An oil production platform is shown at sunset in the Gulf of Mexico. (Source: revy252/Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

No one knows for sure what will happen to the U.S. offshore oil and gas sector under the Biden administration, but any deviation from today’s baseline is likely to impact potential revenue.

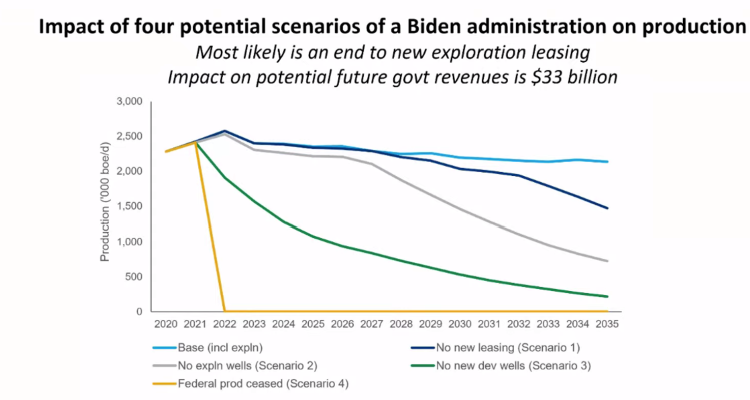

That is according to analysis from the global research firm Wood Mackenzie. The firm looked at how four scenarios could impact production for the Gulf of Mexico (GoM) and Alaska based on statements that the Biden administration would not issue new permits on federal lands and waters: no new leasing, no exploration wells, no new development wells and the worst-case—highly unlikely—scenario, a federal production shutdown.

Talk briefly turned to challenges facing the offshore sector with a change of administration during the Nov. 11 OTC Live virtual event, which focused on frontier basins and emerging offshore areas.

RELATED

· How Likely is Joe Biden to Enact Green, Real Change?

· What Joe Biden’s Win Means for Oil and Gas

While production from federal Gulf of Mexico waters accounts for 17% of total U.S. crude production and 5% of dry gas production, according to the U.S. Energy Information Administration, the mature basin that is also home to frontier and emerging deepwater plays has more to give. By Wood Mackenzie’s estimates the U.S. GoM holds an about 9 billion barrels of oil equivalent (Bboe) of prospective resources. Add to this about 2 Bboe of prospective resources in Alaska’s Natural Petroleum Reserve.

No new leasing would hit the government’s financial coffers hard and as Wood Mackenzie put it: “squeeze the life out of the U.S. GoM and Alaska.”

It would also impact GoM-focused companies, particularly those with infrastructure-led exploration programs looking to quickly develop smaller discoveries near existing infrastructure, Julie Wilson, director of the firm’s global exploration research team, said during OTC Live.

“That’s $33 billion kind of lost opportunity just from that scenario,” Wilson said.

Under this scenario, the firm projects capex would fall by $67 billion, she said. She also acknowledged that candidates can say one thing while campaigning and do something different later after looking at the big picture.

“No new exploration wells have a more immediate impact,” she said, resulting in more than $100 billion in lost government revenue from royalties, corporate taxes and lease sales. “You lose a lot of economic activity.”

The Biden administration could instead increase royalties, making the region less attractive to investors, she added.

Not Unchartered Territory

However, adjusting to changing administrations is nothing new for offshore players, especially given the typically longer development timelines compared to their onshore developments.

“Shell has a history of successfully working across the globe with all manner of governments of all political persuasions and regardless of election outcomes. We expect any administration to honor the contractual lease terms and follow the laws that govern the existing leasehold,” said Bill Langin, vice president of exploration for North America and Brazil at Shell.

He added that hopes are for decisionmakers to consider the potential impact of lost revenue, including for local and state governments, along with the impact on jobs during these tough macroeconomic times.

“We would sincerely hope that the administration would have a sympathetic ear to the folks that are going to be at risk from any of these policies,” Langin said.

The situation is not as dire as the scenarios presented if engagement and a balanced view are pursued, according to Tim Chisholm, vice president of exploration for Hess Corp.’s Guyana and Suriname operation.

“At Hess, we think VP Biden, the president-elect, has outlined some high-level energy policy, but it’s not clear what new policies will be prioritized and implemented in relation to oil and gas and in particular the offshore in deep water,” Chisholm said. “We are confident that the Biden administration will balance its environmental goals with the affordable energy, job creation and energy security. So, from a Hess perspective, we in the industry stand ready to work with policymakers across government on energy policy, and changes in administration is something we’re used to working with globally.”

This is not uncharted territory, he added.

Shrinking Carbon Footprint

Based on the Biden-Harris Transition website, the new administration aims to recommit the U.S. to the Paris Agreement on climate change and increase domestic climate targets, drive down costs in critical clean energy technologies and “move ambitiously to generate clean, American-made electricity to achieve a carbon pollution-free power sector by 2035.”

This comes amid increased focus in the industry on ESG as parts of the world turn toward cleaner energy sources.

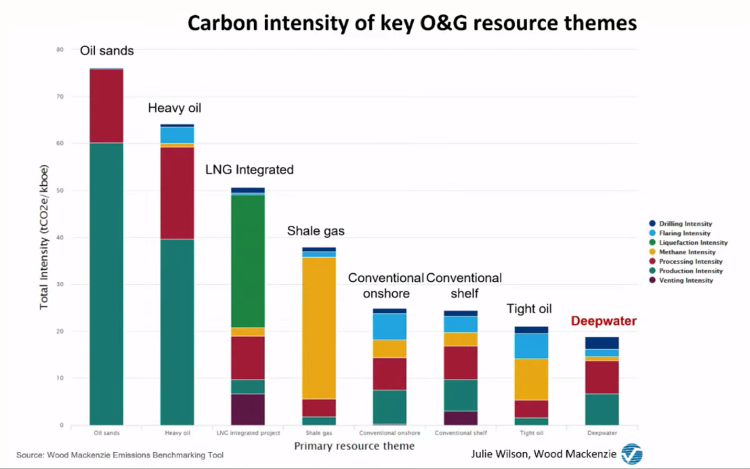

Of the traditional oil and gas production methods, deepwater has the lowest carbon intensity, according to Wood Mackenzie’s Emissions Benchmarking Tool. Though companies are pursuing renewables and other technologies, the increasing need for energy globally means “oil and gas will still play a role as we move into the future,” Wilson said, adding companies can focus on carbon mitigation for new deepwater developments.

Some companies are doing just that.

“We have our own lifecycle net carbon footprint performance standard that we apply to any opportunity we look at from the time we might enter a basin through an exploration well and then through development,” Langin said. “We actually look at the net carbon footprint of that project and decide whether it’s in our future as part of our portfolio or not. That is a criteria that we will use on making decisions going forward. It’s something we’ve already built into our thinking.”

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.