Upon closing of its acquisition of Parsley Energy, Pioneer’s executive management team will lead the combined company with the headquarters remaining in Dallas. (Source: Hart Energy)

[Editor’s note: This story was updated at 8:52 p.m. CT Oct. 20.]

Pioneer Natural Resources Co. agreed on Oct. 20 to acquire Parsley Energy Inc. in an all-stock transaction valued at approximately $4.5 billion, confirming earlier reports of a potential deal.

The merger of the two shale producers, both Permian pure-plays, follows a growing wave of consolidation spreading across the E&P space, including the acquisition of Concho Resources Inc., another Permian operator, by ConocoPhillips Co. announced on Oct. 19. Enverus Senior M&A Analyst Andrew Dittmar described the recent slew of upstream mergers as a “historic winnowing of U.S.-based independent E&P companies.”

“There has now been over $40 billion in public-public corporate mergers year-to-date,” Dittmar said in a statement. “In just two days, we have seen two of the top 10 U.S.-based E&P acquisitions of the last 10 years amounting to over $20 billion in combined value.”

Like the previous four corporate E&P deals announced this year, the combination of Pioneer and Parsley is comprised of all-equity and struck at a low-to-modest premium, which is what Dittmar said the market has shown investors are willing to accept.

“With the limited number of companies that meet investor criteria growing shorter each week, those without a deal in hand may be taking a hard look at the remaining options and push additional near-term consolidation,” he said.

Pioneer Natural Resources will acquire Parsley Energy for a fixed exchange ratio of 0.1252 shares of Pioneer common stock for each share of Parsley stock owned. The total value for the transaction, inclusive of Parsley debt assumed by Pioneer, is approximately $7.6 billion.

The companies said they expect the combination to drive annual synergies of $325 million and to be accretive to cash flow per share, free cash flow per share, earnings per share and corporate returns beginning in the first year.

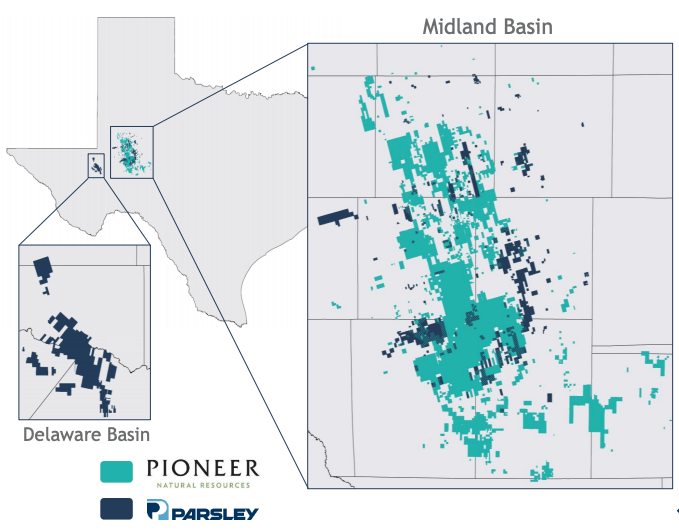

In a statement commenting on the transaction, Pioneer President and CEO Scott D. Sheffield added: “Parsley’s high-quality portfolio in both the Midland and Delaware Basins, when added to Pioneer’s peer-leading asset base, will transform the investing landscape by creating a company of unique scale and quality that results in tangible and durable value for investors.”

In an Oct. 20 research note released prior to the deal’s announcement, analysts with Tudor, Pickering, Holt & Co. (TPH) described the rumored merger between Pioneer and Parsley as favorable given the combination would strengthen an already premium, pure-play heavyweight in the Permian Basin.

“Parsley has long stood as one of our top consolidation targets, and rumor of a potential deal hitting financial headlines shouldn’t come as a big surprise and would make a ton of sense from multiple perspectives,” TPH analysts wrote.

Austin, Texas-based Parsley Energy was founded in 2008 by Bryan Sheffield, son of Pioneer’s CEO. The younger Sheffield started Parsley with a base of 100 wells first drilled by his grandfather, Joe Parsley, and partner Howard Parker, who were also founders of Parker & Parsley which eventually became Pioneer Natural Resources. He currently serves as executive chairman of the Parsley board, a position he assumed after stepping back from the CEO role in 2019.

The TPH analysts estimate combined the company would have about 928,000 net acres with roughly 310,000 bbl/d of oil production in third-quarter 2020. Additional cost savings would include G&A synergies plus the combined company’s ability to potentially further work down well costs toward leading-edge levels.

“Depending on the transaction we suspect long-only investors would likely be in favor of an equity swap as many accounts are constructive on both names with a deal strengthening an already premium, pure-play Permian heavyweight to own in the space,” the analysts continued in its note.

Pioneer, based in Dallas, currently has a roughly 680,000 net-acre position in the Permian within the Midland Basin. Meanwhile, Parsley holds about 248,000 net leasehold acres in the Permian Basin’s Midland and Delaware sub-basins.

Matt Gallagher, a longtime Parsley employee who has served as its president and CEO since January 2019, said he believes the combination creates an organization set to thrive at the low end of the global cost curve.

“With neighboring acreage positions located entirely in the low-cost, high-margin Permian Basin, the industrial logic of this transaction is sound,” Gallagher said in a statement adding: “Furthermore, the Pioneer team shares our belief that a clear returns-focused mindset is the best tool to compete for capital within the broader market. Sustainable free cash flow and growing return of capital are now investment prerequisites for the energy sector and this combination strengthens those paths for our shareholders.”

The all-stock transaction constitutes a 7.9% premium to Parsley shareholders based on unaffected closing share prices as of Oct. 19, according to the companies’ joint press release. After closing, existing Pioneer shareholders will own approximately 76% of the combined company and existing Parsley shareholders will own about 24%.

Upon closing of the transaction, Pioneer’s board of directors will be expanded to thirteen to include Gallagher and A.R. Alameddine, Parsley’s lead director. Pioneer’s executive management team will lead the combined company with the headquarters remaining in Dallas.

The transaction has been unanimously approved by the Boards of Directors of both Pioneer and Parsley and is expected to close in first-quarter 2021. Parsley’s largest investor, Quantum Energy Partners, which owns approximately 17% of Parsley’s outstanding shares, has executed a voting and support agreement in connection with the transaction.

In connection with the transaction, Pioneer retained Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC as financial advisers and Gibson, Dunn & Crutcher LLP as legal adviser. Credit Suisse Securities (USA) LLC and Wells Fargo Securities LLC are financial advisers to Parsley and Vinson & Elkins LLP is its legal adviser.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.