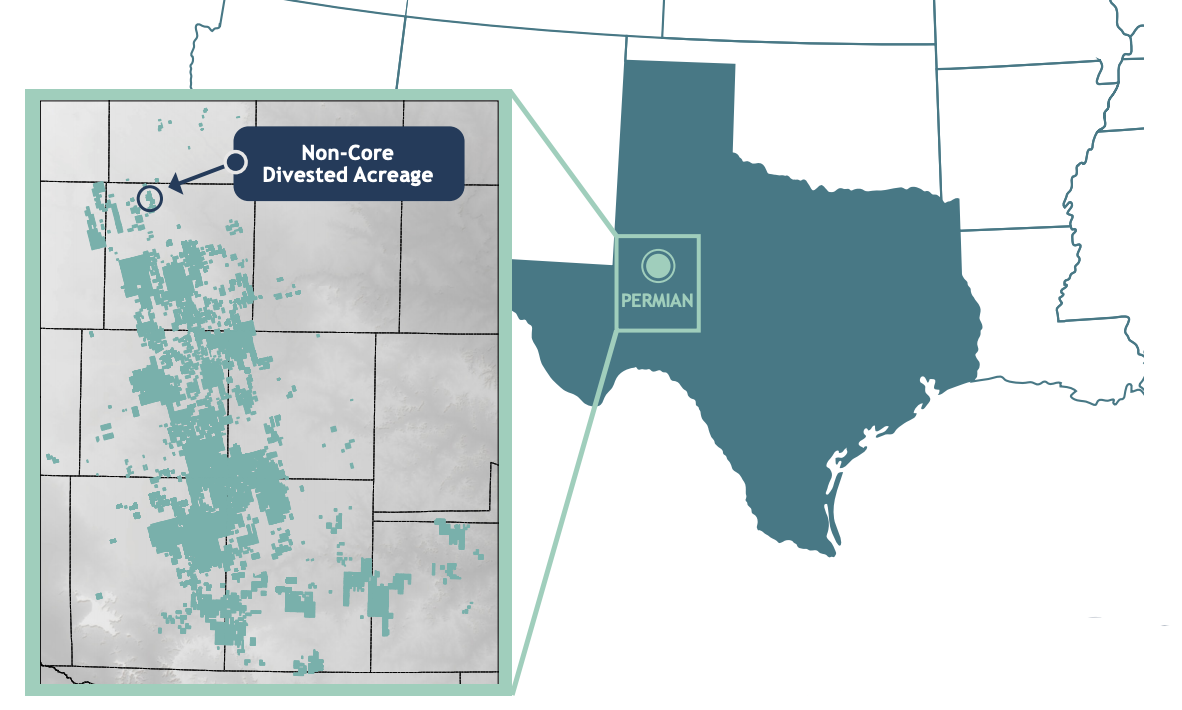

After narrowing its focus solely on the Permian Basin within the past year, Pioneer Natural Resources now boasts a roughly 680,000 net-acre position located in the Midland Basin. (Source: Hart Energy)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Already a trimmed-down version of its former self with assets across Texas, Pioneer Natural Resources Co. is still finding ways to high-grade its pure-play portfolio in the Permian Basin.

On Aug. 6, the Irving, Texas-based independent revealed a recent divestiture of Permian acreage in the one area that CEO Scott Sheffield said will outlive all other U.S. shale basins. An undisclosed buyer, which Sheffield said was private equity backed, agreed to buy the noncore Pioneer assets comprised of roughly 3,300 net acres in northern Martin County, Texas, within the Midland Basin.

The sale, announced alongside its second-quarter results, was for about $20,000 per acre, or $66 million total. During Pioneer’s earnings call on Aug. 7, Sheffield noted the transaction was the company’s first noncore asset sale in the Permian Basin since a deal in 2017 and is eager to do more.

“It’s the first time we’ve seen a cash deal coming in from private equity over the last two years,” Sheffield said. “We’ll continue to do that as we see great opportunity to deliver on noncore asset sales,” he added.

Pioneer, which has been laser-focused on lowering costs, reported on Aug. 6 a 40% jump in adjusted profit for the second quarter. Highlighting the company’s quarterly results were lower-than-expected spending and share buybacks as part of its $2 billion program. Higher production in the quarter also helped the company offset lower oil prices.

RELATED:

Permian Player Pioneer Natural Resources Talks Monetizing Assets

Diamondback Energy: ‘Converting Rock Into Cash Flow’

While discussing the company’s results, Sheffield also offered a bleak view for the U.S. oil and gas industry, warning the shale boom could end in all basin expect one within the next decade. Driven by weak oil prices and aggressive drilling, Sheffield identified the Midland Basin as the sole growth region out of all the shale plays—including the neighboring Delaware Basin—by 2025.

The Midland Basin also happens to be where Pioneer’s position is currently centered in the Permian Basin. The company boasts a roughly 680,000 net-acre position across the Midland Basin with a resource base of over 10 billion barrels of oil equivalent, according to a recent company presentation.

“Based on the scarcity, if Midland Basin is the only basin growing past 2025, it will make Pioneer’s properties worth twice as much money or three times as much money at some point in time over the next five to six years,” he said.

Formerly active in the Eagle Ford Shale and elsewhere in Texas, Pioneer finished divesting its last remaining position outside the Permian earlier this year. Pioneer now has its eyes set on monetizing other assets in its portfolio to help it achieve the company’s free cash flow generation goals.

Possible future monetization includes the planned divestiture of its interest in a Midland Basin gas processing facility as well as transactions involving its water infrastructure or DrillCos. All three of which are being evaluated and proceeding as expected, according to Sheffield.

“I expect two of them will be done by the end of the year,” he said. “And then water, as we mentioned in the past, we’re evaluating it now and ... the board will make a decision in 2020.”

The company is also evaluating options to monetize noncore acreage not slated for near-term development, with such options including cash market divestitures and the use of DrillCo arrangements.

Sheffield noted the DrillCo acreage is focused on acreage that is expiring over the next five years.

“It’s still worth drilling today, and we drilled a few wells on it and... offsite activities have shown that there are some other operators that are drilling in the area, but it doesn’t meet our current hurdle rates above 50%,” he said noting the acreage is more non-Pioneer core vs. non-basin core.

“I can’t tell you exactly how much noncore we have, but we do have some pieces that if we can’t trade or block it up, we’re going to sell somewhere between that $20,000 and $30,000 per acre range,” he added.

Sheffield said A&D activity in the Midland Basin has recently picked up. In addition to Pioneer’s noncore asset sale, Occidental Petroleum Corp. also announced a joint venture (JV) to develop its Midland Basin acreage.

The JV, with Colombia’s Ecopetrol SA, covers 97,000 net acres of Occidental’s Midland Basin properties. Analysts have estimated that the $1.5 billion transaction works out to about $31,500 per acre.

Though, according to Sheffield, only 15% of the acreage in Occidental’s JV is core, leaving 85% noncore.

“It seems like a very, very high price for noncore acreage,” he said. “We would sell noncore acreage all day long at $31,500 per acre.”

But for now, Sheffield said he’s holding out hope that Pioneer will continue to see noncore asset divestitures at $20,000 per acre.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.