An oil rig in Williston, North Dakota. (Source: Shutterstock.com)

With the start of earnings’ season upon us, questions on shale are beginning to swirl around watercoolers. This week, Stratas will direct a spotlight on the Bakken Shale, the granddaddy of shale oil. Our aim is to draw attention to new information arising from recent company announcements that are likely to shape the play in the near-term.

Activity and production guidance from recent reports suggests stable rig counts and lower production growth for 2019, departing from stout growth in 2018. Hess Corp. (Hess), the first major Bakken operator to report financial results this season, reported its production rose 7% from the third quarter to 126 MBoe/d despite some minor weather challenges in the final quarter of the year. Given the recent extreme weather conditions, Stratas expects another challenging quarter in the region. Fortunately, current prospects for Spring flooding look low, according to National Weather Service reports. Snow packs and soil saturation levels are low due to dry conditions.

Stratas estimates 2019 year-end production of 1,693 MBoe/d, essentially unchanged from the 1,680 for December 2018. This stable production outlook reflects the play’s relative maturity and expectations for operators to live within cash flow in the play. Rig counts are expected to range between 60 to 70 rigs over the next two years. Notably, rail exports of Williston Basin crude have been holding steady at roughly 20% of production while refinery processing in the region dipped slightly according to North Dakota Pipeline Authority reports.

Realized Prices, Hedges

Price volatility rose in 2018 on shifting upstream investments in shale, global trade uncertainty, and risks on supply-demand fundamentals. These factors had unequal effects on plays and operators had to adopt a variety of hedging strategies. This is true within the Bakken community.

To mitigate pricing risk, Bakken operators enter into a variety of hedging contracts. Generally, Bakken operators have around 60% of estimated 2019 production. Of course, some operators like Continental Resources (Continental) hedge less (0%). In contrast, Stratas estimates Hess has almost 100% of its estimated Bakken production hedged at $60/Bbl.

Evidence of operational expertise

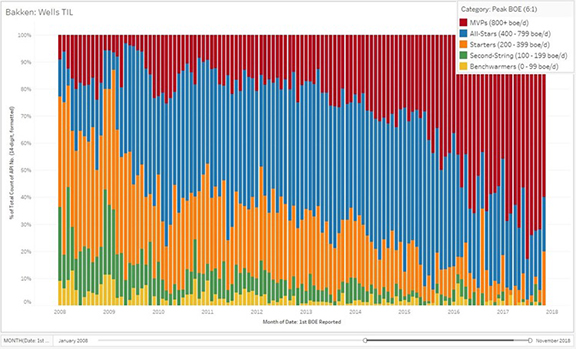

Since the beginning of 2008, when of hydraulic fracturing was beginning to take hold in the Bakken, operators in the top two quintiles (MVPs and All-Stars) controlled roughly 30% of all wells turned online. Recently, we have seen these top operators move to nearly 90% of all wells in the play.

Evolving completion designs generating better production rates

Lateral lengths in the Bakken have remained relatively unchanged for years. However, that is not the case with completions. Higher proppant loadings (pounds of proppant per thousand foot of stimulated rock) have become more common in recent years. The result is visible in the accompanying chart.

Source: Stratas Advisors

Stratas frequently refers to the following categories for producing wells: MVPs, All-Stars, Starters, Second-String and Benchwarmers. MVPs are wells which have achieved peak rates (30-day average rate) of 800+ Boe/d, all-stars post 400 to 799 Boe/d, starters post 200 to 399 Boe/d, second-string post 100 to 199 Boe/d and benchwarmers post 0to 99 Boe/d.

What’s behind the rising share of MVPs and all-stars? Improving knowledge of geology and completions. Digging into completions a little further, MVPs averaged just under 550K Lbs per 1,000’ of lateral length in 2013 while all-stars averaged just over 420K lbs/1,000 ft. Meanwhile, starters typically used under 375,000 lbs/1,000 ft. Since then, MVPs are trending north of 1.2 MMlbs/1,000 ft’ and all-stars are trending just below at 1 MM lbs/1,000 ft while starters are using just over 600,000 lbs/1,000 ft. Looking into 2019, top operators are expected to continue pushing proppant thresholds, with completion techniques breaking the 1.5 MMlbs/1,000 ft bar.

The differences in proppant usage led to improvements on peak rates of around 40%. Average peak rates for the MVPs increased from approximately 1,000 Boe/d in 2013 and now trend north of 1,400 Boe/d. The market share of MVPs in the Bakken has risen from approximately 20% of total wells turned online in 2013 to nearly 70% currently.

Source: Stratas Advisors

Play Outlook

The Bakken rebounded in 2018, with operators putting more capital and rigs back into the play. Production of ~1,550 MBoe/d represented over 10% of U.S. shale in 2018. Going forward, we anticipate the Bakken to continue its transition into harvest mode. Rig counts are expected to range in-between 50 and 70 with capital expenditures ranging from $1 to $2 Billion per year. Production is expected to grow 6% in 2019 to over 1,660 MBoe/d, with an average production of ~1,750 MBoe/d over the next five years.

There still remains running room for operators in the Bakken. By our estimates, the top quintile wells have enough locations to keep drilling into the early- to mid-2020s with locations in the second quintile wells depleting in the early 2030s. Of course, changes in well design and completion techniques could alter this estimate. But for now, with breakeven prices on the majority of Bakken wells below $60/bbl and ample drilling inventories, capital will continue to flow into the Bakken.

Recommended Reading

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.