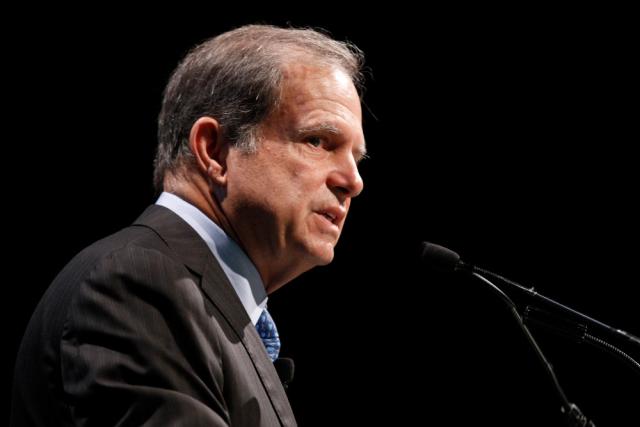

Pioneer Natural Resources Co. CEO Scott Sheffield speaks during a Hart Energy DUG Eagle Ford conference in 2013. (Source: Hart Energy)

Ahead of an April 14 meeting of the Texas Railroad Commission (RRC) at which the commission will consider issuing mandatory oil production cuts, Pioneer Natural Resources Co. CEO Scott Sheffield explained the need for the U.S. to curb production amid distressed demand.

Pioneer and Parsley Energy Inc. in late March asked the RRC to cut oil production in Texas by 20% to help stabilize oil prices amid the Saudi-Russia price war and diminished demand as a result of the COVID-19 pandemic.

“Ever since we started working on [a request] after the collapse and the talks between Russia and Saudi Arabia, we knew that eventually one of the best ways to get a global agreement back together was for the U.S. to participate,” Sheffield told Hart Energy. “The only way the U.S. can participate in reality is for Texas [to take part in production cuts].”

Texas Oil Industry Discusses Opening ‘Pandora’s Box of Proration’

Texas produces about 5 MMbbl/d oil, about 40% of the total U.S. output of 13 MMbbl/d. The RRC hearing comes on the heels of OPEC, Russia and other oil-producing countries agreeing on April 12 to cut production by 9.7 MMbbl/d for two months following efforts by U.S. President Donald Trump to push Russia and Saudi Arabia toward a deal.

“I am pleased that the President became heavily engaged in our industry by bringing Saudi and Russia together in a historic agreement with OPEC+ to save our industry,” Sheffield said. “I hope he takes the next steps to obtain real and immediate cuts from the other G20 countries to add to the 9.7 MMbb/d of reductions.”

Despite the announced cuts, WTI prices stalled April 13 at $22/bbl amid concerns that the announced cuts aren’t enough to offset oversupply. For the U.S. oil and gas industry to remain solvent, oil prices would need to stabilize in the $30/bbl range, Sheffield said.

“Our idea all along was to create a tool in the tool box by having the Railroad Commission at least discuss it, and if there was a chance to put together a global cut that would stabilize the price of oil around $30, $35 (per barrel), versus letting it go back down to $10 or $15 (per barrel), then it was in the best interest in the state of Texas and the U.S. to save the oil and gas industry,” he said.

Sheffield said he has seen the industry survive several downturns, including in 1986 when the price of oil averaged about $14/bbl. He said the current market is “as bad as ’86 or ever.” He acknowledged that some in the industry are opposed to mandated production cuts, citing free market dynamics and an unwillingness to acquiesce to international pressures.

“The argument is that they will continue to ask for cuts,” Sheffield said. “That’s an argument I’ve had from some CEOs. I’m going to make it clear this should be a one-time cut. It should last for a short period of time until demand starts coming back and then we should never look at it again.”

Without mandated production cuts, Sheffield said several small- and medium-sized producers could be in jeopardy, since they currently face challenges in getting their product to market.

“The pipeline companies won’t let them move their oil to the Gulf Coast,” he said. “They’re going to have to shut in about 100% of their production for maybe up to two or three months. And those companies really can’t afford it. So, there’s an unfairness going on if the commission doesn’t pro-rate. Because it will be the majors, it will be the Pioneers of the world—we can get our oil down to the Gulf Coast—but the small and medium producers will be the first ones to cut back. That could put hundreds of them into bankruptcies for that reason.”

According to IHS Markit, the monthly global oil supply surplus ranges between 4 MMbbl/d and 10 MMbbl/d. That surplus pressed oil prices down to $20/bbl in late March, down from 65% from Jan. 1, when WTI traded for $61/bbl.

“If we keep the cuts going forward until the demand starts coming back then it will reduce the high inventory build that the world is building at this point,” Sheffield said. “If it starts reducing inventories, then the market will respond positively with a little bit higher oil price.”

With most of the world’s population restricted in its movements, Sheffield doesn’t expect energy demand to significantly return any time soon, even after restrictions are lifted.

“I don’t think demand is going to come back very fast,” he said. “I’m pessimistic on demand coming back. I don’t think people are going to start driving and flying again. I think people will definitely want to get out of their house when this is over. They may drive some, but they’re not going to fly all over the world. I think most countries are going to have to clamp down on their borders continuously until we get a vaccine. I’m not real optimistic on demand coming back strong for at least a year, year and a half.”

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.