Presented by:

The Permian Basin has attracted the attention of U.S. companies with no international operations as well as international oil companies (IOCs) and a national oil company (NOC) from Latin America with operations in Latin America, Africa, Europe, Asia and beyond.

This analysis is confined to eight multinationals with operations in the Permian. The majority, including Exxon Mobil Corp., Occidental Petroleum Corp. (Oxy), APA Corp., Chevron Corp., EOG Resources Inc. and ConocoPhillips Co., have corporate headquarters in the U.S. The remaining two include one IOC with corporate headquarters in London, BP Plc, and one NOC from Colombia, state-owned Ecopetrol, which stands out in a league of its own.

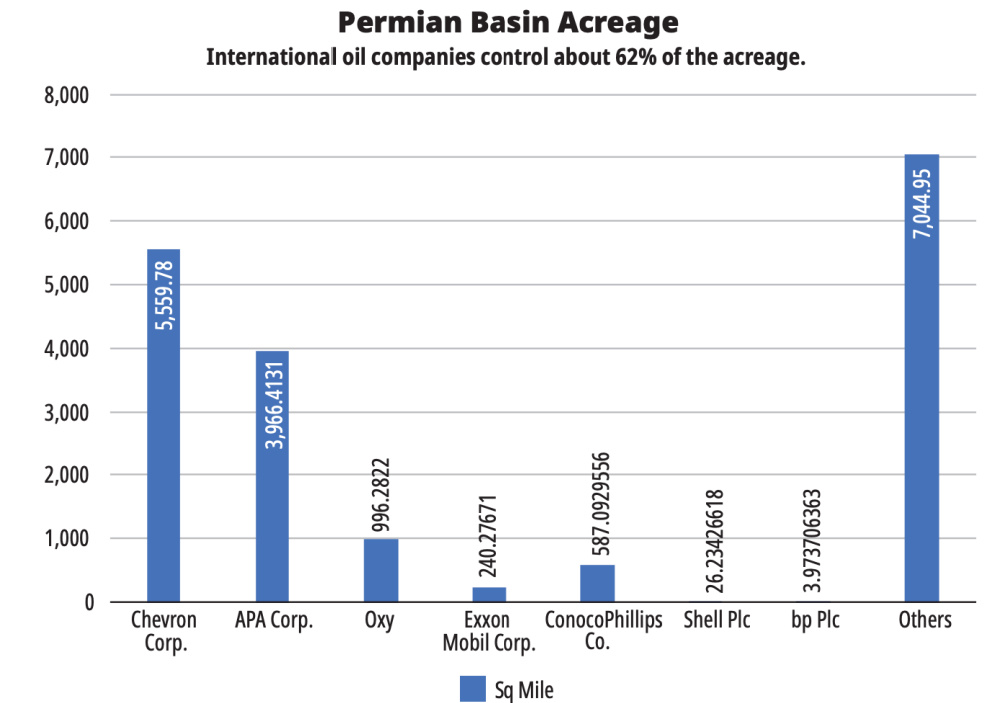

The eight multinationals control about 62% of the acreage in the Permian Basin, according to Rextag data. The dominant acreage holders include Chevron, which holds 30%, APA (22%), Oxy (5%), ConocoPhillips (3%), Exxon Mobil (1%), Shell and BP with a combined (1%) and others holding the other 38%.

“The IOCs are significant contributors to the Basin’s outlook, but we would attribute most of the successes in the Permian Basin to the E&Ps and energy service companies,” Wells Fargo Equity Analyst Roger D. Read told Hart Energy.

“Associated gas production from the Permian is a meaningful, but not dominant, contributor to U.S. gas production growth and LNG exports. We continue to see traditional gas-producing areas such as the Marcellus and Haynesville as significant gas production growth regions alongside the Permian Basin.”

Regardless of whether the IOCs were active in the Permian or not, the basin would be an active one and a meaningful contributor to U.S. and global production growth, Read said.

“What we believe the IOCs bring to the market is consistency, a high level of environmental compliance, a long fairway of growth potential through the end of the decade and their integrated model of development which will capture value throughout the production, distribution and end-use chain.”

The IOCs are “significant, but not dominant” players in the development of the Permian and will contribute 1/6th to 1/7th of Permian oil production growth through 2025 based on current forecasts, Read said.

What follows is a summary of the multinational’s operations in the Permian Basin including acreage, production and near-term plans.

Majors

Exxon Mobil

Houston-based Exxon Mobil, which acquired XTO Energy Inc. in 2010, has key international upstream operations in Brazil and Guyana. In the U.S., the Permian remains a key asset within its portfolio as it looks to maximize the value of an advantaged acreage position through technology and integration.

The Permian Basin continues to improve efficiency and grow volumes. Average production in the Permian during the first half of 2022 grew by nearly 130,000 boe/d versus the first half of 2021, and averaged more than 550,000 boe/d in the second quarter of 2022.

“For the full year in the Permian, we expect to achieve 25% production growth for the second consecutive year,” Exxon Mobil CEO Darren Woods said during the second quarter webcast. “The plans that we have in place should deliver and our current production is in line with that 25% growth versus last year, which as you know, is on top of 25% growth the year before.”

Exxon Mobil aims to grow Permian free cash and retain development pace optionality and flexibility. By 2027, Exxon Mobil forecasts average Permian production to exceed 800,000 boe/d with free cash potentially exceeding $5 billion.

“For the full year in the Permian, we expect to achieve 25% production growth for the second consecutive year.”—Darren Woods, Exxon Mobil Corp.

Exxon Mobil’s development approach in the Permian leverages competitive advantages to drive efficient growth with benefits coming from early investment in surface infrastructure which provides an established foundation for long-term efficiency as well as a multiwell pad corridor approach and significant operating cost reductions driven by efficiency and performance gains.

Exxon Mobil aims to achieve net-zero Scope 1 and 2 greenhouse gas emissions at its operated Permian assets by 2030. The company’s plan includes eliminating all routine flaring in the area by the end of 2022, upgrading equipment, improving monitoring and electrifying operations with lower-emission power.

Exxon Mobil’s net-zero road map in the Permian includes minimizing methane emissions through use of leak detection, flare minimization, electrification of drilling, completions and operations, and purchasing or producing renewable power.

Chevron

San Roman, Calif.-based Chevron has operations and projects in North America, South America, Europe, Africa, Asia and Australia. In the U.S., the company, through its legacy companies, has been active in the Permian since the early 1920s and is one of the largest oil and gas producers. In the Permian, Chevron holds approximately 2.2 million net acres and approximately 75% have either low or no royalty payments.

Chevron’s acquisition of Noble Energy in October 2020 strengthened its Permian position. In 2021, Chevron’s net unconventional production in the Permian averaged 284,000 bbl/d of oil, 1.1 Bcf/d of gas and 148,000 bbl/d of NGL, while conventional production averaged 10,000 bbl/d of oil, 39 MMcf/day of gas and 2,000 bbl/d of NGL. Looking forward, Chevron forecasts Permian production to reach 1MMboe/d by 2025.

“The IOCs are significant contributors to the basin’s outlook, but we would attribute most of the successes in the Permian Basin to the E&Ps and energy service companies.”—Roger D. Read, Wells Fargo

Chevron’s advantaged portfolio of development areas in the Permian consists of stacked formations which allow production from multiple geologic zones from single surface locations. Top tier drilling and completion performance has allowed Chevron to report year-over-year capex efficiency improvement and cycle time reduction generating higher returns throughout its Permian portfolio.

Chevron’s Permian operations have also demonstrated continual progress on its lower carbon and water goals, consistently ranking among the best Permian operators for methane emissions intensity, routine flaring and water handling (utilizing 99% brackish or recycled sources), Chevron said.

BP Plc

The BPX Energy business, which began operating as a standalone entity in 2015, comprises London-based BP Plc’s onshore oil and gas operations in the U.S. Lower 48.

BPX operates in the Permian-Delaware and Eagle Ford basins in Texas and focuses on safely producing high-margin barrels while driving down emissions. In 2021, BPX reported emission reductions comparable to the annual electricity-related emissions of over 114,000 typical homes, according to the company.

BPX’s production in 2021 from its Texas and Louisiana operations averaged 296,000 boe/d. By 2025, BPX aims to achieve zero routine flaring at all its U.S. onshore operations mainly through investments in new and upgraded infrastructure.

In the Permian, BPX’s new, state-of-the-art Grand Slam facility is an electrified central oil, gas and water handling facility that decreases operational emissions by replacing gas-driven equipment, compressors and generators. BPX forecasts that over 95% of its Permian operated wells will be electrified by 2023, according to the company. Additionally, the company plans to install methane measurement equipment at all of its existing oil and gas processing sites by 2023.

Independents

Oxy

Houston-based Oxy has international operations in Oman, United Arab Emirates (UAE), Algeria and the U.S. where its acquisition of Anadarko Petroleum Corp. in 2019 significantly boosted the company’s Permian holdings.

Oxy manages its Permian operations through two business units: Permian Resources, which includes unconventional opportunities, and Permian EOR, which utilizes EOR techniques such as CO₂ floods and waterfloods. The exploitation of synergies between the two business units allows Oxy to deliver short- and long-term advantages, efficiencies and expertise across its Permian operations.

Oxy’s position in the Permian Basin covers 2.8 million net acres.

In the basin, Oxy is known for its EOR—whereby CO₂ is injected and permanently stored in hydrocarbon reservoirs during production to improve efficiency, economics and environmental sustainability. Oxy boasts being the Permian Basin’s largest CO₂ EOR operator and stores up to 20 million tons of CO₂ underground annually.

In the second quarter of 2022, Oxy’s share of production in the Permian Basin averaged 493,000 boe/d, up compared to 487,000 boe/d in 2021.

RELATED:

Exclusive Q&A: Oxy’s Hollub Pleased with Permian Basin JV

“Our Permian production delivery remains very strong, with a growth of approximately 100,000 boe/d when comparing the fourth quarter of 2021 through our implied production guidance for the fourth quarter of 2022,” Oxy senior vice president and CFO Robert L. Peterson said during the second quarter of 2022 webcast.

In 2022, Oxy has allocated $1.7 billion to $1.9 billion, or almost 50% of its worldwide capex to the Permian, up compared to $1.1 billion in 2021, of which approximately 93% was spent on Permian Resources assets. In 2021, Oxy divested of certain nonstrategic assets in Permian Resources while acquiring additional working interests in certain assets related to Permian EOR.

Oxy JV with Ecopetrol

Oxy and Ecopetrol created a joint venture (JV) in November 2019 to develop 97,000 net acres of Oxy’s Midland Basin unproved properties in the Permian. The JV allows Oxy to accelerate its development plans in the Midland Basin and retain production and cash flow from its existing operations in the basin.

“Our Permian production delivery remains very strong, with a growth of approximately 100,000 boe/d when comparing the fourth quarter of 2021 through our implied production guidance for the fourth quarter of 2022.”—Robert L. Peterson, Oxy

Recently, Oxy and Ecopetrol agreed to enhance their Midland Basin JV and expand their partnership to cover approximately 20,000 net acres in the Delaware Basin, which includes 17,000 acres in the Texas Delaware.

“In the Midland Basin, Oxy will benefit from the opportunity to continue development with an extension to the capital carried through the end of this agreement in the first quarter of 2025,” Oxy president and CEO Vicki A. Hollub said during the company’s second quarter of 2022 webcast. “In the Delaware Basin, we have the opportunity to bring forward the development of high-quality acreage that was further out in our development plans, while benefiting from an additional capital carry of up to 75%. In exchange for the carried capital, Ecopetrol will earn a percentage of the working interest in the JV asset.”

Activity in the Delaware sub-basin is expected to commence in the fourth quarter of 2022 and add production from the first quarter of 2023 onward, according to Oxy.

In the first half of 2022, the Oxy-Ecopetrol JV in the Permian, known as the Rodeo JV, had a total of 149 wells in production, which represented average production of 268,000 Mboe/d net for Ecopetrol before royalties, up 94% compared to 138,000 boe/d for the first half of 2021, according to Ecopetrol.

Ecopetrol’s forecast for 2022 includes the drilling of 97 wells, the completion of around 95 wells and an increase in production for Ecopetrol between 4,000 boe/d to 6,000 boe/d (corresponding to a greater Ecopetrol working interest in the JV Rodeo of 26%, increasing from 49% to 75% after the JV amendment), for an expected total average production in 2022 of 38,000 boe/d to 40,000 boe/d net to Ecopetrol before royalties.

In terms of emissions reduction, the Rodeo JV “continues to apply the zero routine flaring initiative and to install systems for the assessment of fugitive emissions,” Ecopetrol CEO Felipe Bayón said during the company’s second quarter of 2022 webcast. Additionally, up to 36% of the volume of diesel used in the completion activities has been replaced by CNG.

ConocoPhillips

Houston-based ConocoPhillips has operations in Asia Pacific, Europe, the Middle East, North Africa, Alaska, Canada and Lower 48.

For ConocoPhillips, the U.S. Lower 48 now represents the company’s largest business segment based on production. There in 2021, the company specifically reported significant growth in the Permian Basin with the acquisition of Concho Resources Inc. in January 2021 and the addition of Shell’s Permian acreage in December 2021.

At year-end, ConocoPhillips held approximately 1.5 million net acres in the Permian Basin.

ConocoPhillips’ net production for the Permian in 2021 was 442,000 boe/d (286,000 boe/d from Delaware, 136,000 boe/d from Midland and 20,000 boe/d from other Permian assets), excluding production associated with its acquisition of Shell’s prolific Delaware basin position.

The Shell assets include about 225,000 net acres and producing properties located entirely in Texas as well as over 600 miles of operated crude, gas and water pipelines and infrastructure. These assets were initially forecast to produce around 200,000 boe/d in 2022, roughly half of which is operated.

In the second quarter of 2022, production from ConocoPhillips’ Permian assets averaged 634,000 boe/d. In 2022, Permian production growth is expected to be back-half weighted and grow at the higher end of a mid-to-high single-digit growth range on a pro forma basis, ConocoPhillips’ Lower 48 executive vice president, Jack Harper, said during the company’s second quarter of 2022 webcast.

ConocoPhillips’ Permian footprint

In the Delaware Basin, ConocoPhillips holds approximately 709,000 total net acres spanning West Texas through southeast New Mexico, including approximately 654,000 unconventional net acres. Current development activity targets prospects in the Avalon, Bone Spring and Wolfcamp formations, while balancing leasehold obligations and permit terms. Ongoing improvements in drilling and completion efficiencies, infrastructure development and water management are supported by offtake agreements to further reduce the cost of supply.

In the Midland Basin, ConocoPhillips holds approximately 376,000 total net acres, which includes approximately 266,000 unconventional net acres located in the heart of West Texas. The current focus is on full-scale development utilizing large multiwell pad projects targeting both Spraberry and Wolfcamp reservoir targets, according to ConocoPhillips.

With over 2,500 ft of high-quality reservoir targets in the Spraberry, Dean and Wolfcamp formations, ConocoPhillips has more than a decade of remaining development inventory. The company reports it’s leveraging new drilling and completion technologies to safely increase lateral length and improve drilling and completion efficiency while reducing the surface footprint.

ConocoPhillips’ other Permian assets in the Central Basin Platform and the Northwest Shelf are legacy positions, mostly HBP.

APA Corp.

Houston-based APA Corp. has key operations in Egypt’s Western Desert and the U.K.’s North Sea, and exploration opportunities offshore Suriname. In the U.S., APA has operated in the Permian Basin since the 1990s.

The Permian Basin has played a significant role in APA’s long-term strategy, offering conventional and unconventional opportunities. APA holds 332,000 gross acres (238,000 net acres) in the southern Midland Basin and 267,000 gross acres (134,000 net acres) in the Delaware Basin, including opportunities in the Bone Spring and other formations of eastern New Mexico and bordering West Texas, and the Alpine High play in the southern portion of the Permian Basin, primarily in Reeves County, Texas.

In the Permian, APA operates approximately 6,000 gross oil and gas wells across its acreage, with additional interests in more than 3,000 nonoperated wells. Of note, approximately 6% of the company’s net acreage position in the Permian is on federal onshore lands. In the Permian, APA is targeting sub-basins shale plays including the Woodford, Barnett, Pennsylvanian, Cline, Wolfcamp, Bone Spring and Spraberry.

The company recently added a third rig in the Permian, which is now drilling at Alpine High.

In the southern Midland Basin during the second quarter of 2022, APA averaged two rigs, while it placed six wells on production. In the third quarter of 2022, the company forecasts placing approximately 10 wells on production.

In the Delaware Basin in the second quarter of 2022, APA averaged one rig, while no new wells were brought into production. Six wells were drilled at DXL Field, which are expected online in the fourth quarter of 2022. A rig was also moved to Alpine High where it will drill the first pad since 2019.

APA also recently completed a tuck-in acquisition in July of properties primarily in Loving and Reeves counties near the company’s active development areas in the Texas Delaware Basin. The acquisition consists of producing wells, wells in the drilling and completion process and an inventory of undrilled locations.

Currently, two rigs are operating with one rig to be released in the fourth quarter of 2022, while the other will be retained as a fourth U.S. development rig.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.