Pioneer Natural Resources Co. completed its acquisition of Parsley Energy Inc. on Jan. 12, forming what Pioneer CEO Scott D. Sheffield calls “the premier Permian independent energy company.”

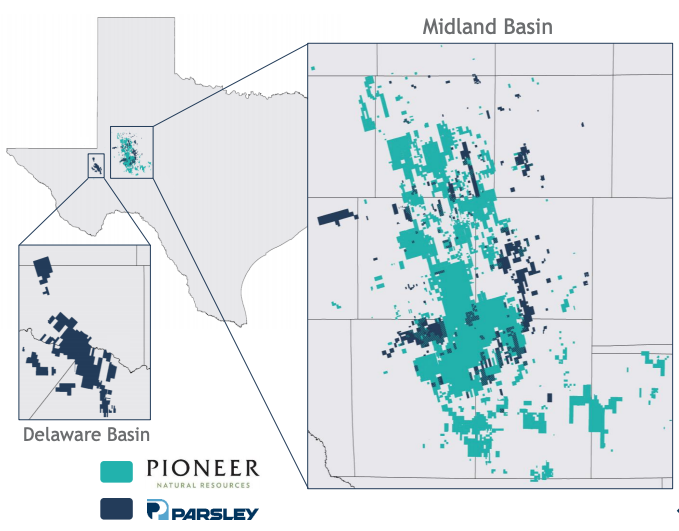

The all-stock acquisition valued at over $7 billion gives Pioneer, based in Dallas, combined control of nearly 1 million acres across the Permian Basin with positions in both the Delaware and Midland sub-basins.

“We are excited to close our transaction with Parsley and begin delivering on the significant synergies provided by this combination,” Sheffield said in a statement on Jan. 12. “The transaction is expected to further strengthen our investment framework by improving our free cash flow profile and enhancing return of capital to shareholders.”

The companies had previously said in a joint release from late October announcing the transaction that they expected the combination to drive annual synergies of $325 million and to be accretive to cash flow per share, free cash flow per share, earnings per share and corporate returns beginning in the first year.

Austin, Texas-based Parsley Energy was founded in 2008 by Bryan Sheffield, son of Pioneer’s CEO. The company started with a base of 100 wells first drilled by younger Sheffield’s grandfather, Joe Parsley, and partner Howard Parker. The duo were also founders of Parker & Parsley, which eventually became Pioneer Natural Resources.

As part of the merger agreement approved by stockholders of both companies in special meetings held Jan. 12, Pioneer acquired Parsley for a fixed exchange ratio of 0.1252 shares of Pioneer common stock for each share of Parsley stock owned. The total value for the deal, inclusive of Parsley debt assumed by Pioneer, is approximately $7.6 billion.

Matt Gallagher, a longtime Parsley employee who had served as its president and CEO since January 2019, will now join the Pioneer board of directors. Former lead director of the Parsley board, A.R. Alameddine, also joined the Pioneer board upon closing of the transaction. Prior to joining the Parsley board, Alameddine worked at Pioneer from 1997 until his retirement in 2008.

The addition of Gallagher and Alameddine increased the number of directors of Pioneer’s board to 13.

Following closing, the executive management team of Pioneer will lead the combined company with the headquarters remaining in Dallas.

In connection with the transaction, Pioneer retained Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC as financial advisers and Gibson, Dunn & Crutcher LLP as legal adviser. Credit Suisse Securities (USA) LLC and Wells Fargo Securities LLC are financial advisers to Parsley and Vinson & Elkins LLP is its legal adviser.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.