware sub-basin before shifting back to more oil-rich assets later in the year. Diamondback held more than 342,000 net acres in both the Delaware and Midland sub-basins as of November 2019.

Raymond James forecasts Diamondback’s capex for the whole of 2019 to be in line with company guidance of $2.73 billion to $2.95 billion. Fourth-quarter spending, however, is expected to come in fractionally above the Wall Street consensus of $717 million, at around $726 million.

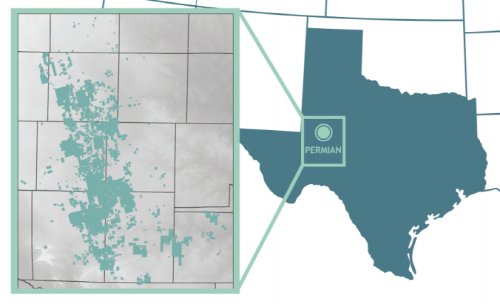

Expectations are also relatively positive for Irving, Texas-based Pioneer Natural Resources Co. Another investment firm, Tudor, Pickering, Holt & Co. (TPH) said Pioneer is set to close a “solid” 2019 on a good note.

Pioneer is a Permian “pure-play” boasting the largest Midland Basin acreage position of about 680,000 net acres. TPH forecasts the company’s fourth-quarter oil production at 217,000 bbl/d with capex of around $750 million, both in-line with Wall Street expectations and above the mid-point of Pioneer’s 210,000-220,000 bbl/d guidance.

UPDATE:

Concho Resources, Devon Energy To Spend Less In 2020

“We see 2020 as a continuation of 2019’s trends: (i) increased capital efficiency throughout the year, (ii) a growing [free cash flow] profile and (iii) a focus on enhancing return on and of capital,” TPH wrote in a recently published research note.

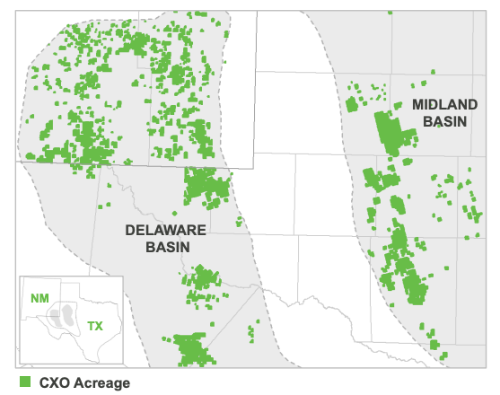

A mild winter in Texas is expected to have helped some Permian players boost their fourth-quarter production. Raymond James cited weather as a factor in its production and capex expectations for Concho Resources Inc. being toward the higher end of the Midland, Texas-based producer’s fourth-quarter guidance, for example.

Concho is one of the largest unconventional shale producers in the Permian. The company’s core operating areas span nearly 570,000 net acres across the Delaware and Midland sub-basins.

Raymond James also noted a 28% decline in well costs this year compared with first-half 2019, which it expects will allow Concho to bring its capex for 2020 below the roughly $3 billion spent in 2019.

“Cost savings are the name of the game,” agreed TPH on Concho’s 2020 performance expectations. “We believe [Concho] could still see both drill bit and completion efficiency gains, potentially pulling spending lower throughout the year.”

TPH expects Concho to hike its dividend, with any excess cash channeled towards an announced $1.5 billion share buyback. It describes this as Concho “hitting the right notes from a shareholder returns standpoint.”

Recommended Reading

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.