[Editor's note: A version of this story appears in the February 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The majority of hydraulic fracturing fleets across the Lower 48 are idle, combating pricing pressures, an overall softening in demand as well as budget belt-tightening by clients. The outlook for 2020 is at best uncertain, but most agree there is little light to be seen at the end of this particular tunnel.

The current state of the market does not sound like the best time for an expensive, new spin on a proven technology to make inroads, but that is the exact position where contractors of electrically driven fracturing or e-frac fleets find themselves.

Operators would tend to push toward conventional and readily available diesel-based or even dual-fuel units for their fracturing requirements, but these are interesting times and things are not so cut and dry.

While investors are pressuring operators to live within cash flow and be more cash-conscious in general, there is also a movement toward increased environmental and social awareness that is gaining momentum. Some of the same equity backers that are demanding returns are pushing the ESG (environment, social and corporate governance) agenda, and operators are responding by looking at ways to reduce their carbon footprints and generally be better stewards of the environment. The movement is serious.

According to one vendor, some operators have even gone as far as to tie executive bonus structures directly to the amount of annual carbon reduction achieved by the efforts at the field level, financially incentivizing the use of technology like e-frac.

“Given multiple benefits, we foresee e-frac continuing to take share in the years ahead,” said Scott Gruber, analyst with Citi Research in a mid-2019 note to clients. “However, this is unlikely to be a surge as in prior cycles, rather a steady investment stream over time given capital discipline demands, but nonetheless a free-cash-flow moderator.”

There are more than 500 frac fleets across North America totaling around 20 million horsepower, the majority of which are powered by trailer-mounted diesel engines. Each fleet can consume up to 7 million gallons of diesel annually, emit 70,000 metric tons of CO2 and require around 700 tanker truckloads of diesel to be supplied to site.

The draw of e-frac is obvious in a place like the Permian Basin, where natural gas is often a byproduct of crude oil production to be flared if there is no takeaway capacity available. Operators can put that gas to work to generate electricity for completion operations. Electric systems also run more quietly than conventional diesel spreads, offering an additional safety or nuisance consideration for both workers at the field site and any neighboring populace.

Entry into the e-frac market for the interested contractor is an expensive proposition. While none of the current crop of providers involved in the market are speaking too candidly about the overall cost, pundits place the price tag of a new e-frac system at upward of $60 million. That’s about double the cost of a conventional diesel spread.

SIDEBAR:

Coming Clean

For operators in the most remote locations of popular unconventional oil and gas basins around the world, turning on a light—much less a frac pump—isn’t as easy as a flick of a switch. That power needs to come from somewhere, and the isolation of the infrastructure-poor regions of the Permian Basin of West Texas, for example, can make that normally simple task a challenge.

across industries

are looking for

solutions to a low

carbon footprint,

and the Chevron

project is one

example of how

organizations

are moving the

world toward

a new energy

future,” Nathan

Griset, SunPower

senior director of

commercial solar.

If the operators are too far away from a tap-able power grid, then the historic solution has been running diesel turbines on site to supply the needed juice.

Today, eco-minded operators are looking more to the sky for their required electricity. Both wind and solar are being employed more by producers in multiple locations to power oilfield operations.

In the fourth quarter of 2019, supermajor Chevron Corp. signed a deal with Silicon Valley-based solar specialist SunPower Corp. to build a new 35-megawatt DC solar array to supply power to the operator’s Lost Hills project in Kern County, Calif. Once completed in 2020, the project is expected to provide around 80% of the total production, processing and office power needs of the 40-year old field. It is the only oilfield solar project that the provider currently has under construction.

“Companies across industries are looking for solutions to a low carbon footprint, and the Chevron project is one example of how organizations are moving the world toward a new energy future,” said Nathan Griset, SunPower senior director of commercial solar.

“The nonprofit CDP [Carbon Disclosure Project] has ranked 24 of the largest and highest-impact publicly listed oil and gas companies on business readiness for a low-carbon transition, estimating that low-carbon projects account for just 1.3% of their spending. One might see this as an opportunity to increase solar adoption. There’s undeniably room for growth.”

Last October, operator Occidental Petroleum Corp. started up its Goldsmith Field solar facility—a 120-acre, 16-megawatt solar array in Ector County near Odessa, Texas. The operator will use the facility to directly power an enhanced oilfield recovery (EOR) operation in the Permian Basin.

Occidental also signed a 12-year power purchase agreement with a joint venture of Macquarie’s Green Investment Group and Core Solar LLC to source additional solar energy for its Permian operations.

Deals like these followed supermajor Exxon Mobil Corp.’s announcement in late 2018 that it locked in a power purchase agreement with Lincoln Clean Energy, a subsidiary of Denmark’s Orsted, for 500 megawatts of wind and solar power for use in its Texas operations. And there are likely more coming.

But why is Big Oil looking to renewables to assist with oilfield power generation in the first place? The answer is twofold.

First, the current streak of environmental, safety and governance consciousness sweeping across the industry appears to be more than just a phase. Companies are seeing that sensible environmental stewardship is the way forward and that can start with lowering emissions across their respective asset bases. Second is just simple economics.

“We frequently evaluate opportunities to diversify our power supply and ensure competitive costs,” explained Exxon Mobil spokesperson Julie King.

In these instances, use of renewable power is not only more environmentally friendly; it is also more pocket book friendly. Government incentives and tax credits, both of which are due to phase out soon barring extensions, have made it attractive for developers to punch their renewables ticket now.

While power generation from natural gas and diesel works well in scale, the economics skew as the projects get smaller. With green field renewables, operators can simply start small—a few solar panels or wind turbines—and scale up as needed, or simply purchase green power from existing low-cost providers.

“As part of our onshore operating principles, we’re working to reduce the operational footprint of our assets in the Permian,” said Curtis Smith, a spokesperson for Royal Dutch Shell Plc.

“This year, we’ve piloted the use of solar energy to power parts of our operations in the region, and we’re continually exploring ways to improve the energy efficiency of our existing facilities.”

That is not to say that the renewables route isn’t without its own pitfalls. California-based Aera Energy, a joint venture between subsidiaries of Shell and Exxon Mobil, was due to have California’s largest solar energy project—the Belridge solar plant—under construction during the first half of 2019 and online in 2020.

Aera’s plan is to use the power to create steam for its regional EOR projects. However, Belridge has suffered setbacks, including the financial trouble and management changes at project partner GlassPoint Solar. As a result, the planned 770-acre, 850-megawatt project has yet to move forward.

The win-win

E-frac pure-player Evolution Well Services started up in 2011 as a Canadian concern. Later, the company moved to the U.S. and spent a few years engineering its e-frac unit, which came to market in 2016. The company currently has six e-frac fleets currently pumping and a seventh that will be deployed during the first quarter of 2020. The contractor’s active fleet is operating in the Permian, Eagle Ford and Marcellus-Utica basins.

“As a company, the timing for when we’re rolling out our electric technology has been a perfect fit,” said Nicholas Ruppelt, director of sales for Evolution. “Before when we rolled out the technology it was all about the fuel savings. Currently, it is still one of the top two reasons that people go electric, but now we are seeing the ESG focus coming into play, and investors are pushing oil companies to go this way. It has been a huge factor in why people are choosing electric frac as well.”

of the ESG funds

coming into play,

and investors

are pushing oil

companies to

go this way.

It has been a

huge factor in

why people are

choosing electric

frac as well,” said

Nicholas Ruppelt,

director of sales,

Evolution Well

Services

The bulk of the price for an e-frac unit lies with the gas turbine required to generate the electricity. E-frac units can utilize standard gas turbine systems; however, the size and composition can make them challenging to mobilize.

“We started with an off-the-shelf turbine package, and it worked great,” said Ruppelt. “It is just as reliable, but it is made for industries like hospitals or if there was a natural disaster where the power plant goes down and you’d need to deploy something in seven days, and that is literally how long it can take to move them. When we had that, our move times didn’t meet the standards of the North American frac market. So we spent quite a bit of money, time and engineering to come up with our own package. That’s what our sister company Dynamis Power Solutions is making for us.”

Evolution uses one large turbine that it manufactures itself, in partnership with GE Aviation. The engine is a GE LM2500+G4 aero-derivative gas turbine used by GE in aircraft and ships. Evolution Well Services and Dynamis Power Solutions package these engines into ultra-mobile, built for purpose, hydraulic fracturing power generation units. Due to its size and modular design, it can move quicker, competing with conventional fleets on mobilization time.

“That is one of the biggest differentiators between us and those trying to get into the space right now,” said Ruppelt.

While expensive for contractors, the lure of e-frac units for operators is real, and there are savings to be had over diesel units. Pundits have estimated that use of an electrically driven frac unit could shave around $300,000 in cost off of a $6- to $8 million shale well.

The power of efficiency

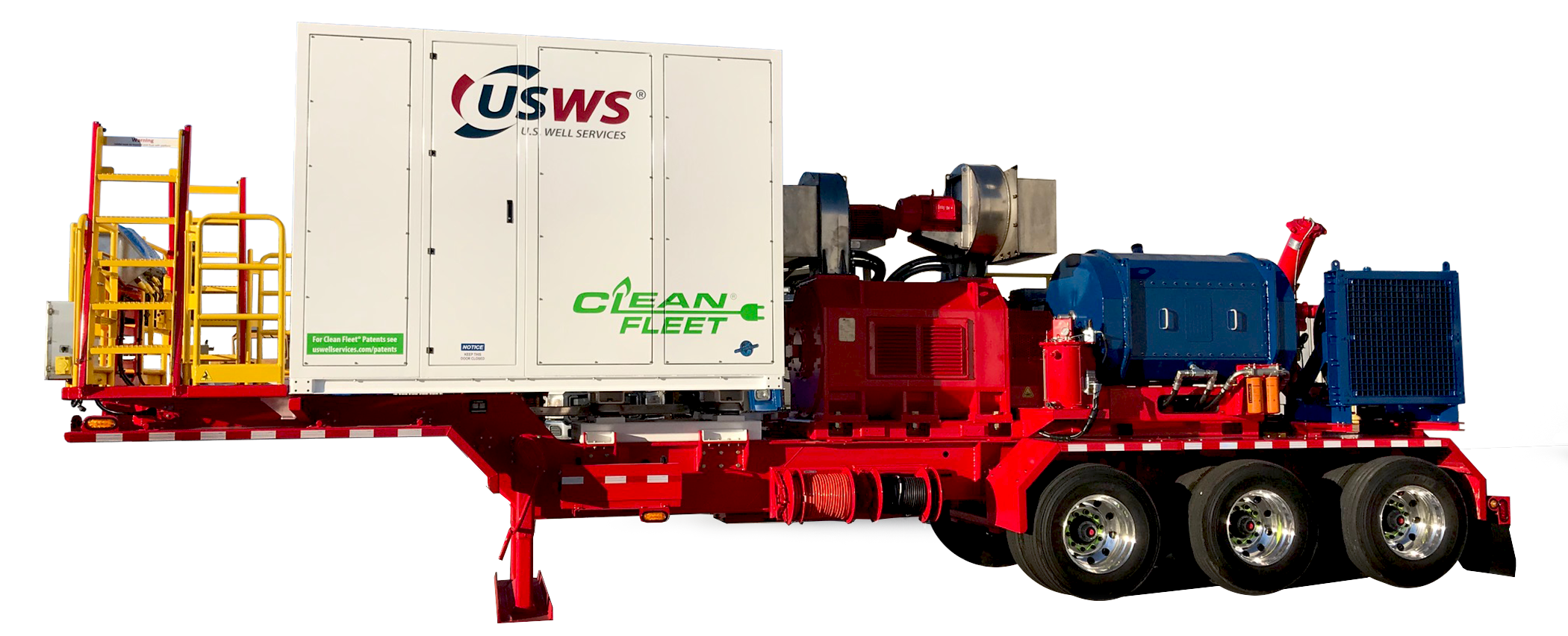

Demand for e-frac units is robust, according to the contractors in the space. U.S. Well Services, which is currently preparing to take delivery of its fifth electric fleet, or Clean Fleet, across a handful of unconventional basins, is in active dialog with customers regarding new build fleet opportunities.

as much as

$250,000 per

well by going

with electric, as

well as reaping

the ESG benefits

and emissions

reductions,” said

Jared Oehring,

chief technology

officer with U.S.

Well Services.

With both fuel savings and ESG benefits playing in its favor, the company is not shying away from expanding its horsepower footprint in the e-frac market if the deal is right. Earlier this year, the company deployed its latest fleet in the Permian Basin for supermajor Royal Dutch Shell Plc.

“We began designing the Clean Fleet in 2012, and after more than five years of operating experience with the technology, we have been able to optimize the design of the equipment to reduce our upfront cost and still deliver fuel savings, emissions reductions and best-in-class performance for our customers,” said Joel Broussard, U.S. Well Services’ CEO.

“We took delivery of three new fleets in 2019 and will take delivery of a fourth early in 2020,” said Jared Oehring, chief technology officer with U.S. Well Services. “We are increasing our electric frac horsepower to meet the demands of our customers. They are saving as much as $250,000 per well by going with electric, as well as reaping the ESG benefits and emissions reductions.”

The new additional fleet brings U.S. Well Services’ e-frac portfolio to five active fleets. The company has built six fleets overall but combined the first and second into a single fleet as leading edge jobs have commanded higher horsepower fleets over time.

U.S. Well Services has been consciously working with its supply chain network to drive down its own cost per fleet to assist with improving economics on the vendor side of the equation. The company has a partnership and exclusivity agreement with PW Power Systems, which packages a Pratt & Whitney turbine for use in its fleets—the 30-megawatt FT8 MOBILEPAC aero-derivative gas turbine. The contractor has also moved to reduce its footprint per fleet, and that has had a positive effect on mobilization times.

“We have also worked with our turbine packaging partner to make the turbines more mobile,” said Oehring. “Maybe it does take slightly longer to move, but are you willing to take half-a-day longer to save $250,000 per well?”

The company’s latest fleet design it will deploy for Shell is a testament to the strides being made in the space to reign in the overall footprint of e-frac spreads. U.S. Well’s initial fleets consisted of over 100 power cables, with 18 cables per pump. The latest generation has only one cable into the pump trailer. The trailers themselves have shrunk from around 45 feet down to 35 feet. They have also rolled out an all-electric blender. The company’s first generation blender was electric over hydraulic.

“We are aggressively evaluating our supply chain in order to reduce costs,” Oehring said. “We’ve been able to build an electric pump for less than it would cost to build a conventional diesel pump. Contractors that are just starting in the space don’t have those supply chain efficiencies and partnerships that we’ve been able to achieve. These will serve as a competitive advantage for U.S. Well Services and help us continue to build cost-efficient, long-lived frac equipment.”

A bet with upside

Baker Hughes sold its pressure pumping fleet in 2016 to help recreate BJ Services, so it is not a contractor in the domestic space; however, it is a player in e-frac via the supply of the gas turbines required to power these systems. The company was the first to successfully deploy gas turbines for e-frac applications and remains a leading provider of gas turbine technology for the e-frac market offering customizable options in power ranges from 5.6 megawatts up to 38 megawatts. An early client was Evolution Well Services, which utilized Baker’s TM2500 turnkey gas turbine generator package. Additionally, Baker Hughes is working with packagers like Dragon, which chose the contractor’s Nova LT5 and Nova LT16 for its power packages in the Permian.

“We continue to see a lot of potential for our turbomachinery and process solutions business in the e-frac space,” said Steve Goldstein, Baker Hughes Turbomachinery and Process Solutions unconventional platform manager. “We have received several e-frac contracts from customers this year and are continuing to generate interest from others.”

Baker Hughes is leveraging its oilfield service relationships across the Permian and other unconventional plays in the U.S. to draw interest in its gas turbine offerings. Even though additional infrastructure is required, Baker Hughes views e-frac as a compelling economic solution that is safer, cleaner and more efficient for people and the planet. It addresses remote power access, saves on fuel costs, streamlines logistics and operational footprint, reduces maintenance cycles and minimizes noise pollution.

“As a result, e-frac fleets are being added, while some conventional fleets are being stacked,” added Goldstein. “And, since we are not exposed to the pressure pumping market in North America like some of our competitors, the e-frac market is all upside for us.”

The bullishness on the e-frac market starts at the top for Baker Hughes. Speaking to investors in early 2019, chairman, president and CEO Lorenzo Simonelli called e-frac and the company’s range of carbon-competitive products a “great example of a new solution” addressing “some of our customers’ toughest challenges such as logistics, power and reducing flare gas emissions.”

Integration hesitation

Larger oilfield service companies in the space have made recent investments in the conventional fracturing market and show little sign of taking the e-frac plunge.

president and

CEO Lorenzo

Simonelli said

e-frac addresses

operator

challenges related

to logistics,

power and flare

gas emissions.

In late 2017, Schlumberger Ltd. paid $430 million for Weatherford’s pressure pumping business, while Halliburton CEO Jeff Miller told attendees at a recent Barclays conference that the contractor had tested the technology but held no current desire to pursue the market. Miller added that the cost of converting the industry’s 500-plus diesel systems to electric could run upward of $30 billion.

Others with assets in pressure pumping have made similar overtures. Patterson-UTI manufactures electric control systems used for e-frac spreads but does not own any electric frac fleets.

At the same Barclays conference, Patterson-UTI president and CEO Anthony Hendricks told attendees that the numbers made it difficult to move forward with phasing in e-frac fleets, alluding to the current oversupply of under-utilized diesel spreads.

That oversupply and lack of demand has even forced some conventional hydraulic fracturing companies out of the business completely. Basic Energy Services said in December it would divest of its pumping services assets (not inclusive of coiled tubing) in multiple transactions with expected proceeds of around $30- to $45 million. The contractor pointed to the difficult pricing and activity environment for the move.

Around the same time, Superior Energy Services Inc. said it would shutter its hydraulic fracturing unit. The company said it was cutting 112 Pumpco jobs in West Texas and anticipated a $45 million pre-tax charge to earnings from a reduction in the value of its assets.

According to estimates by investment bank Tudor, Pickering, Holt & Co., e-frac accounts for about 3% of active fleets and could reach between 25% and 33% in the next five years.

“Ultimately the customer is going to decide what technology is going to win in the market, and we have found that the demand is there for our products and services,” said Ruppelt. “We see that the demand is there due to the cost savings, efficiencies and environmental benefits. Markets change and costs improve as technology advances.”

Recommended Reading

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.