Energy is back on center stage, but it's critical to recognize the geopolitical events that may affect the industry in 2005 and beyond. "We're in a state of change that's profound," Tom Petrie, chairman, Petrie Parkman & Co., told the Houston Energy Finance Group in a year-end speech. "It's pretty clear that if [investors] are not in energy, you will be punished, and that's going to be true for the better part of this decade," he said. Industrial, commercial and residential users are now beginning to react to higher energy prices, although there is still a belief that prices are only a bit out of the normal range. Petrie thinks robust prices are here to stay because energy supply problems are coming, although timing for the latter is not yet clear. Meanwhile, the energy component of the S&P 500 is likely to be a winner for investors. It rose 22% in 2003 and another 26% in 2004, he said. However, exogenous events or "bolts from the blue," as Petrie calls them, have the potential to disrupt energy supply and demand-and energy equities. He cited continuing problems in Iraq, Nigeria, Venezuela and Russia as examples. "I think markets are overestimating the amount of oil Russia can export as its internal needs grow. Putin's goal is to improve the economic lot of the Russian populace and that requires oil. "These all have implications for the cost of capital and for energy supplies. But what matters is the time-weighted distribution of oil prices. From 1995 to 1999, they averaged $19 a barrel, but from 2000 to 2004, they averaged $29. I think it will be around $35 for the rest of the decade." -Leslie Haines

Recommended Reading

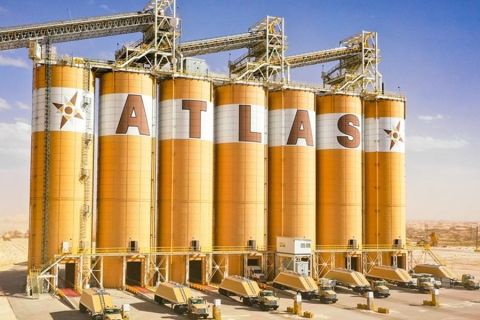

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.

Majority of Recent CO2 Emissions Linked to 57 Producers - Report

2024-04-03 - The world's top three CO2-emitting companies in the period were state-owned oil firm Saudi Aramco, Russia's state-owned energy giant Gazprom and state-owned producer Coal India, the report said.