Petrobras and Brazilian flag. (Source: Shutterstock)

State-owned Petrobras aims to reinject 39.2 million tonnes (MMtonne) of CO2 between 2023 and 2025 in carbon capture, utilization and storage (CCUS) projects associated with EOR, up 49% compared to 26.3 MMtonne reinjected in the three-year period between 2020 and 2022.

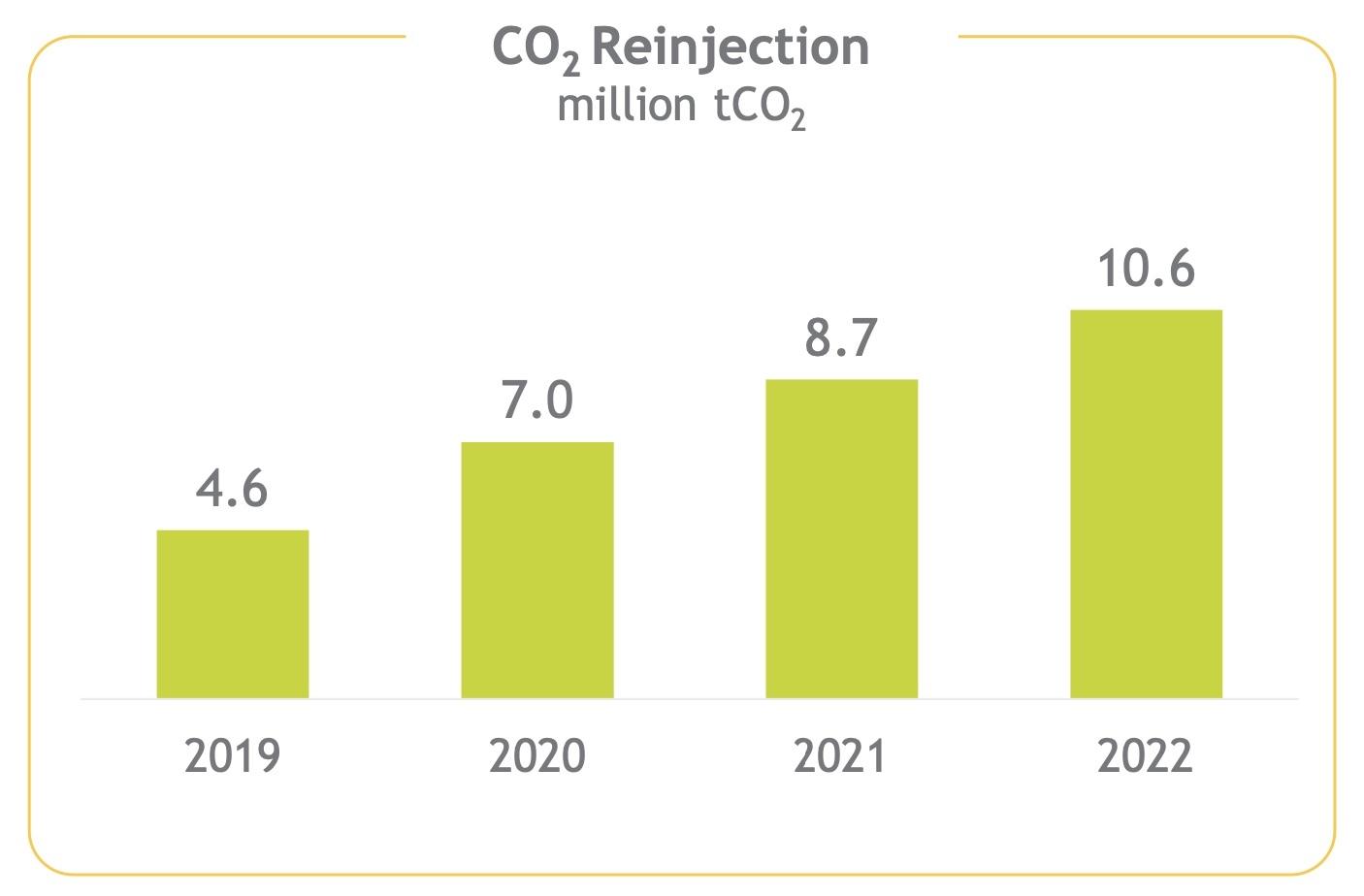

In 2022, Petrobras injected 10.6 MMtonne of CO2, the highest amount in a single year compared to 8.7 MMtonne in 2021, 7 MMtonne in 2020 and 4.6 MMtonne in 2019, the company’s CFO Rodrigo Araujo Alves said Mar. 2 during a fourth-quarter 2022 webcast.

The reinjection of CO2 is an important part of Petrobras’ plans to reduce greenhouse-gas emissions intensity in oil and gas production, he said.

“It was the best result that we have had and reinforces our commitment and capability to deal with carbon intense reservoirs, reinjection — and having a lot of technology to support that process — and to reduce the carbon footprint of the pre-salt oil,” Araujo said referring to the company’s 2022 results.

Over the past 15 years (2008-2022), Petrobras has reinjected an accumulated 40.8 MMtonne CO2, the executive said.

Petrobras is Brazil’s premier energy producer with a dominant role in the South American country’s deep and ultra-deep waters. The company aims to maximize the value of its offshore portfolio and maintain its low cost operations and low carbon footprint. The energy giant also wants to neutralize operational emissions by 2050 in-line with the Paris Agreement.

“We have invested in the decarbonization of our operations, already operate the world's largest offshore carbon injection program, and are implementing a series of state of the art technologies to reduce emissions,” Petrobras CEO Jean Paul Prates said during the webcast. “We are a company in permanent transformation. We are working every day to make Petrobras a company that is increasingly stronger, more responsible and connected to the future, because we believe this is the best way to fulfill our responsibility to society and to our investors.”

Strong growth in net income, EBITDA

Rio de Janeiro-based Petrobras’ recurring net income was $34 billion in 2022, up 122% compared to $15.5 billion in 2021. Annual EBITDA was $67 billion, up 54% compared to 2021’s $43.5 billion. The strong results were achieved despite a 3% decline in production, which averaged 2.7 MMboe/d in 2022, which was offset by a Brent price that rose 43% compared to an average $101/bbl in 2022.

RELATED

Petrobras’ Output Falls 3.2% to 2.7 MMboe/d in 2022

“The year 2022 was challenging with global supply limitations caused by the conflict in Ukraine,” Araujo said in the company’s fourth-quarter press release. “Our global market coverage and development of new customers were instrumental for the shift in our exports flow aimed at generating value and seizing new arbitrage opportunities. We have been able to diversify the destinations of our exports and practice competitive prices, while reducing volatility to our customers.”

Petrobras continued to develop its pre-salt oil streams in 2022, despite the outbreak of the Russia-Ukraine conflict in Feb. 2022, in order to maximize the value of its exports. Petrobras altered export flows as a result of conflict but China and Singapore remained the main destinations for Petrobras oil exports and oil product exports in the fourth quarter compared to the fourth-quarter 2021.

Overall, China and Europe were the top two destinations for 74% of the company’s oil exports in the fourth quarter of 2022.

Petrobras’ capex totaled $9.8 billion in 2022, up 12% compared to $8.8 billion in 2021, mainly due to signature bonus payments related to the Sépia and Atapu fields, increased investments in modernization and adaptation of its refineries and expenses to maintain logistical assets. Capex in 2023 is forecast to reach $16 billion, according to Petrobras’ 2023-2027 strategic plan revealed on Nov. 30.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.