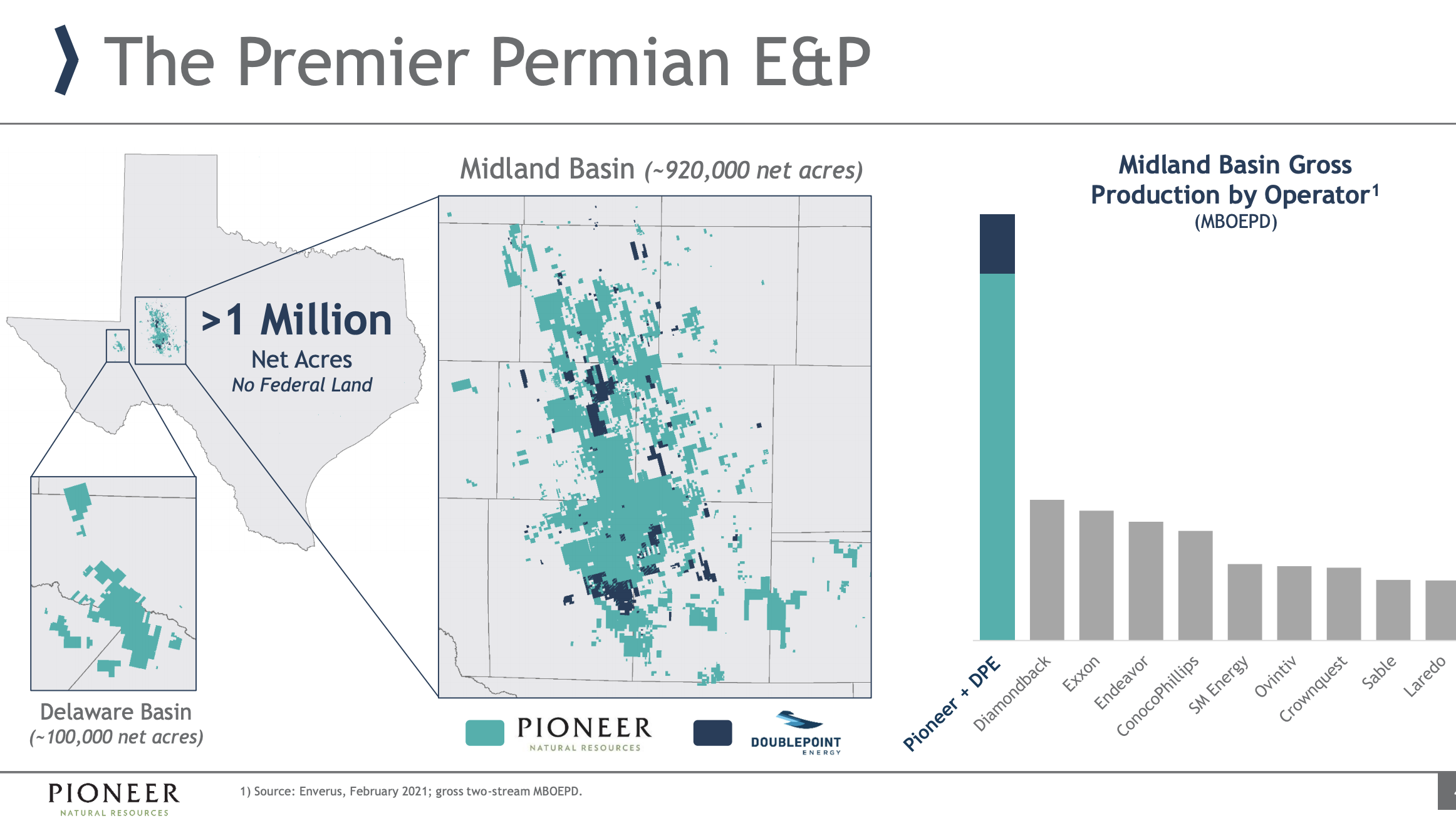

DoublePoint Energy is a Fort Worth, Texas-based upstream oil and gas company with a position in the Midland Basin covering roughly 97,000 net acres. (Source: Image of Pioneer Natural Resources logo by Casimiro PT / Shutterstock.com)

Pioneer Natural Resources Co. agreed on April 1 to acquire the leasehold interests and related assets of DoublePoint Energy in a cash and stock transaction valued at approximately $6.4 billion, which includes the assumption of $900 million of debt and liabilities.

DoublePoint Energy is a Fort Worth, Texas-based upstream oil and gas company with a position in the Midland Basin covering roughly 97,000 net acres. The company was formed by Double Eagle Energy in 2018 through a partnership with FourPoint Energy LLC and is backed by equity commitments from Apollo Global Management Inc., Quantum Energy Partners, Magnetar Capital and GSO Capital Partners LP.

“DoublePoint has amassed an impressive, high quality footprint in the Midland Basin, comprised of tier one acreage adjacent to Pioneer’s leading position,” Pioneer CEO Scott D. Sheffield said in a statement. “We are pleased with their decision to become long-term partners with Pioneer in a transaction that will complement our unmatched position in the core of the Permian Basin.”

The acquired DoublePoint acreage is primarily undrilled and augments Pioneer’s premium asset base, increasing the company’s acreage position to greater than 1 million net acres in the Permian Basin with no exposure to federal lands. Further, Pioneer expects production from the acquired assets to reach approximately 100,000 boe/d by late in the second quarter.

In a joint statement on April 1, Cody Campbell and John Sellers, co-CEO’s of DoublePoint Energy, said: “We are honored to have the opportunity to combine our business with Pioneer, who we have long admired and regard as the premiere operator in the Midland Basin. The fit and the synergies are clear, and we look forward to working with Pioneer to continue creating value.”

In the company release, Pioneer said it expects the acquisition of DoublePoint to result in annual cost savings of approximately $175 million through operational efficiencies and reductions in general and administrative (G&A) and interest expenses. The expected present value of these cost savings totals approximately $1 billion over a 10-year period, the company added.

“The combination of Pioneer and DoublePoint is compelling from both a financial and operational standpoint and a natural fit for DoublePoint,” Geoffrey Strong, senior partner and co-head of infrastructure and natural resources at Apollo, said in a statement commenting on the deal.

Strong also added that the acquisition continues the trend of consolidation in the prolific Permian Basin.

After an anemic start to A&D activity last year, E&Ps raced to announce corporate combinations in the second half of 2020, with several mergers centered on the oil-rich Permian Basin.

One of the three multibillion-dollar mergers announced in fourth-quarter 2020 was the acquisition of Parsley Energy by Pioneer for $7.6 billion. Pioneer closed on the Parsley acquisition, which included the assumption of $3.1 billion of debt, in January of this year.

Following the DoublePoint acquisition, Pioneer said its pro forma leverage metrics will remain relatively unchanged, “among the lowest in the industry,” preserving the company’s financial and operational flexibility and allowing for significant return of capital to shareholders.

Dheeraj Verma, president of Quantum Energy Partners, also added, “we are firm believers in Pioneer’s strategy of free cash flow generation, which enables a competitive base and strong variable dividend.”

As part of the DoublePoint transaction, Pioneer will issue approximately 27.2 million shares of common stock in the transaction with an additional $1 billion of cash. Pioneer plans to finance the cash portion of the purchase price through a combination of cash-on-hand and existing borrowing capacity under its revolving credit facility.

After closing, existing Pioneer shareholders will own approximately 89% of the combined company and existing DoublePoint owners will own the remaining 11% of the combined company.

The transaction has been unanimously approved Pioneer’s board of directors and is expected to close second-quarter 2021, subject to customary closing conditions and regulatory approvals.

Vinson & Elkins LLP (V&E) and Alston & Bird LLP advised DoublePoint Energy in connection with the sale of its leasehold interests and related assets to Pioneer. The V&E team was led by Jim Fox, Doug McWilliams and Shay Kuperman.

J.P. Morgan Securities LLC is serving as lead financial adviser to Double Eagle and sponsors, with Citi and RBC Capital Markets also acting as financial advisers.

Gibson, Dunn & Crutcher LLP represented Pioneer Natural Resources in its purchase of DoublePoint Energy. The Gibson Dunn team was led by Houston partner Michael P. Darden and Dallas partner Jeffrey Chapman.

Recommended Reading

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Chord Energy Updates Executive Leadership Team

2024-03-07 - Chord Energy announced Michael Lou, Shannon Kinney and Richard Robuck have all been promoted to executive vice president, among other positions.