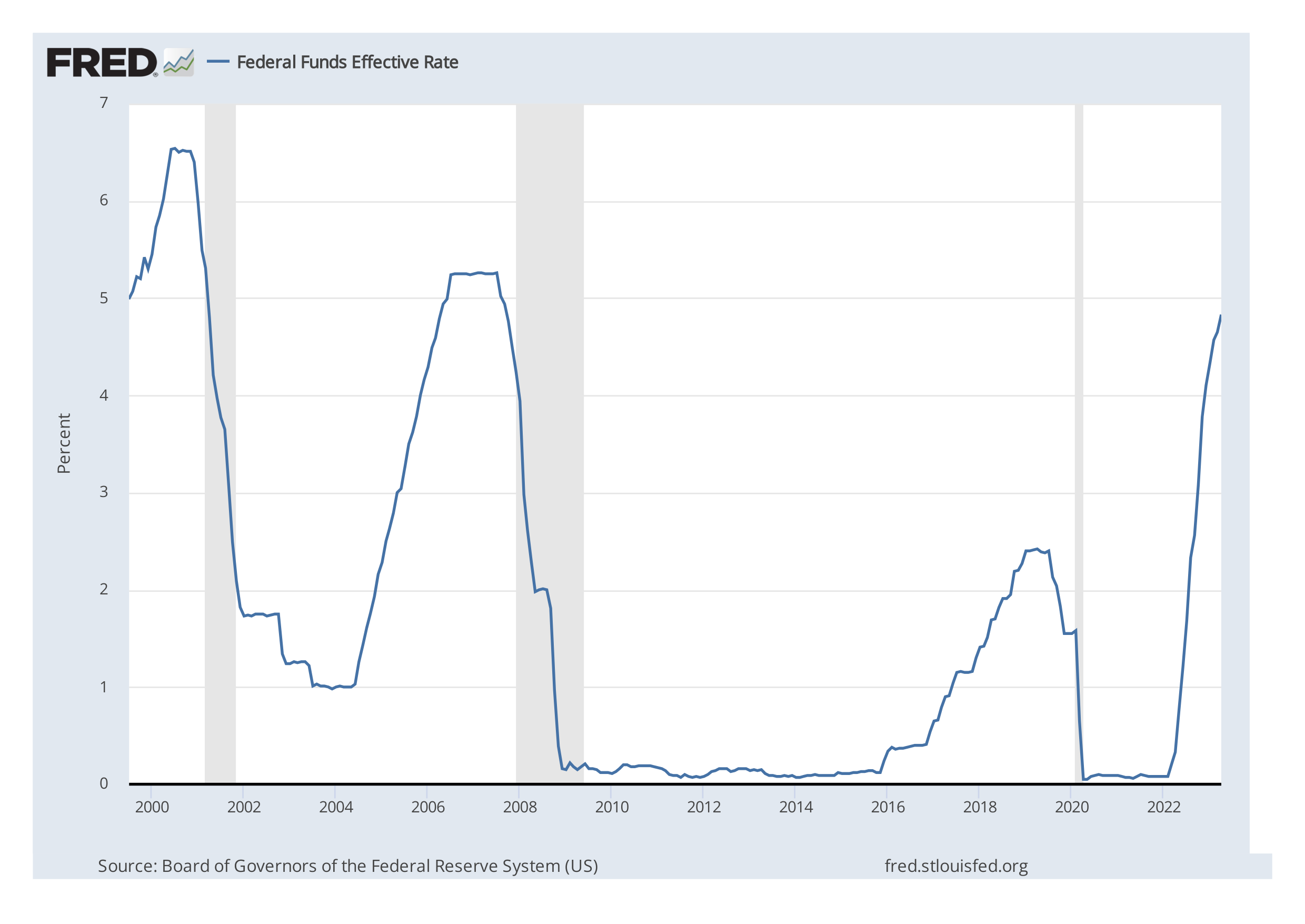

The rising Fed rate—now 5.25%—will change how producers finance their acquisitions, according to Rich Dealy, Pioneer Natural Resources Co. president and COO.

“They’ll have to utilize more equity to do those transactions,” Dealy, who will assume the CEO post on Jan. 1, told Hart Energy in an exclusive interview.

Oil and gas producers’ balance sheets have become quite strong over the past few years, he said. "The question is, 'When are people willing to put less cash in [to an offer] versus using equity?'"

“I think that these higher rates are going to lead to more equity [deals] from the smaller companies. It’s going to be more stock-for-stock type transactions, I would suspect.”

Pioneer itself isn’t in need of buying more future-well locations, though, Dealy said. “We’re blessed with the inventory we have,” which he said includes 15,000 future high-graded locations and more than 25,000 total locations.

“We’re drilling roughly 500 wells this year.” Pioneer’s current rig count is 25.

“We have a 20-plus-year high-rate-of-return inventory. So we don’t have to replace inventory at the pace that others do.”

That pace allows Pioneer to distribute 75% of its free cash flow (FCF) to shareholders and retain 25% to pay down debt. “A lot of other companies that you look at their return-of-capital program are doing 50%, or just doing buybacks, because they don’t have that luxury as they know they will have to use [FCF] to replace inventory,” he said.

From 0.25% to 5.1%

Pioneer issued debt in 2020 and early 2021 at less than 1%. In one deal, convertible notes were issued at 0.25%.

A $750 million offering in May 2021 at 0.55% was due on May 15. In March, Pioneer chose to issue 5.1% notes, due March 2026, to pay off maturing 0.55% notes.

Dealy, who was Pioneer’s CFO for 16 years prior to becoming president in 2021, said, “We thought it was prudent—because of the bond maturity [this month]—to go ahead and refinance that for a shorter duration.”

The new bonds have a three-year maturity. “It’s not a long duration. It wasn’t a 10-year type bond, but something much shorter,” Dealy said.

Pioneer had been returning roughly 100% of FCF to shareholders through dividends and buybacks. The new capital-allocation regime will direct 25% to the balance sheet “to improve financial flexibility to pay down gross debt over time. Our long-term goal is to pay down gross debt.”

The 5.1% money, while in stark contrast to getting cash as cheap as 0.25% (in May of 2020), isn’t too off path in terms of basis points—100 over the 5% Fed target rate at the time of issuance in late March versus zero over the 0.25% Fed target rate in May of 2020.

The points suggest Pioneer’s creditworthiness is unchanged.

But surely paying 5.1% for money is painful, yes? Dealy said the 5.1% price “clearly was higher than anything we’ve done in the recent past just because of where interest rates have gone and what’s happening in the market.

“But our long-term goal is to move to a net-debt-zero balance sheet, given the volatility in this industry and the cycles that we’ve seen over the last 10 or 15 years. The cycles have come faster.”

Pioneer has been improving its balance sheet.

“And longer term, our balance sheet will provide additional opportunities to buy back stock,” he said.

Absolute zero?

In the first quarter, Pioneer produced $950 million of FCF, resulting in a $3.34/share dividend and $500 million in stock buybacks at an average price of $206/share. The total is some 135% of first-quarter FCF, noted Neil Mehta, an analyst with Goldman Sachs & Co., in a report.

Buybacks have totaled more than $2 billion since year-end 2021 or roughly 4% of outstanding shares, according to Pioneer.

At $80 oil, the operator expects to generate some $27 billion in FCF during the next five years, Dealy said in an analyst call in late April. At $100 oil, it would be about $40 billion; at $60, $13 billion.

First-quarter production costs were $10.82/boe.

Pioneer holds $5 billion in senior notes due between 2025 and 2031, with interest rates ranging from 0.25% to 7.2%.

Gabriele Sorbara, an analyst with Siebert Williams Shank & Co., noted in a report that Pioneer’s first-quarter-end liquidity was $3.2 billion, consisting of $1.2 billion of cash on hand and an undrawn bank line of $2 billion.

During an analyst call in late April, Scott Hanold, an analyst with RBC Capital, asked if Pioneer’s goal, then, was to get debt to absolute zero. “Or do you think there’s an optimal level of leverage on the balance sheet?”

Neal Shah, Pioneer CFO, said, “It’s our intention to continue to pay down gross debt as it comes due.”

Why issue new debt, though, to pay off the notes that were set to mature on May 15? Shah said that, at this time, “we thought it was prudent” and “I view it more of a temporary bridge as we shore up free cash on the balance sheet.”

Debt-for-deals financings

While many M&A deals of the past few years have been all-stock transactions, oil and gas producers have recently been issuing senior debt to finance a cash portion.

Matador Resources Co. sold $500 million of 6.875% senior notes due 2028 as part of buying Permian producer Advance Energy Partners in April for $1.6 billion.

Canada-based Baytex Energy Corp. sold US$800 million of 8.5% senior unsecured notes due in 2030 to fund the cash portion of buying Eagle Ford producer Ranger Oil Corp.

And Riley Exploration Permian Inc. sold $200 million in 10.5% senior unsecured toward funding a $330-million acquisition of Permian properties from Pecos Oil & Gas LLC.

Pioneer Natural Resources’ Senior Notes ($MM) |

||

|---|---|---|

|

March 31, 2023 |

Dec. 31, 2022 |

|

|

0.550% Due 2023***** |

750* |

750 |

|

0.250% Due 2025** |

870 |

962 |

|

5.100% Due 2026 |

1,100* |

— |

|

1.125% Due 2026**** |

750 |

750 |

|

7.200% Due 2028 |

241 |

241 |

|

4.125% Due 2028 |

138 |

138 |

|

1.900% Due 2030*** |

1,100 |

1,100 |

|

2.150% Due 2031**** |

1,000 |

1,000 |

|

5,949 |

4,941 |

|

|

Issuance Costs and Discounts, Net |

(41) |

(37) |

|

Total Debt |

5,908 |

4,904 |

|

Current Portion of Long-Term Debt |

(814) |

(779) |

|

Long-Term Debt |

$5,094* |

$4,125 |

|

*Notes due May 15, 2023, will be retired with proceeds from 5.1% notes due March 2026 that were issued in March 2023. **Convertible; issued in May 2020. ***Issued in August 2020. ****Issued in January 2021. *****Issued in May 2021. |

||

Recommended Reading

EnQuest Selling Stake in North Sea Golden Eagle Oilfield, Sources Say

2024-04-16 - EnQuest has struggled in recent years with high debt levels and a drop in profits after Britain imposed a 35% windfall tax on North Sea producers.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Occidental to Divest Some Permian Assets after Closing CrownRock Deal

2024-02-21 - Occidental CEO Vicki Hollub said plans to divest non-core Permian assets would come after closing the pending acquisition of CrownRock — but reports have since emerged that the company is considering selling its share of Western Midstream Partners, valued at about $20 billion, according to Reuters.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.