Record oil and gas output from the Permian Basin continues to drive U.S. production growth forecasts. (Source: Shutterstock.com)

Record oil and gas output from the Permian Basin continues to drive U.S. production growth forecasts.

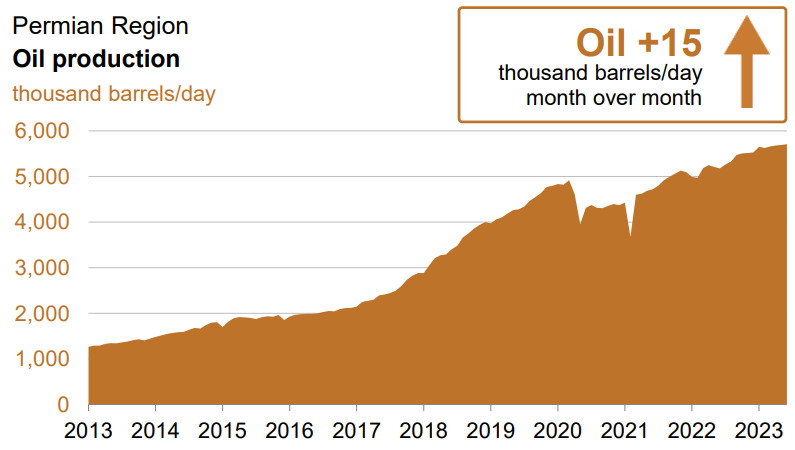

The Permian’s West Texas and New Mexico operators are expected to grow volumes to approximately 5.71 million barrels per day (MMbbl/d), according to the U.S. Energy Information Administration’s (EIA) latest forecasts.

Permian crude output is anticipated to rise by about 15,000 bbl/d month over month from May, when production was expected to hit about 5.69 MMbbl/d.

The Permian is expected to lead Lower 48 oil production growth in June, accounting for approximately 37% of the incremental 41,000 bbl/d month over month.

Crude output from the Bakken play in North Dakota and Montana is expected to grow by about 13,000 bbl/d to 1.23 MMbbl/d in June, the EIA said.

Other basins are anticipated to grow oil production next month, including the Anadarko (5,000 bbl/d), the Niobrara basins (5,000 bbl/d) and the Eagle Ford Shale (2,000 bbl/d).

Permian, Haynesville gas output rises

Natural gas production from the Permian and Haynesville Shale is also hitting new records.

E&Ps come to the Permian Basin largely to drill for crude oil, but Permian wells are producing more natural gas as the play matures.

Associated gas production from Permian wells will grow to 22.55 Bcf/d in June, an increase of about 82 MMcf/d month over month.

RELATED: Analysis: Wells in Top U.S. Oil Basins Getting Gassier

In contrast to the oily Permian, E&Ps largely drill for natural gas in places like the Haynesville Shale and Appalachia.

Gas production from the Haynesville is forecast to rise to 16.87 billion cubic feet per day (Bcf/d) in June, up about 62 MMcf/d month over month, per EIA figures.

Appalachia, home to the Marcellus and Utica plays, still leads overall gas production in the Lower 48. Output from Appalachia will rise by about 54 MMcf/d to 35.31 Bcf/d next month.

U.S. gas output is growing as drillers face low commodity prices and pull back on drilling. The U.S. oil and gas rig count fell to its lowest point in nearly a year last week, and gas rig activity fell by the most in a week since 2016.

Natural gas production from the Anadarko Basin is expected to fall by about 16 MMcf/d next month– the only region seeing declining gas output.

Gas producers saw prices rise above $9 per million Btu (MMBtu) last year, but have faced market oversupply, weak demand and high levels of gas storage in recent months.

Henry Hub natural gas prices are forecast to average $2.91/MMBtu in 2023, down more than 50% from 2022’s average of $6.42/MMBtu, according to the EIA’s latest estimates.

But U.S. gas prices should receive a lift back above $3 this summer as demand for electric power generation surges, the EIA said.

Drillers in the Haynesville are delaying well completions in the gassy basin amid the volatility in natural gas prices.

RELATED: Tellurian to Cut Haynesville Production by 18%

The number of DUC wells in the Haynesville grew by 11 from March through April. Producers have been adding DUCs in the Haynesville since September 2021, according to the EIA’s most recent available data.

DUCs are a tool producers use to have new oil and gas supply ready when prices improve.

Meanwhile, producers in oil-weighted basins are working through completions and decreasing DUC inventories. DUCs available in the Permian fell by a count of 36, while DUCs in the Bakken fell by 12 and in the Eagle Ford by 8.

RELATED: Economic, Banking Risks Tamp Down EIA’s Crude Price Outlook

Recommended Reading

API Gulf Coast Head Touts Global Emissions Benefits of US LNG

2024-04-01 - The U.S. and Louisiana have the ability to change global emissions through the export of LNG, although new applications have been frozen by the Biden administration.

Global Oil Demand to Grow by 1.9 MMbbl/d in 2024, Says Wood Mac

2024-02-29 - Oil prices have found support this year from rising geopolitical tensions including attacks by the Iran-aligned Houthi group on Red Sea shipping.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

Gunvor Group Inks Purchase Agreement with Texas LNG Brownsville

2024-03-19 - The agreement with Texas LNG Brownsville calls for a 20-year free on-board sale and purchase agreement of 0.5 million tonnes per annum of LNG for a Gunvor Group subsidiary.

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”