Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Pan Capital Management LP, a Houston-based trader of natural gas futures and options, said it is expanding its portfolio to include infrastructure investments.

Pan said in a press statement that it had launched a platform—Pan Midstream—to pursue investments in the natural gas storage, transportation and infrastructure sectors. The company will focus on middle-market transactions involving $50-150 million of invested capital.

Pan, founded in 2013, manages a portfolio of over $1 billion in cumulative assets. The midstream team includes Kevin Chen, partner; Sean Pan, the company’s co-founder and chief investment officer; and Ken Fu, Pan’s COO and chief risk officer.

Recommended Reading

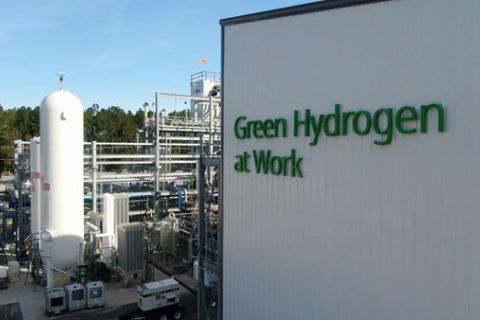

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.

Dysfunction With a Capitol D.C.

2024-01-23 - Growing party infighting makes Washington, D.C., a difficult place for the energy industry to get things done.

South Africa’s Economic Transformation is of US Strategic Importance

2024-01-23 - South Africa’s Cape Town is at the forefront of other major cities in Africa’s southernmost country in its approach to deal with rolling blackouts and boost its own energy security while reducing its coal usage in favor of renewables.

Plug Power Jumps on Govt Loan, Liquid Green Hydrogen Production Start

2024-01-23 - Plug Power has secured over $1 billion in government funding following liquidity issues amid supply challenges in the liquid hydrogen market in North America.