(Source: HartEnergy/Shutterstock.com)

Hart Energy Special Report

Energy ESG: Investing in Our Future

An in-depth report on the state of ESG initiatives in oil and gas. This Energy ESG special report produces a clear picture of ESG today. Learn more

Brought to you by

Oil and gas companies have faced pressure from investors for several years to reduce their greenhouse carbon emissions and adopt ESG measures while balancing financial goals with returning money to shareholders and generating sustainable value.

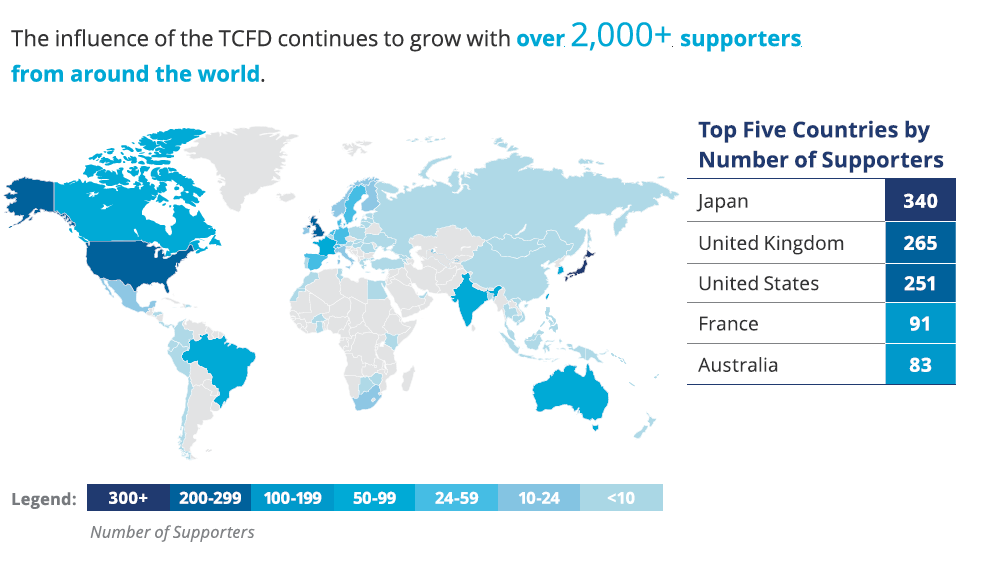

Quantifying ESG has become easier as more data are being captured and frameworks have been set by the Task Force for Climate-related Disclosures (TCFD) to help businesses, especially energy companies, disclose their climate related risks and their goals to reach lower emission output. The Sustainability Accounting Standard Board also developed standards and a subset of ESG issues that are relevant to financial performance.

Companies must conduct in-depth reporting to demonstrate they are being transparent about their goals and performance. Sustainability issues are becoming part of the norm, and companies that disclose their metrics and performance are able to attract more capital and satisfy shareholder concerns.

ESG investments are drawing more and more attention from institutional investors. U.S. sustainability-focused funds received almost $21.5 billion in net inflows during the first quarter in 2021, which is a new record, according to a Morningstar report. Global assets under management in ESG funds rose to almost $2 trillion during the first quarter.

Major public energy companies have faced this pressure for several years. More recently, private equity via their limited partner investors have upped the ante. Now family offices and other private investors are also seeking assurances that the implementation of ESG and performance standards are in place before they will agree to a deal, said Christina Kitchens, managing partner with 3P Energy Capital, a Dallas-based alternative capital and advisory firm.

“Many family offices, especially new entrants, are very attuned to ESG,” she said. “Some of them will only allocate capital to energy acquisitions if there are ESG standards already implemented and progressive.”

Capital providers are seeking greater transparency and ESG assessments from companies and their intended goals.

Valero, the refiner, disclosed its first climate risk report in 2018 after continued pressure from its investors to conduct an assessment, but the report did not meet best practices on climate disclosures. By June 2020, Valero published a report, referencing the TCFD.

The Climate 100+, which consists of 545 investors representing more than $52 trillion in assets and coordinates efforts across 167 companies with the highest greenhouse-gas (GHG) emissions, continued its discussion with Valero in August 2020 on emission disclosure and reduction.

By October, Valero disclosed its longterm goals to reduce Scope 1 and 2 of greenhouse emissions by 20% and reduce and offset global refining emissions by 63% by 2025. The company’s report commitment does not meet TCFD standards.

The right strategy

Exploration and oil producers need to have a strategic plan with measurable goals that show they have adopted

these measures and what process will be used to implement them since investment banks will make more critical choices, according to Dennis Petito, CEO of Montrose Capital Advisors, a Houston-based company that assists clients on the energy transition and ESG strategies.

Petito said the old private equity model of backing a management team at an oil and gas company, getting

some production and flipping the company in two to three years no longer works in this market. Private equity firms do not have the “free reign that they used to have,” he added. They are ensuring that their portfolio companies are compliant with ESG standards that their limited partners demand.

“No one is willing to buy that strategy anymore,” Petito said. “People want to invest in sustainable business models.

They want to see exploration and production companies that are going to be able to demonstrate their

ability to survive under the scenarios that were developed under their business plan and TCFD.”

Banks will be more selective and conservative in their lending process, Petito said. Some banks have already included a scenario where the implications of a carbon tax is included on a borrowing base.

“Equity investors of banks are clamoring for them to change,” he said. “More sophisticated banks and investors are adopting these measures and following standards adopted by government entities.

Major banks will underwrite deals for syndication only if the client has developed a meaningful ESG culture and a measurable greenhouse-gas emissions reductions strategy.”

While some regional banks are more relaxed in their ESG requirements, others are requiring that energy producers demonstrate and document how they are working to reduce greenhouse emissions.

“Some of them are gaining familiarity and have begun to adopt ESG into their credit process, yet they lag behind banks that have been practicing these standards for several years,” Petito said. “The pace is going to accelerate very rapidly because the market cannot function smoothly with disparate standards.

The Federal Reserve will make sure this happens because it joined the Network for Greening the Financial System, an organization of about 100 central banks focused on risk of climate change in the financial system.”

Small to mid-cap energy companies will have a harder time obtaining capital if they are not ESG compliant,

Petito added.

“Investors are more selective, and ESG compliance is a non-negotiable component of their target market

selection criteria,” he said.

Environmental aspect is a priority

Greenhouse emissions are the biggest focal point for capital providers and investors in regard to ESG strategy, said Michael Underhill, chief investment officer with Capital Innovations in Milwaukee.

The Capital Innovations Sustainable Infrastructure Fund will invest in traditional and newer infrastructure such as energy transportation and storage in 2021.

“This is the first order of business when capital providers start their screening process for companies with

the concern around climate change and with the U.S. rejoining the Paris Agreement,” he said.

Underhill said oil and gas companies must demonstrate that they are efficient in managing their use

of energy. “The ability to use less energy and deploy it in a more efficient manner and reduce their carbon footprint is important,” he said. “There are 50 billion tons of greenhouse emissions contributing annually to climate change right now.”

Energy producers and providers must also demonstrate that they are addressing social issues, including cybersecurity concerns such as the hack and ransomware of the Colonial Pipeline and the product quality and

safety of wells and their employees, Underhill said.

Capital providers are looking for a very specific plan of how an energy company will report and measure

its progress, Kitchens added. While some lenders and equity providers are not seeking companies to achieve net-zero emissions in a short timeframe, they are looking for what steps companies are making toward

reducing emissions. They are also examining investments made to reach that goal and how implementing ESG into operations can impact the economics of a company. For instance, providers are looking at factors such as carbon capture or not being able to flare.

“They all have a cost component and that is understandable,” she said.

Stepping up to the challenge

Midstream companies, those operating pipelines and storage terminals, have opportunities to improve carbon capture and some stranded assets as well as gas processing facilities and retrofitting storage.

The challenge falls mostly on the upstream firms as producers of fossil fuels to demonstrate significant

progress in field operations and a receptiveness to an energy transition to cleaner production and products, Kitchens said. Midstream companies will have an “easier course with a more affordable way to transparently repurpose or retrofit infrastructure to demonstrate methane and carbon sequestering improvements,” she added.

E&P companies need to address methane emissions because it is the second largest contributor to climate change after CO2 and traps heat in the atmosphere. Since it only lasts in the atmosphere for about 12 years, lowering emissions can quickly have a larger impact on global warming.

The catch is that methane is more harmful than CO2—it is more than 80 times as potent.

The Permian Basin of West Texas and southeastern New Mexico, the nation’s largest and most prolific oil field, faces some challenges. There needs to be improvement on how to deploy technology and midstream assets to lower the amount of venting and flaring and not put methane directly into the atmosphere, Kitchens said.

While upstream companies will have more options in technology and services that can put ESG into play sooner and also scale ESG strategies, the companies that are proactive will be able to obtain more and cheaper capital, Kitchens continued. Investors and lenders are seeking “disciplined dollars,” and the ESG efforts will have to be legitimate concerns, she said.

“Even fossil fuel companies will have to face a certain ESG standard, and the cost of capital for oil and gas companies that can’t perform better on ESG principles will see their cost of capital go up significantly, making it more difficult for them to prosper,” Kitchens said.

Smaller asset-based producers could be at a disadvantage in the future if they are not able to meet progressive ESG standards. They will likely wind up as targets for larger companies if they have assets that

are desirable and be part of a “drive for consolidation for larger firms that have the footprint to scale ESG initiatives or they risk failure,” she added.

“Many of the smaller private equitybacked firms in desirable regions will be attractive to buyers and as a part

of a larger operation footprint, while some who do not or cannot prioritize ESG will not be attractive and will

be capital starved,” Kitchens said.

“That is a substantial trend investors should be looking for. Some companies will have to merge or they may

not survive.”

Why social impact and governance are critical

Capital providers are examining whether companies are truly following governance issues compared to what

they promise.

Investment banks will scrutinize if a public energy company is following bona fide governance procedures,

Petito said.

“The banks will look at the board and will determine if there is proper governance, such as whether the board is asking the right questions about sustainability and security,” he said. “The company has to satisfy those

creditors, and those answers have to be acceptable from an underwriting perspective.”

Investors will examine governance and leadership issues, including business ethics such as how they approach

regulatory and legal issues, Underhill added. Other factors such as how a CEO is compensated compared to

the company’s track record and stock prices as well as whether capital or dividend distributions are allocated

responsibly all factor into the decision of a capital provider, he said.

“ESG is in the second inning of an 11-inning baseball game,” Underhill said. “Sustainable investing has

become the new normal.” Oil and gas companies must adopt these standards sooner rather than

later, Petito said. “There will be enough good actors responsibly navigating the energy transition, and the industry will be able to survive and thrive,” he said.

powered by large solar panels and wind turbines, which reduce the company’s GHG footprint. (Source: Photographic Services, Shell International Ltd.)

While the energy industry is making inroads on improving ESG, it has been “slow to catch up,” Kitchens added. “There is still a miss on demonstrating inclusion prioritization across key roles.”

Recommended Reading

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.