U.S. shale players are shifting from quick production growth mode to increasing cash flow in hopes of returning money to investors. (Source: SG Arts/Shutterstock.com)

Having shed its assets outside the Permian Basin, pure-play Pioneer Natural Resources Co. is on a cost-cutting, revenue-generating, free cash flow-making, growth rate-slowing, shareholder capital-returning mission.

And, “We have been laser-focused on lowering our breakeven costs,” Pioneer CFO Rich Dealy said June 19 during the JP Morgan Energy Conference.

The attention on monetization comes as U.S. shale players continue to be pummeled by investors fed up with oil companies’ inability, for the most part, to generate cash flow. Although the industry has successfully used technology and improved techniques to get more from wells while bringing down costs, it still faces challenges of steep well declines, geopolitics and the cyclical nature of the business plus debt.

Resisting the temptation to spend—even in instances of higher oil prices—has also been a challenge.

Like many of its peers, Pioneer has shifted from quick growth mode to increasing cash flow so it can return money to investors.

The Irving, Texas-based company sold its pressure pumping business last year to ProPetro Holding Corp., making way for about $750,000 in per well costs savings. Additionally, the company turned to West Texas for sand, instead of Brady, Texas, for $400,000 in per well savings.

Earlier this year, Pioneer also cut about 25% of its staff, or about 500 people, adjusting its corporate structure to better align with becoming a single-basin operator. The target: $100 million in annual G&A savings.

The company is focused on monetizing assets and optimizing cash flow. In the crosshairs are Pioneer’s 27% interest in a Midland Basin gas processing infrastructure operated by Targa Resources Corp. and spending on field facilities amid moderated growth. Dealy said the Targa system has a capital budget of about $150 million.

“The goal is to really carve $100 million or so out of our facilities capital relative to what we’re spending this year as we move into 2020,” he said.

Pioneer is also evaluating potential moves with its Permian Basin water infrastructure as it winds down major capital spend on such infrastructure this year. The company’s Midland wastewater plant is set to be complete by early 2021.

“We want to look at what other transactions have been going on in the basin, what other companies have done in terms of selling their water assets,” Dealy said. “We want to understand that, take a look at that and decide if there’s something there that would make sense for Pioneer.”

Pioneer has already given information memorandum to prospective buyers, mainly infrastructure funds, Dealy said, adding he expects some indications in the next month or so. Hopes are to complete the process by year-end.

In May, the company sold its remaining Eagle Ford Shale assets in a sale expected to bring in up to $475 million in proceeds while lowering overall production costs and increasing margins. Dealy said Pioneer is also exploring options to monetize inventory not already slated for near-term development, prioritizing areas with leases nearing expiration if not drilled.

The company has about 680,000 acres within the Permian’s Midland sub-basin with about 1,400 horizontal wells producing oil that is mostly destined for the Gulf Coast. Its resource base is more than 10 billion barrels of oil equivalent.

Acreage the company would consider selling or including in a DrillCo funding arrangement, which brings in a partner to fund a drilling program, involves assets that would be developed 10-20 years from now. “It’s acreage at the tail end of our drilling portfolio,” Dealy explained.

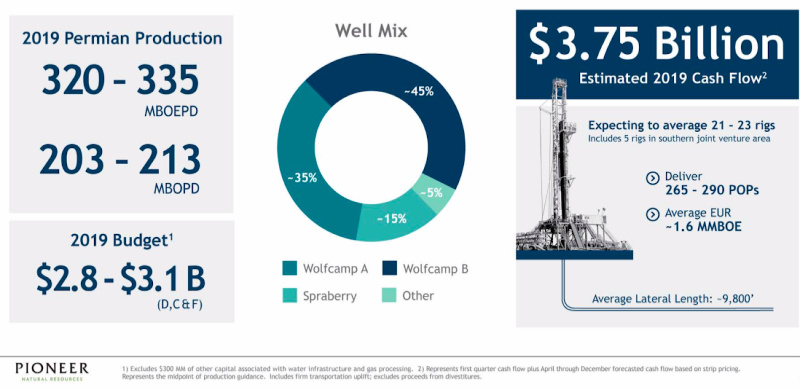

The focus on financials comes as Pioneer continues E&P efforts. The company said its returns-focused horizontal development strategy targets optimal well performance, maximized returns and is less capital intensive.

Pioneer plans to grow production by 12%-17%, or 320,000-335,000 barrels of oil equivalent per day, this year on a capital budget of between $2.8 billion and $3.1 billion.

Pioneer’s contiguous acreage enables the company to maximize returns and well performance, Dealy said. “Over the last four years our well productivity has increased in each of those years, and that’s really a combination of the spacing, completion designs and how we’re developing those wells,” he said.

Speaking on basin knowledge gained through the years, Dealy said the company has learned optimal spacing is about 850 ft between wells.

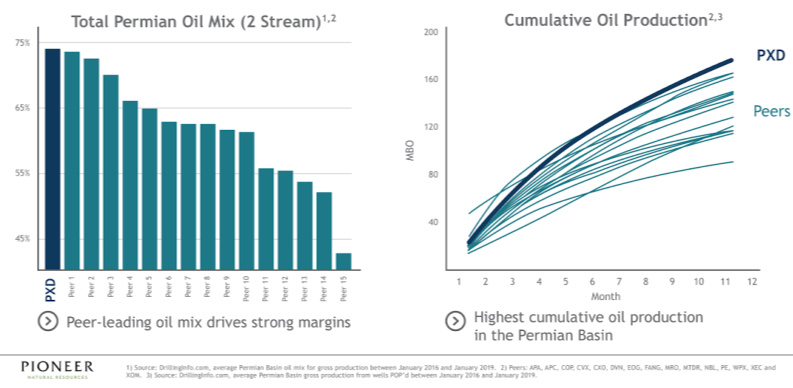

“You can never go wrong with good rock. We think we’re in that the best part of the Midland Basin, the deepest part of the basin such that we have multiple stacked pays,” he continued. “What that’s led to is the highest oil recovery as well … on a two-stream basis of anybody in the basin.”

That oil—currently more than 200,000 barrels per day—is going to the Gulf Coast refineries or into export markets, which “adds to our bottom line and improves our results,” he said.

An added benefit is that the oil is sold at prices linked to Brent, instead of Midland. Dealy said the difference has boosted the company’s cash flow by about $600 million over the last five quarters. The company has about 20 different repeat customers.

Firm commitments ramp with production growth, he said.

Pioneer hopes improved returns, capital discipline and spending within cash flow will pave the path toward returning money to shareholders via dividends and/or share repurchases.

“We think we can do both,” Dealy said, adding it’s possible with a strong balance sheet, acreage position and drilling inventory. “All those things, we think, are going to drive our results and show that Pioneer’s delivering good results over the coming years.”

A share of Pioneer’s stock was trading for about $149 on June 19, up from about $143 in mid-January but down from about $180 a year ago.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

ARC Resources Adds Ex-Chevron Gas Chief to Board, Tallies Divestments

2024-02-11 - Montney Shale producer ARC Resources aims to sign up to 25% of its 1.38 Bcf/d of gas output to long-term LNG contracts for higher-priced sales overseas.

Woodside Brings in the Know-how

2024-04-01 - Woodside Energy Group CEO Meg O’Neill is relying on technical sophistication to guide the Australian giant as it takes on three challenging projects in the U.S. Gulf of Mexico.

CERAWeek: Trinidad Energy Minister on LNG Restructuring, Venezuelan Gas Supply

2024-03-28 - Stuart Young, Trinidad and Tobago’s Minister of Energy, discussed with Hart Energy at CERAWeek by S&P Global, the restructuring of Atlantic LNG, the geopolitical noise around inking deals with U.S.-sanctioned Venezuela and plans to source gas from Venezuela and Suriname.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.