Presented by:

Hedging remains a mainstay activity for many oil and gas producers to protect cash flows and manage operating budgets. However, these hedge programs and coverage levels were in place before price increases that occurred in early 2022. This resulted in the 30 largest public oil and gas E&P companies recording an overall total derivative liability of $26.8 billion as of March 31, 2022.

Price volatility is ever-present in oil and gas markets and encourages producers to have an effective hedging program in place. Other than a couple of short-lived dips, prices for NYMEX WTI futures climbed steadily through 2021. The lowest futures price for oil in 2021 was over $47/bbl. Natural gas prices made strong gains in 2021, even trading above $6/MMBtu for multiple days in October 2021. The average natural gas spot price in 2021 was $3.72/MMBtu, which is nearly $1.60/MMBtu higher than the 2020 average.

The following is a survey of the 30 largest public E&P companies and their hedging activities as disclosed in their Dec. 31, 2021, 10-K filings. It also includes comparisons to the same survey done in the prior year.

The following survey provides as much information as possible based on what was disclosed in regulatory filings. U.S. GAAP accounting rules form the minimum disclosures companies must provide in their filings to provide users with an understanding of:

- An entity’s use of hedges;

- How the hedges and the hedged production are accounted for in the filing; and

- How the hedges affect the financial statements.

While the accounting rules require entities to disclose the level of an entity’s derivative activity, there can be variance in practice as to how much information a company discloses about the instrument types, the volume of production hedged and the average hedge price.

Why hedge?

Upstream oil and gas companies have relatively straightforward objectives, which are to search for, develop and extract hydrocarbons. These activities are very capital intensive and require large amounts of cash. Companies need enough cash flow not only to support a level of capex and exploration activity to ensure that oil and gas continue to flow, but also to make debt payments, comply with debt covenants and support the general and administrative costs. Hedging programs at upstream companies are developed with the primary purpose of providing a level of cash flow to increase the likelihood of meeting those needs.

Without the protection of an effective hedging program, an upstream company’s cash flows are subject to the volatility of the market. An upstream company without hedges will benefit from higher market prices, but they may need to adjust their operations when market prices decline for an extended time.

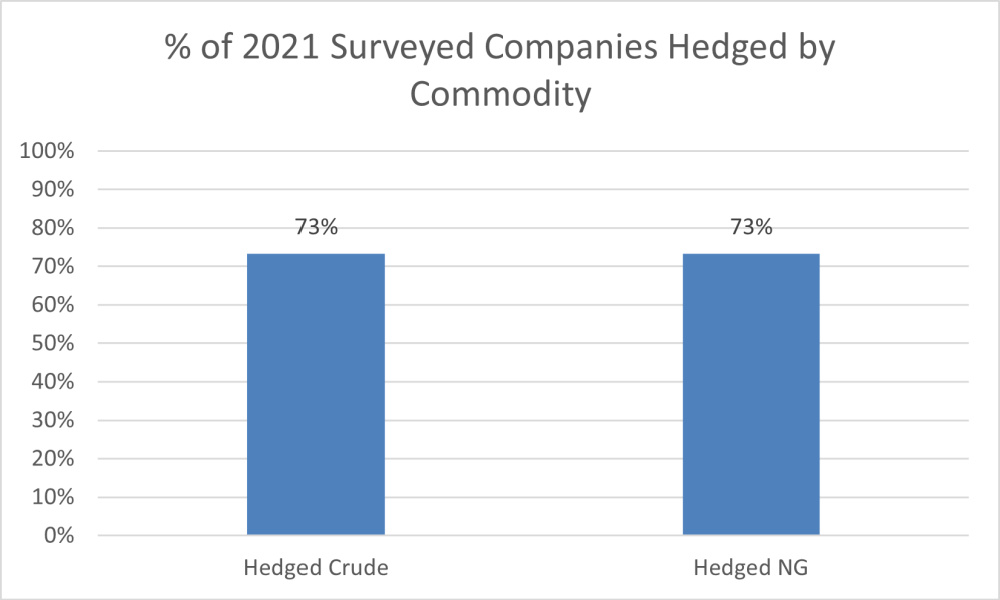

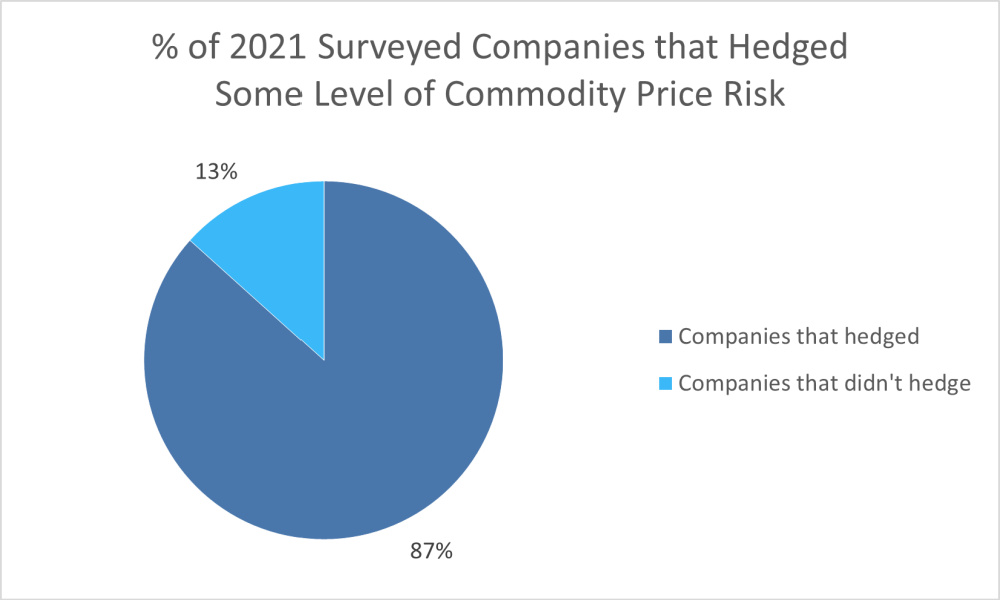

The following outlines the percentage of companies in the survey that maintained hedges as of Dec. 31, 2021, for crude, natural gas or NGL. Consistent with prior years, it is clear that the majority of public oil and gas producers maintain hedging programs.

Companies that hedged

Twenty-six of the 30 upstream energy companies surveyed, or 87%, had hedges on the books as of Dec. 31, 2021. This is similar to the 90% figure on Dec. 31, 2020, and is consistent with most prior year survey results. At the end of 2021, 73% of the surveyed companies had crude hedges in place, and 73% had gas hedges in place.

Instrument types

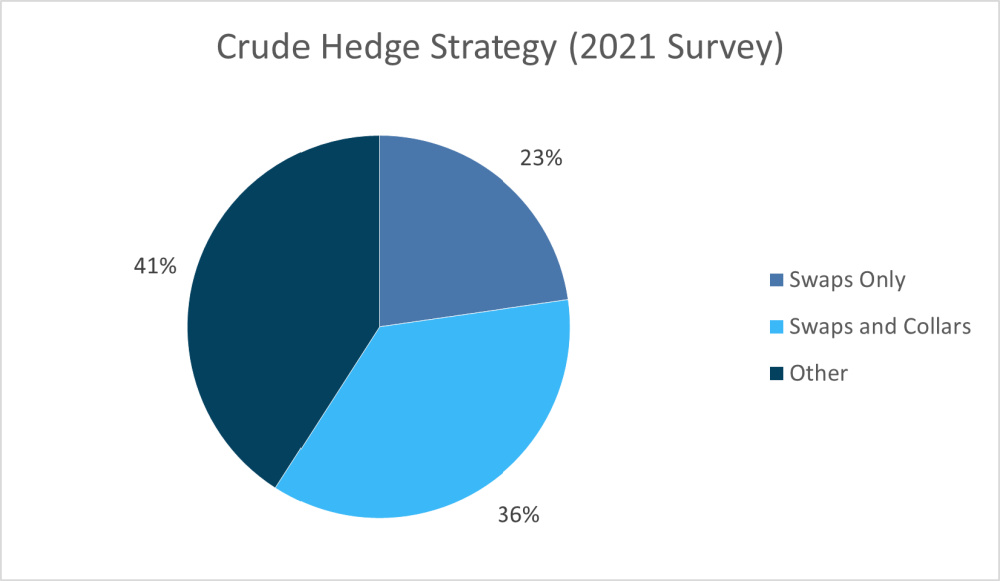

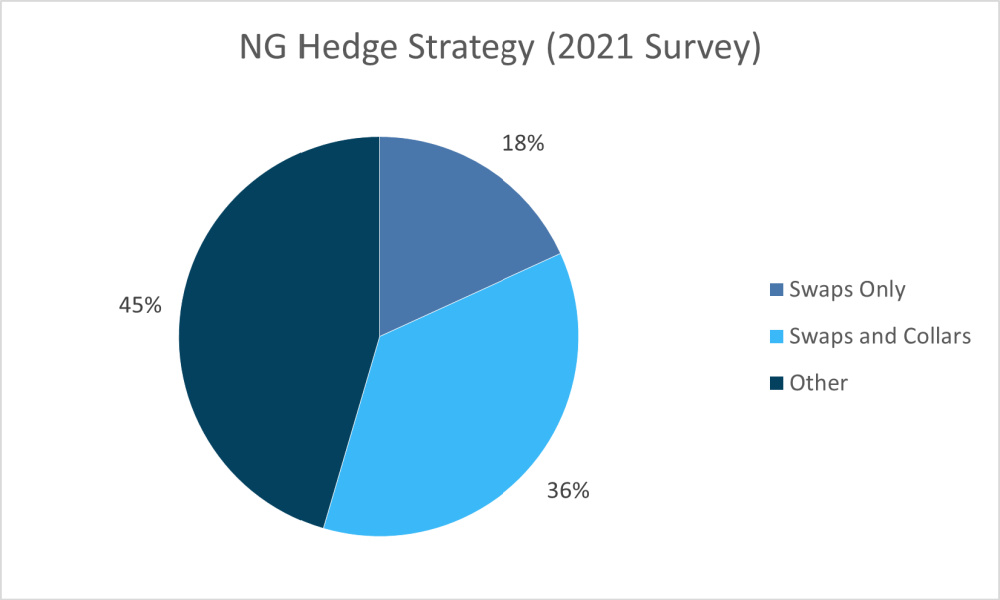

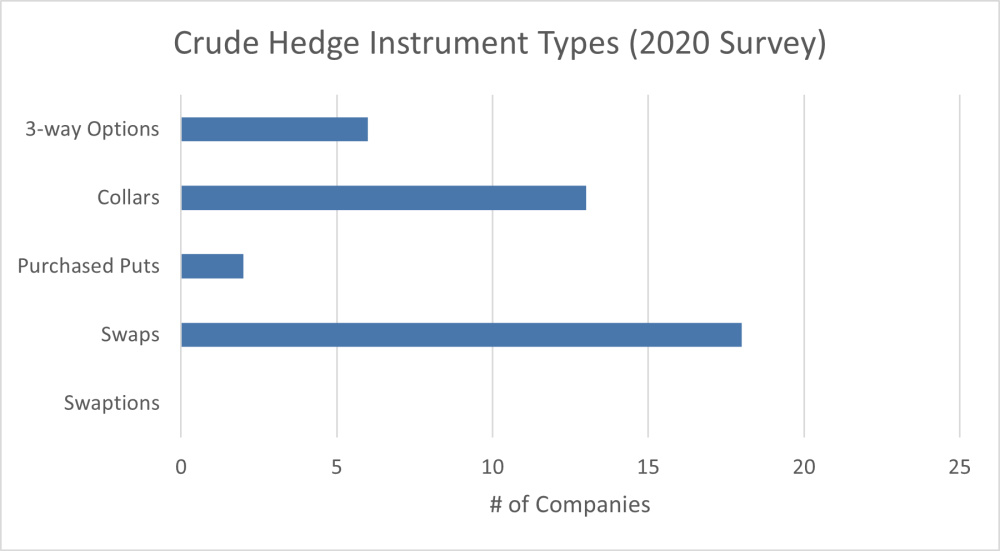

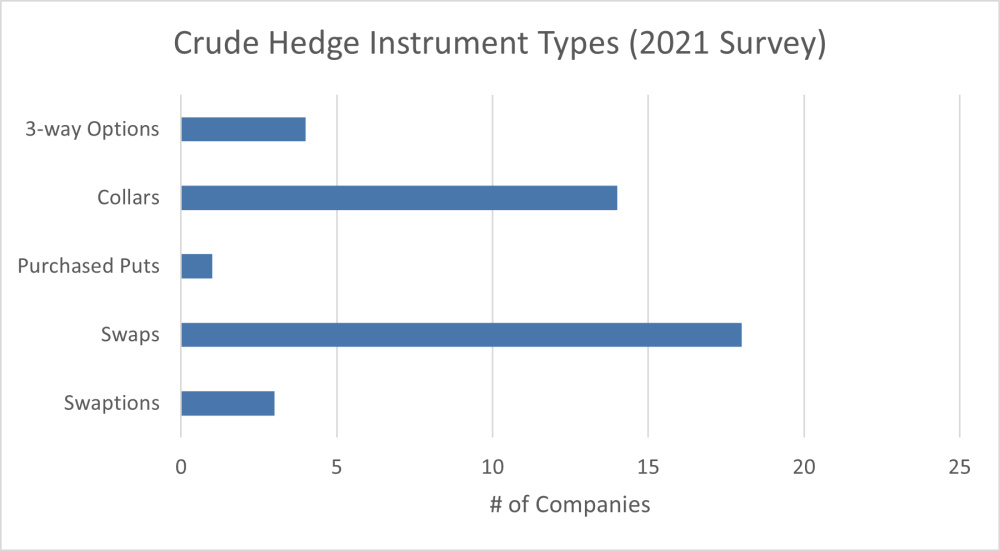

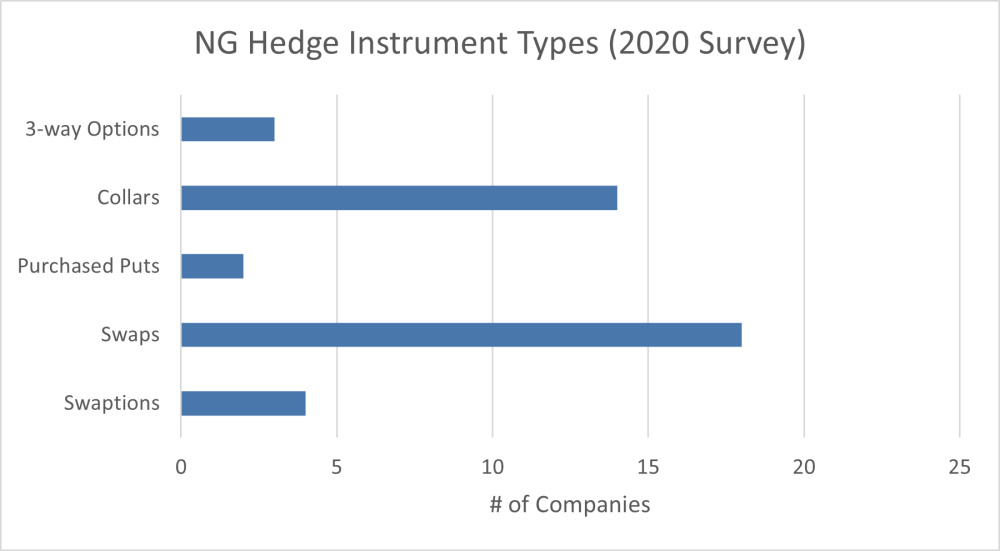

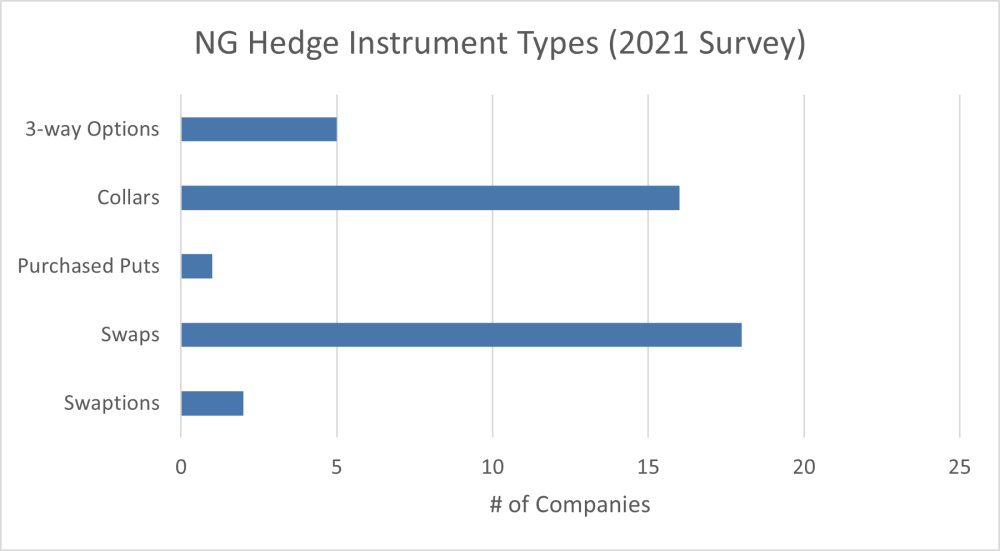

Investors should carefully consider the types of instruments utilized in their hedging program. Hedging strategies can provide different levels of downside protection based on the combination of hedging instruments used. The following notes the number of companies holding various instrument types in their hedging portfolio.

For a producer, swaps provide the highest amount of downside protection. However, swaps limit upside price participation. This leads producers to utilize purchased puts, which can be costly, or costless collars, which allows the producer to participate within a range of price movements. Other instruments noted in the survey were swaptions and three-way options.

Swaptions, often used to raise a strike price by allowing a counterparty to increase the volume or lengthen the tenor of the contract at their discretion, continue to represent a minority of the instrument types utilized by the public companies.

Three-way options (sometimes called three-way collars) are also used to raise the window of strike price participation between the purchased put and sold call that generally straddles the current market prices in the costless collar strategy by using the premium received from selling a put below current market prices. This strategy can backfire if market prices fall below the sold put.

Of the public oil and gas companies reviewed, swaps continue to be the preferred instrument for both natural gas and crude. A strategy utilizing both swaps and collars was common for both crude and natural gas, which is generally consistent with the prior year.

Length of hedging

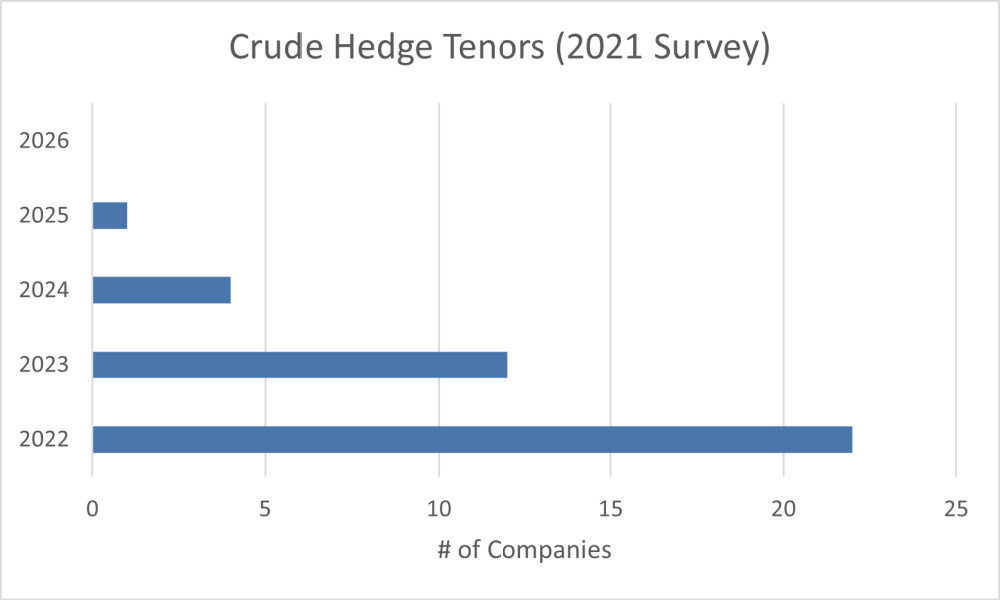

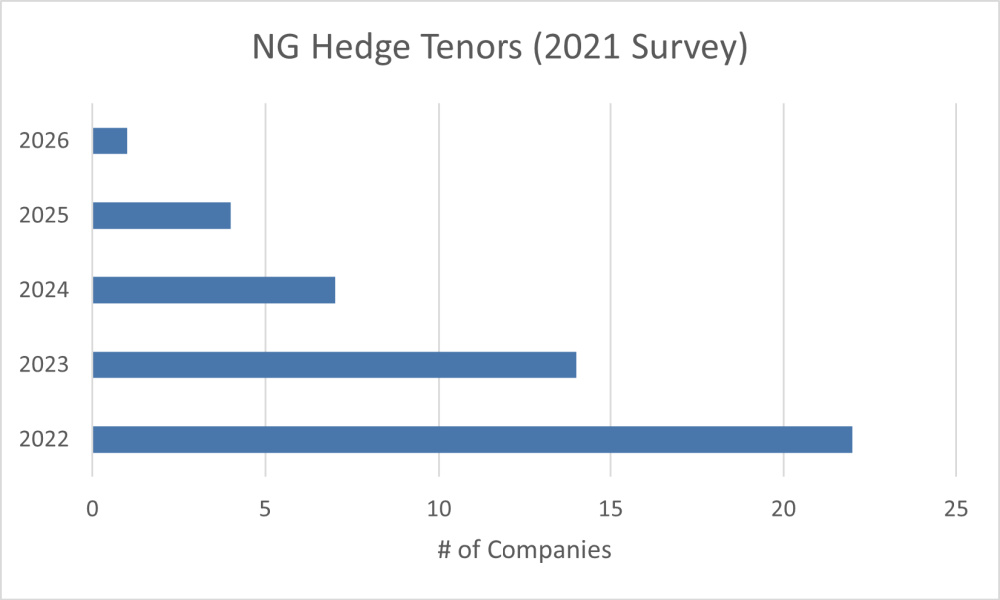

When executing a hedging program, many companies are challenged with how far out to hedge their production. If the prices increase over time, they largely give up the upside. However, if the prices drop, it allows the company to weather the storm for a longer period. Based on the survey results, it is common for companies to hedge some level of the prompt 12-month period representing 2022. About half of the companies with crude or gas hedges held hedges in 2023 as of Dec. 31, 2021. Similar to last year, only a handful of companies held hedges for crude in 2024 (36 months out). More companies held gas hedges in the two- to four-year range as of Dec. 31, 2021, than the previous year.

Price levels

As a hedging program is intended to increase cash flow predictability, the price level at which companies execute hedges is often heavily influenced by operating budgets and debt compliance.

For the companies that disclosed their average floor prices for WTI Cushing crude, Henry Hub natural gas, or both, the average swap price for crude was $54.17/bbl for 2022 and $56.16/bbl for 2023 and natural gas was $2.95/MMBtu for 2022 and $2.94/MMBtu for 2023. The average put price (non-three way) for crude was $51.60/bbl for 2022 and $51.29/bbl for 2023, and natural gas was $2.94/MMBtu for 2022 and $2.91/MMBtu for 2023.

Hedge coverage

Consistent with the prior year’s survey, few companies disclosed the amount of their forecasted production that was hedged as of Dec. 31, 2021. Only six companies disclosed a percentage of forecasted production hedged. For the companies that did disclose this information, the average hedge level for crude was 51% of forecasted 2022 production and, for natural gas, was 54% of forecasted 2022 production. Note that these hedge levels include coverage provided by three-way options.

In summary, the implementation of an effective hedging program can be a tool that helps ensure certainty of cash flow and provide a longer reaction time in the event of a market price collapse. Management teams are encouraged to consider the various hedging alternatives and strategies available to them.

About the Authors: Josh Schulte is a manager in Opportune LLP’s commodity risk management advisory group. He assists companies with developing and executing complex risk management programs.

About the Authors: Josh Schulte is a manager in Opportune LLP’s commodity risk management advisory group. He assists companies with developing and executing complex risk management programs.

Jeff Nicholson is a senior consultant in Opportune LLP’s derivative reporting practice, in which he assists companies with the reporting and analysis of derivatives and complex securities.

Jeff Nicholson is a senior consultant in Opportune LLP’s derivative reporting practice, in which he assists companies with the reporting and analysis of derivatives and complex securities.

Reece Lambert is a senior consultant in Opportune LLP’s derivative valuation practice based in Tulsa.

Reece Lambert is a senior consultant in Opportune LLP’s derivative valuation practice based in Tulsa.

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.