As a result of the transactions, Laredo Petroleum will have more than 30,000 highly productive, contiguous net acres in Howard County, Texas, and a near-term pathway to increasing its oil cut to more than 50% from the current 30%, says CEO Jason Pigott. (Source: Shutterstock.com)

Laredo Petroleum Inc. announced over $1 billion worth of transactions on May 9, which the Tulsa, Okla.-based independent says will accelerate its strategic ambitions in the Permian Basin.

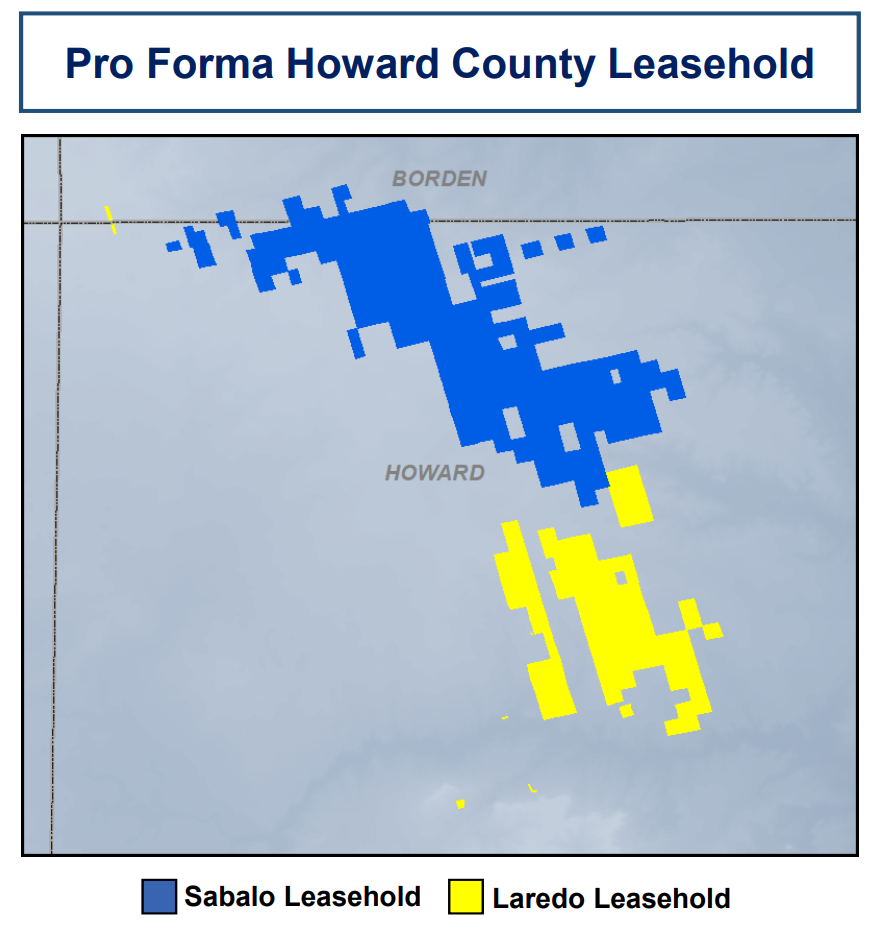

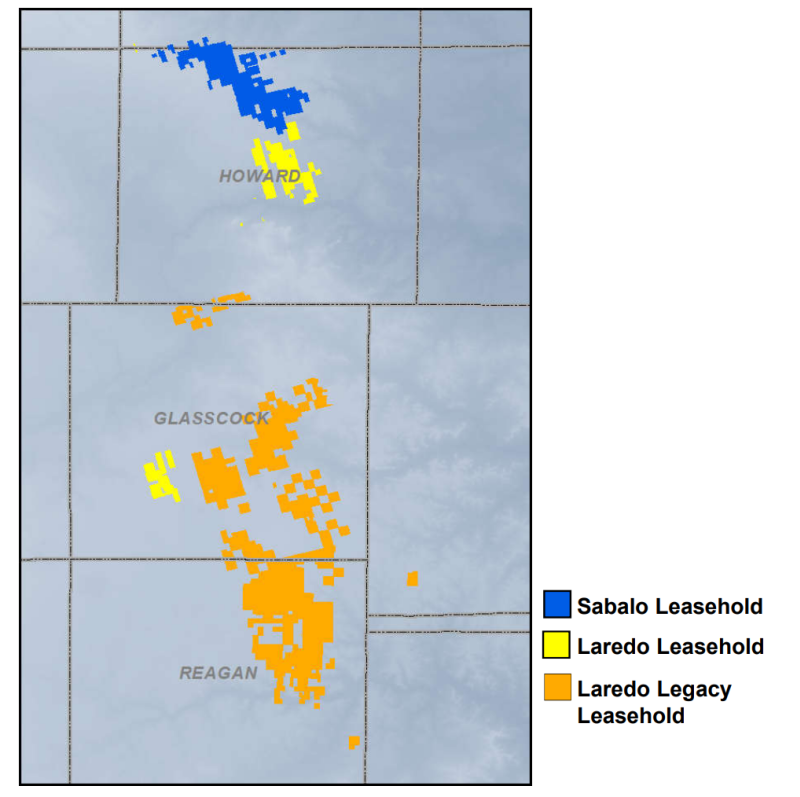

In a company release, Laredo said it had signed an agreement to acquire the assets of Sabalo Energy LLC, a portfolio company of EnCap Investments LP, and a nonoperating partner for approximately $715 million in cash and stock. Additionally, the company announced the partial sale of operated PDP reserves in gas-weighted legacy assets in Reagan and Glasscock counties, Texas, to an affiliate of Sixth Street Partners LLC.

Laredo expects the $405 million of proceeds from the sale to partially fund its acquisition, which includes roughly 21,000 contiguous net acres directly offsetting Laredo’s existing Howard County leasehold in the Midland Basin of West Texas.

“The transformational impact for Laredo of the combined transactions is significant,” Jason Pigott, the company’s president and CEO, said in a statement on May 9. “Upon closing, we will be positioned for sustainable free cash flow generation and significant deleveraging, have more than 30,000 highly productive, contiguous net acres in Howard County and a near-term pathway to increasing our oil cut to more than 50% from the current 30%.”

The current production on the acquired properties is about 14,500 boe/d (83% oil, three stream) with an estimated next 12-month oil decline of 35%, according to the company release. PDP reserves are approximately 30 million boe (73% oil, three stream).

The transaction adds roughly 120 operated oil-weighted locations and 150 nonoperated locations to Laredo’s drilling inventory, 83% of which, the company noted, are capital efficient long laterals of 10,000 feet or greater.

In a statement commenting on the sale of Sabalo to Laredo, Doug Swanson, managing partner of EnCap, said: “This transaction complements Laredo’s existing asset base and strategy and accelerates the company’s transformation to becoming a leading independent operator in the Midland Basin.”

“Laredo is well positioned to maximize value from the Sabalo assets and we view this transaction as compelling for Laredo shareholders, including EnCap, as part of this transaction,” Swanson added in the statement, as the transaction was comprised of $625 million in cash plus approximately 2.5 million shares of Laredo common equity.

The sale also announced May 9 comprises 37.5% of Laredo’s working interest in the legacy PDP reserves and does not include the Western Glasscock acreage acquired in late 2019.

The company said divested reserves were approximately 94 million boe (18% oil) with associated production of approximately 25,000 boe/d (23% oil), at closing. The deal included wellbore working interest only and Laredo will retain all undeveloped locations.

Laredo also expects additional potential cash-flow based earn-out payments over the next six years from the sale.

The company said both transactions are forecast to close July 1. Citigroup and Houlihan Lokey provided advisory services on the Sabalo acquisition. Houlihan Lokey also acted as financial adviser on the PDP sale to Sixth Street. Akin Gump and Willkie Farr & Gallagher served as Laredo’s legal advisers. Jefferies was exclusive financial adviser to Sabalo and Bracewell served as Sabalo’s legal advisor. White & Case acted as legal adviser to Sixth Street.

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.