PDC Energy Inc. recently announced the completion of its $1.3 billion cash-and-stock acquisition of privately held Great Western Petroleum LLC in the Denver-Julesburg (D-J) Basin.

“We are excited to close the Great Western acquisition, which is accretive to our operating, ESG and financial metrics. We look forward to providing the market with updated guidance by early next month as we work to integrate Great Western’s operations,” Bart Brookman, president and CEO of PDC, commented in a May 6 company release.

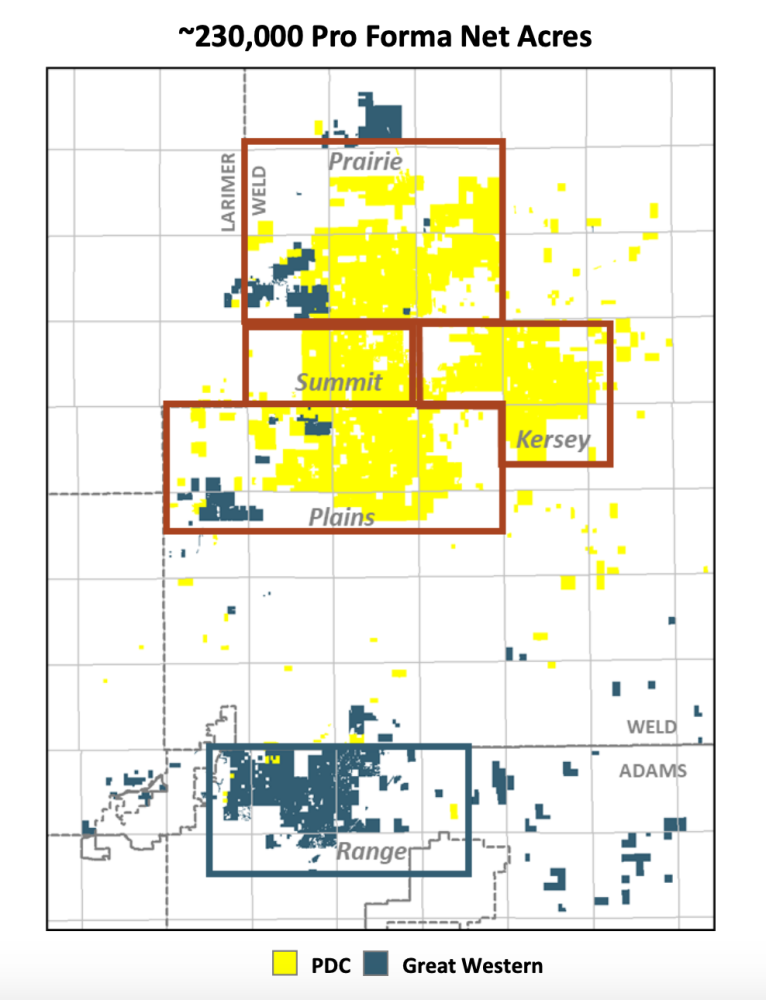

The acquisition of Great Western boosts PDC Energy’s D-J Basin position to roughly 230,000 net acres. PDC also holds some 25,000 net acres in the Delaware Basin in the Permian. Great Western’s D-J Basin acreage stretches across Adams, Larimer and Weld counties in Colorado.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said the Great Western acquisition adds much-needed inventory in the Wattenberg Field to PDC Energy’s D-J Basin portfolio, according to a note by the firm when the deal was first announced in February.

“On the equity, a deal was not all that surprising to us given concerns on the inventory side (and good to see the company not transact in expensive M&A) and will help remove some of the M&A overhang on the stock, but basin and county exposure (outside of Weld) is a bit surprising,” the TPH analysts wrote in a research note on Feb. 28.

Consideration paid for the Great Western acquisition, valued at roughly $1.3 billion when it was announced, comprised of $543 million (less $50 million previously placed into escrow) and approximately 4 million shares of PDC common stock. PDC Energy planned to finance the acquisition with cash on hand and borrowings under the company’s credit facility.

In addition, PDC said May 6 it paid off the Great Western secured credit facility totaling $235 million and $312 million in principal amount of Great Western’s 12% senior secured notes due 2025.

“I want to thank the Great Western team for their strong focus and commitment to responsible Colorado development,” Brookman added in the May 6 release. “PDC shares this commitment, and we will continue to lead the way in community-focused, environmentally-sound, and efficient operations as we move forward.”

Previously, PDC Energy said it planned to run three rigs and 1.5 crews in the second half of 2022 on the combined D-J asset with pro-forma capex of about $900 million and $1 billion. Pro-forma production for the second half of the year is expected to be roughly 250,000 to 260,000 boe/d and 82,000 to 87,000 bbl/d of oil.

PJT Partners is exclusive financial adviser to PDC, and Davis, Graham and Stubbs LLP is PDC’s legal counsel. Citi is exclusive financial adviser to Great Western, and Latham & Watkins LLP is Great Western’s legal counsel.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Stockholder Groups to Sell 48.5MM of Permian Resources’ Stock

2024-03-06 - A number of private equity firms will sell about 48.5 million shares of Permian Resources Corp.’s Class A common stock valued at about $764 million.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.