(Source: Ovintiv Inc.)

While some players in the Anadarko Basin’s Scoop/Stack play have seen better days, the company formerly known as Encana Corp. said one-fourth of its 2019 free cash flow was delivered by assets in the basin.

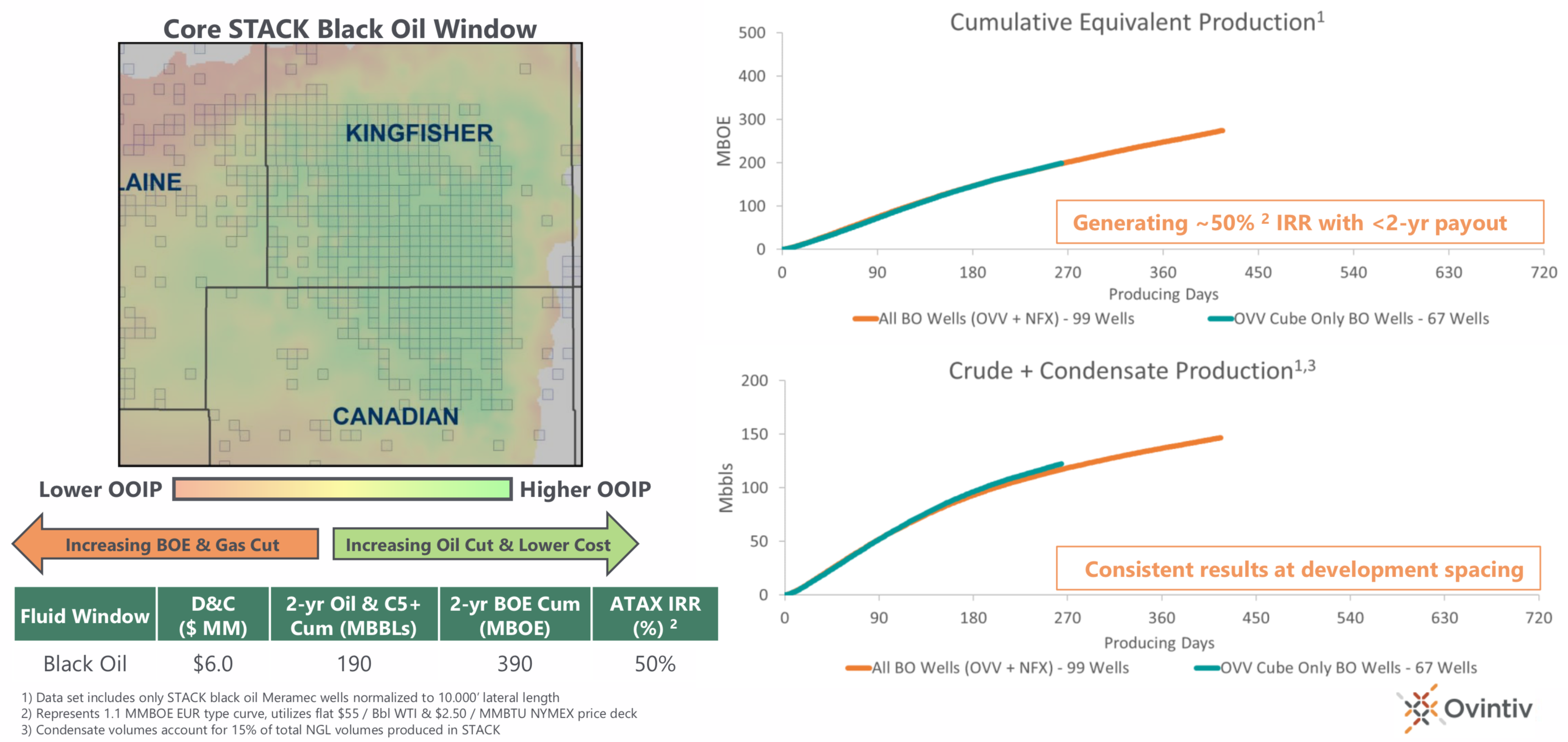

“With a rate of return of about 50%, this play not only competes within our portfolio, but … it is competitive with the very best shale plays across North America,” Ovintiv CEO Doug Suttles said on a recent call with analysts. “We’ve outperformed initial expectations through rapid cost reductions and consistent well performance. We expect these trends to continue just like we’ve demonstrated everywhere else we operate.”

The results come nearly a year after the newly renamed and relocated Denver-based Ovintiv acquired Newfield Exploration Co. along with its oil-weighted stacked-pay asset with multiple zones—which proved to be ideal for Ovintiv’s cube development model.

By developing all prospective benches at once, instead of the most certain benches first, the company said it is focusing on value and returns.

Lower well costs play a big role in higher returns, particularly in the Stack.

Ovintiv said its drilling and completion (D&C) costs in the Stack play dropped to $6 million per well, about double the original $1 million reduction target. D&C costs for recent pacesetter wells in the play fell further—down to $5.2 million.

Legacy Newfield D&C costs were $7.9 million per well.

Analysts with Tudor, Pickering, Holt & Co, however, pointed in a note to Ovintiv’s “downward revision to headline Stack EURs (-19% total / -26% oil from previous 1.3 million boe total / 455,000 barrels of oil to midpoint of new 900,000-1.2 million boe total / implied 288,000-384,000 barrels of oil, for a 10,000-ft lateral),” as influencing trading momentum the most. Analysts saw this as “more than offsetting progress made on well costs thus far.”

TPH said modeling current well costs plus facilities and the new EUR range results in a 30% after-tax rate of return breakeven of about $45-$50/bbl, which exceeds the TPH estimate of about $40-$45/bbl using legacy EURs and well costs.

Ovintiv also highlighted improved capital efficiencies, having brought down its spud to first production cycle times in the basin by 35% in 2019.

Mike McAllister, president of Ovintiv, said the company’s supply management team delivered nearly $100 million of savings during the first year of operations in the Anadarko. “Our frac sand costs have been cut in half from 7 cents to 3½ cents per pound,” shaving about $700,000 off costs per well.

Plus, fewer rigs are producing more hydrocarbons.

Despite dropping the rig count from 11 to five, Ovintiv said fourth-quarter production averaged 164,000 barrels of oil equivalent per day (boe/d), above third-quarter volumes.

Brendan McCraken, the company’s executive vice president of corporate development and external relations, pointed to a set of Stack black oil Meramec wells normalized to 10,000-ft lateral length, to illustrate how crude and condensate performance improved with its cube development wells and lowered costs.

“The orange curve represents 99 wells that were a combination of Newfield drill and Ovintiv completion,” McCracken said. “The blue curve represents 67 wells that are open to only cube development.”

McCracken noted the company’s crude and condensate performance were slightly improved for its cube wells.

“This is exactly what we expected,” he said. “And the key is the costs are dramatically lower. In fact, when we combine these well results with our $6 million well cost, 19% royalty rate, $2.50 per boe LOE and realized price at WTI, this is what delivers the 50% rate of return.”

Ovintiv said it also continues reducing drilling time in the play.

In less than a year, “We achieved an average drilling rate of more than 2,200 feet per day in our latest cube,” said Greg Givens, the company’s executive vice president and COO. “We recently drilled a pacesetter well in nine days from spud to rig release. This was achieved by drilling the lateral more than 60% faster than the previous best in class well.”

Learnings in the Stack, which dominates Ovintiv’s activity in the basin today, are now being applied to the Scoop.

“In a recent cube, we reduced our drilling days by 20%,” Givens added. “We have an active 2020 plan in the Scoop and expect to see additional cost improvements as our teams continue to innovate and apply our learnings across the organization.”

Ovintiv said it has about 70 undeveloped operated drilling spacing units (DSUs) in the Scoop and about 200 undeveloped operated DSUs in the Stack across its more than 365,000 net acre position in the Anadarko Basin.

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.