Permian Resources Corp. announced more than $200 million in Delaware Basin deals during the first quarter, including royalty acreage and the closing of a bolt-on. The company also divested some midstream infrastructure during the quarter. (Source: Shutterstock.com)

Permian Resources Corp. announced more than $200 million in Delaware Basin deals during the first quarter, including royalty acreage and the closing of a bolt-on. The company also divested some midstream infrastructure during the quarter.

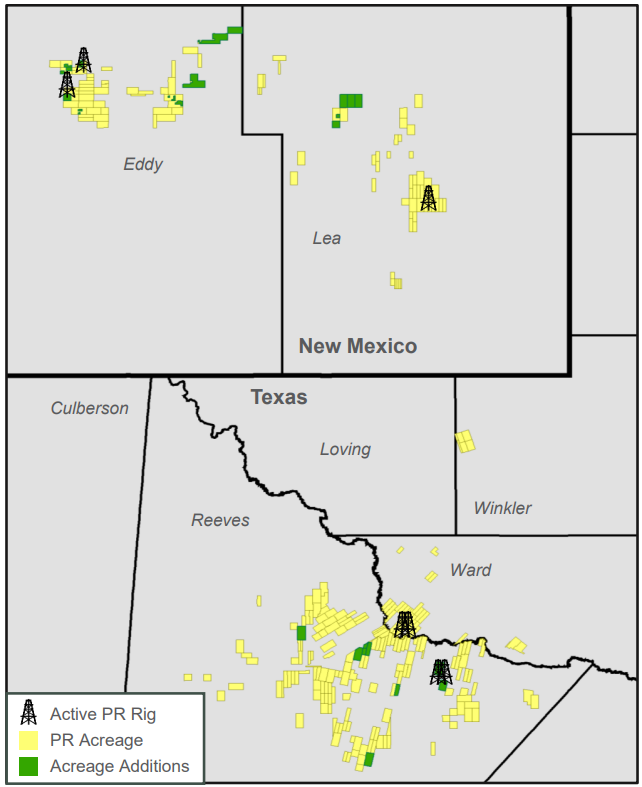

Midland-based Permian Resources completed an acquisition of 4,000 net acres, 3,300 net royalty acres and average net production of 1,100 boe/d, the company reported in first-quarter earnings after markets closed on May 8.

The bolt-on of Lea County, New Mexico assets from an undisclosed third-party were acquired for $98 million prior to post-closing adjustments. Permian Resources said it agreed to pay approximately $8,000 per net leasehold acre and $7,000 per net royalty acre for the deal.

The properties’ operated position includes largely undeveloped acreage and is contiguous with Permian Resources’ existing core position in Lea County, the company said.

In addition to the bolt-on deal, Permian Resources executed an acreage trade during first-quarter 2023.

The company swapped about 3,400 net acres in Eddy County, New Mexico, in exchange for about 3,200 net acres of lower working interest acreage with no material production and few near-term drilling prospects.

“This trade increased our working interest in high-return locations and created several new operated drilling units,” Permian Resources co-CEO James Walter said on a May 9 call with analysts. “Notably, we expect to begin development activity in approximately half of the 3,400 inbound acres over the next 12 months, making this type of transaction highly accretive to shareholders.”

Permian Resources said it executed more than 45 transactions during the first quarter, including grassroots acquisitions that added about 530 net acres and around 20 net royalty acres.

“These smaller deals are among the highest rate-of-return acquisitions that we evaluate,” Walter said. “We credit being based in Midland, [Texas], for giving us an edge on this ground game approach to growing the business.”

In addition to upstream transactions, Permian Resources also divested a portion of its saltwater disposal wells and associated produced water infrastructure in Reeves County, Texas, during the first quarter.

The company’s midstream divestiture with an undisclosed third-party buyer generated a total cash consideration of $125 million – $60 million, of which is subject to repayment if certain thresholds tied to Permian Resources’ future drilling activity in the service area over the next several years are not met.

RELATED: Permian Resources Adds, Subtracts in Nearly $300 Million in Deals

Potential for future A&D

Permian Resources was created about a year ago through the merger of Colgate Energy Partners II LLC and Centennial Resource Development Inc., which created the largest pure-play E&P company in the Delaware Basin.

The company has achieved operating cost reductions, improvements in drilling and completion costs and other efficiencies after the combination and integration process, Permian Resources’ co-CEO Will Hickey said.

“Our talented team will continue to look for additional opportunities to reduce costs and improve capital efficiency so that we can return that incremental free cash flow to our shareholders,” Hickey said on the call.

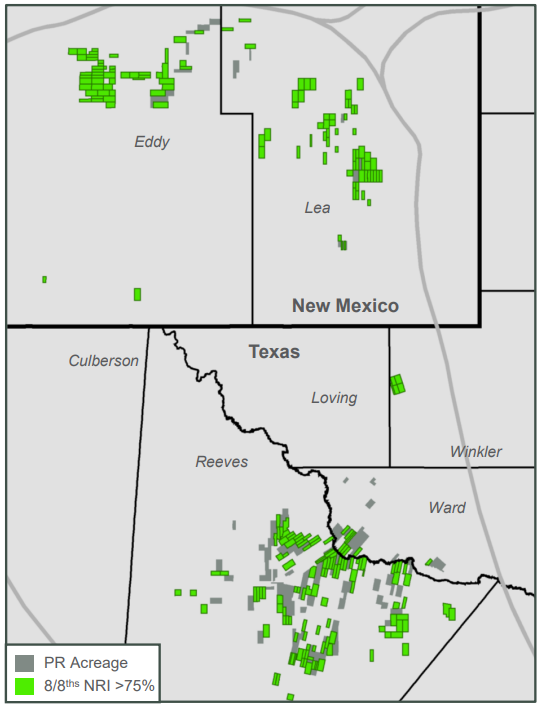

Permian Resources has also developed a sizable portfolio of mineral and royalty interests in the Delaware.

The company’s royalty-focused entity is currently generating more than $50 million of free cash flow annually, Walter said.

While Permian Resources doesn’t have major divestiture plans in the pipeline, there could be opportunities to monetize some of the non-operated override interests not fully valued in the company’s portfolio today, Hickey said.

RELATED: Public Mineral, Royalty Players Eye M&A After Record 2022

Launching inaugural variable dividend

Permian Resources returned $85 million to investors in the first quarter through stock repurchases and dividends.

The company has committed to returning at least 50% of its free cash flow through a base dividend, variable dividends and share repurchases. To that end, Permian Resources initiated its first variable dividend of $0.05 per share during the first quarter.

The Permian Resources board also declared a quarterly base cash dividend of $0.05 per share. The base and variable dividends are payable on May 24 to shareholders of record as of May 16.

The company also spent $24.9 million repurchasing shares during the quarter.

Recommended Reading

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Flame Acquisition Holders Approve Merger with Sable Offshore

2024-02-14 - The business combination among Flame Acquisition Corp., Sable Offshore Holdings and Sable Offshore Corp. will be renamed Sable Offshore Corp.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

NGL Energy Partners Announces Cash Distribution

2024-02-08 - Payments to holders of NGL Energy Partners’ Class B and C preferred units will be made Feb. 27.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.