Pioneer Natural Resources Co. completed on Dec. 21 the multibillion-dollar divestiture of its Delaware Basin assets in the Permian to Continental Resources Inc.

“Pioneer’s fourth quarter and full-year guidance assumed that the Delaware Basin assets would be included in the company’s financial results for the entire quarter. However, with the completion of the divestiture today, Pioneer will not include any operating or financial results attributable to the Delaware Basin assets after December 20, 2021 in its fourth-quarter results,” the company said in a release on Dec. 21.

Pioneer had previously announced the sale to Continental Resources on Nov. 3, marking the Oklahoma City-based company’s entry into the Permian Basin. At the time, Pioneer valued the all-cash transaction at approximately $3.25 billion. Although, after normal adjustments, the company said Dec. 21 the divestiture had resulted in cash proceeds closer to $3.1 billion.

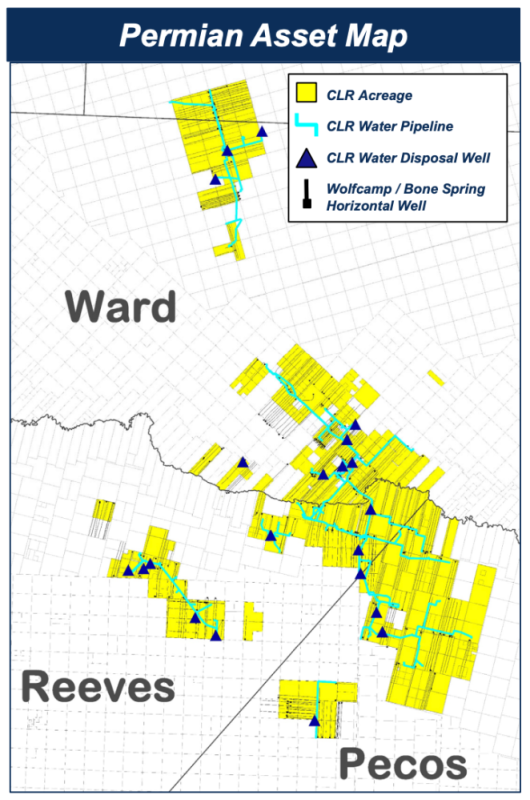

Continental Resources Permian Basin Asset Map (Source: Continental Resources Inc. investor presentation)

Closing of the transaction completes Pioneer’s exit from the Delaware side of the Permian Basin, where it held a position covering approximately 92,000 net acres and net production of approximately 50,000 boe/d, mostly acquired through its purchase of Parsley Energy.

“This transaction returns Pioneer to being 100% focused on its high-margin, high-return Midland Basin assets, where we have the largest acreage position and drilling inventory,” CEO Scott D. Sheffield said in a Nov. 3 release by the company.

At the time, Sheffield said proceeds from the sale would be used to strengthen the Pioneer balance sheet including supplementing the company’s “industry leading base and variable dividend program.”

Citi Global Market Inc. was Continental’s financial adviser and White & Case LLP was the company’s legal adviser with respect to the transaction. Pioneer retained BofA Securities Inc. as a financial adviser and Vinson & Elkins LLP as legal adviser for the transaction.

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.