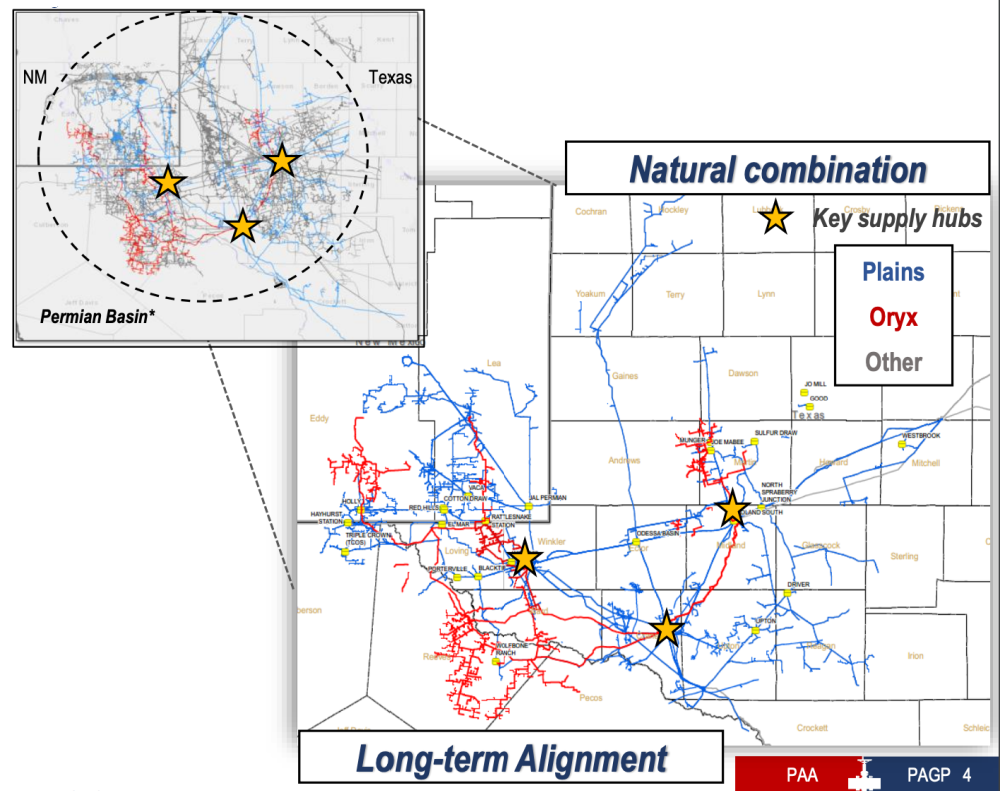

Oryx Midstream, a portfolio company of Stonepeak Infrastructure Partners based in Midland, Texas, is one of the largest privately held midstream crude operators in the Permian Basin. (Source: Oryx Midstream)

Plains All American Pipeline LP agreed to merge a vast majority of its Permian Basin assets with privately held Oryx Midstream Holdings LLC, the companies said in a joint release on July 13.

The merger, structured as a cashless transaction, will create a debt-free joint venture (JV) named Plains Oryx Permian Basin LLC that the companies expect will generate $50 million of operational synergies within the first 12 months and potentially reach over $100 million over time.

Since its launch in 2013, Oryx Midstream, a portfolio company of Stonepeak Infrastructure Partners based in Midland, Texas, has grown into one of the largest privately held midstream crude operators in the Permian Basin. According to CEO Brett Wiggs, its combination with Plains is a “natural evolution of the Oryx growth story.”

“We look forward to partnering with Plains and are confident that Plains Oryx Permian Basin will continue to grow and provide producers with the best solutions in the region,” Wiggs commented in the joint release.

In 2019, Stonepeak purchased substantially all of the assets of Oryx Midstream for roughly $3.6 billion in cash from its investors, which included affiliates of Quantum Energy Partners, Post Oak Energy Capital, Concho Resources and WPX Energy. Later that year, Qatar Investment Authority announced an additional investment of approximately $550 million through the acquisition of “a significant stake” in Oryx.

Pro forma, the Plains Oryx Permian Basin JV will be comprised of 6.8 million bbl/d of crude pipeline capacity spanning 5,500 miles with an average remaining contract life of about seven years on the JV’s 4.1 million dedicated acres.

The JV will be owned 65% Plains and 35% Oryx with exact cash split determined by a tiered 10-year modified distribution sharing agreement. Plains has retained ownership and the JV will be consolidated into its financial statements. However, the release noted a joint operating committee that includes representatives from Plains and Oryx will provide oversight on material JV operating and commercial decisions.

Excluding synergies, the JV is forecasted to contribute $800 million of EBITDA and $625 million of free cash flow for 2021, according to an investor presentation by Plains.

Willie Chiang, chairman and CEO of Plains All American, described the JV, which does not include Plains’ long-haul pipeline systems and certain of its intra-basin terminal assets in the Permian Basin, as a natural combination and logical next step to optimizing its complementary systems.

“Structured as a debt-free JV entity through a cashless transaction, this aligns with Plains’ financial and portfolio optimization strategies, is near-term free cash flow accretive to Plains and Oryx, and reinforces Plains’ ability to maximize free cash flow for our investors, while enhancing our overall credit profile,” Chiang commented in the release.

The transactions contemplated by the merger agreement are expected to close fourth-quarter 2021. The agreement also includes the refinancing by Oryx of existing debt with a new term loan B secured by its equity interests in the debt-free JV.

J.P. Morgan Securities LLC served as Plains’ exclusive financial adviser for the transaction and Vinson & Elkins LLP provided the company legal counsel. Simmons Energy, a division of Piper Sandler, served as Oryx’s lead financial adviser. Barclays also served as a financial adviser to Oryx and is leading a committed term loan B refinancing. Sidley Austin LLP, led by two Houston partners Tim Chandler and Tommer Yoked, represented Stonepeak Infrastructure Partners and its portfolio company Oryx in the transaction.

Recommended Reading

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.