The U.S. Permian Basin as well as the other U.S. shale basins are key to anchoring U.S. LNG exports and projected rises in the future. Rystad Energy’s Rob Cordray discussed the global gas market outlook and more at Hart Energy’s Executive Oil Conference in Midland, Texas, on Nov. 16. (Source: Arnaldo Larios / Hart Energy)

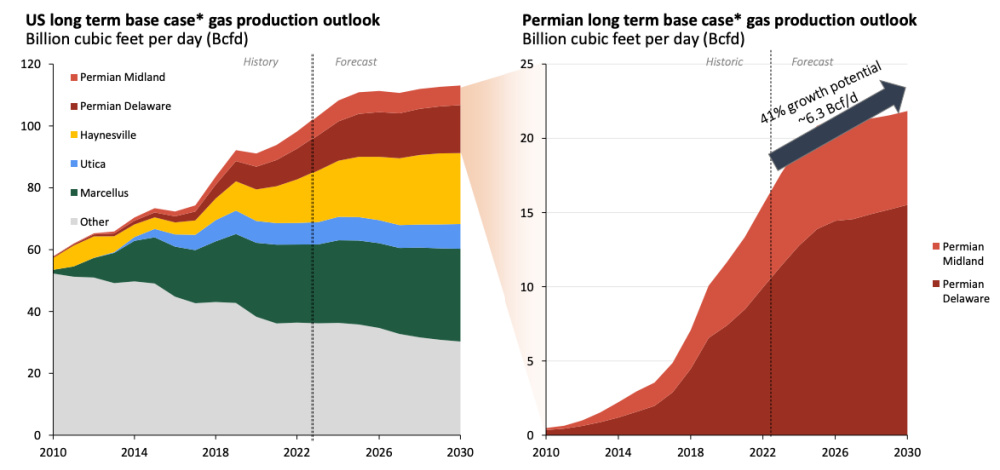

MIDLAND, Texas—Gas production from the Permian Basin is expected to grow approximately 6.3 Bcf/d by 2030, up around 41% compared to current levels.

The bulk of the Permian’s gas production will come from the Delaware sub-basin followed by the Midland sub-basin by the end of the decade, Rob Cordray, senior vice president of consulting at Rystad Energy, told attendees to the Hart Energy Executive Oil Conference.

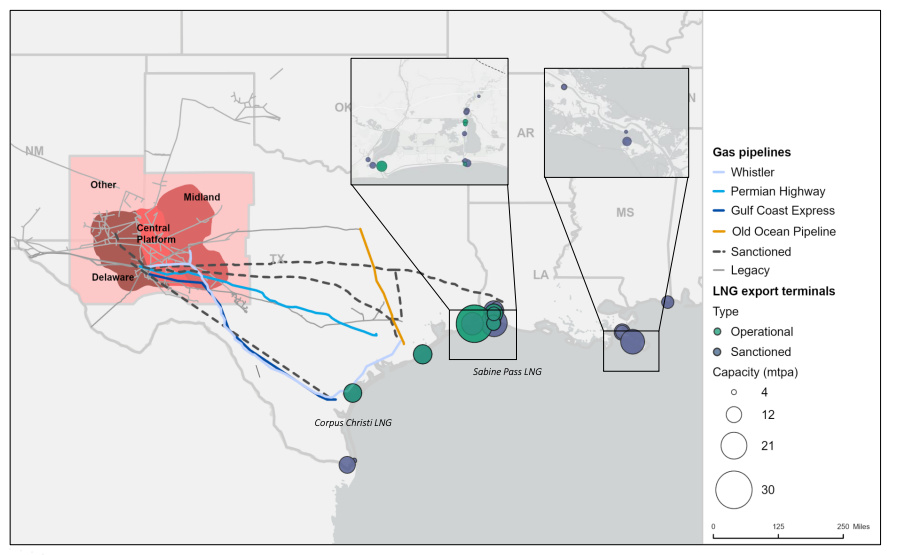

The U.S. Permian Basin as well as the other U.S. shale basins are key to anchoring U.S. LNG exports and projected rises in the future. Permian production of both oil and gas has already surpassed pre-pandemic highs, Cordray said.

“Permian production grew at a rate of 15.3% per annum from January 2018 to June 2022, rich gas production led growth, while light oil volumes have maintained a greater share of production owing to higher baseline volumes,” he said, adding that “rich gas volumes have broken out above the share range bound 30%-35% share of production, reaching nearly 40% in the second quarter of 2022.”

Volume growth in the Permian Basin has been led by gas production in both the Delaware and Midland basins with volumes doubling between first-half 2018 and first-half 2022 to 11.7 Bcf/d and 6.8 Bcf/d, respectively. However, the production mix in the Central Basin Platform and elsewhere in the Permian has seen little or no change, according to Rystad data.

Despite the rising production profile in the Permian Basin, flaring intensity has declined by 70%, led by substantial improvements in key sub-basins. Expanded pipeline capacity has coincided with immediate flaring reductions, according to Cordray.

It should also be noted that flared volumes in the Permian Basin rose between 2018-2019 owing to a lack of infrastructure as well as outages of gas processing facilities and pipelines, he added.

RELATED:

Permian Basin, Haynesville Shale Key to Rising US Production

Cordray said the top five U.S. shale plays—Permian Midland, Permian Delaware, Haynesville, Utica and Marcellus—are slated for continued growth and expected to assist gas production rise to around 110 Bcf/d in 2030. The five plays are set to account for 73% of all U.S. gas output by 2040.

U.S. LNG piped-gas exports to Mexico are also set to rise anchored by much of the same gas production growth trends.

Anchor Rising U.S. LNG Exports

Growth in U.S. LNG exports is expected to accelerate through the end of the decade and surpass 25 Bcf/d by 2030 amid strong demand for the low-carbon energy source and as Europe scrambles to buy up LNG to replace lost Russian piped gas-imports.

Through the end of the decade, U.S. gross LNG exports for producing and sanctioned projects could reach around 25% of total U.S. LNG production by 2030 and around 31%-32% by 2040.

Global LNG capacity additions from Australia, Canada, Indonesia, Mexico, Mozambique, the U.S. and Russia are slated to reach 133 million tonnes per annum (mtpa) between now and 2024, according to Rystad estimates, with U.S. LNG projects on the Gulf Coast representing 88 mtpa or around 66%.

Putin’s military invasion in Ukraine is driving demand for U.S. LNG exports as the LNG markets have been thrown out of balance due to Russian sanctions and the removal of Russian gas export volumes from the market, which has left a large hole to fill.

The global sanctions have resulted in a significant decline in both piped-gas and LNG exports from Russia and many European nations have turned to rising LNG imports to ensure domestic energy security.

While Asia has reduced its LNG imports to around 75% compared to 80% in 2021, Asian demand has limited alternatives to LNG imports. Piped-gas imports are currently around 25% compared to 20%, respectively as LNG continues to be the predominant method for gas imports among Asian nations. Cordray said.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.