Ovintiv announced more than $5 billion in deals on April 3. (Source: Shutterstock)

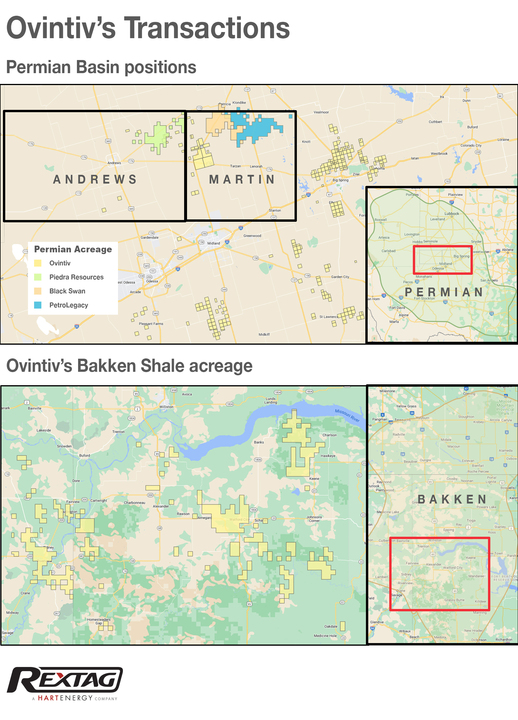

Ovintiv Inc. said on April 3 that it has agreed to buy 65,000 net acres in the core of the Midland Basin from EnCap Investments LP’s Permian Basin portfolio companies — Black Swan Oil & Gas, PetroLegacy Energy and Piedra Resources — in a cash-and-stock transaction valued at approximately $4.275 billion.

The deal will nearly double Ovintiv’s oil production in the Permian. Separately, Ovintiv agreed to exit the Williston Basin’s Bakken play in another deal in which EnCap is the buyer. In all, Ovintiv announced more than $5 billion in deals on April 3.

The Midland deal will add approximately 1,050 net, 10,000-ft well locations to Ovintiv's Permian Basin inventory. Ovintiv said the assets, in Martin and Andrews counties, Texas, are strategically located near the company’s current operations in Midland.

Under the terms of the agreement, the Midland portfolio companies will receive approximately 32.6 million shares of Ovintiv common stock and $3.125 billion of cash.

Part of the cash portion will also come from Ovintiv’s exit from the Williston Basin, also announced on April 3. Ovintiv said it entered into a definitive agreement to sell all of its Bakken assets in North Dakota to Grayson Mill Bakken LLC, an EnCap portfolio company, for total cash proceeds of approximately $825 million.

Ovintiv's Bakken leasehold totaled 46,000 net acres as of Dec. 31, 2022, with estimated first-quarter 2023 production expected to average approximately 37,000 barrels of oil equivalent per day (boe/d), consisting of 60% oil and condensates.

Along with the Bakken sale, Ovintiv will finance its Midland purchase through a combination of cash on hand and the use of its credit facility, and/or proceeds from new debt financing for the cash portion of the acquisition. Ovintiv has received fully-committed bridge financing from Goldman Sachs Bank USA and Morgan Stanley.

The Midland deal extends Ovintiv’s scale and inventory life in the Permian, the company said. The Midland transaction’s 1,050 locations include what Ovintiv described as 800 “premium-return well locations and approximately 250 high potential upside locations,” Ovintiv said. Ovintiv defines premium locations as those generating a greater than 35% internal rate of return at $55/bbl WTI oil and $2.75 per million Btu NYMEX natural gas prices.

Ovintiv valued the Midland assets its acquiring at 2.8x next 12 months (NTM) adjusted EBITDA with an estimated 19% free cash flow at current commodity strip pricing. At close, Ovintiv said its leverage ratio is expected to be 1.4x debt to adjusted EBITDA, based on March 30 strip prices. The company’s target is to reduce leverage to 1x leverage and $4 billion of total debt.

“Ovintiv remains committed to an investment-grade balance sheet and expects the rating agencies to affirm its investment-grade rating,” the company said.

Ovintiv President and CEO Brendan McCracken said the company is acquiring a “unique undeveloped asset” in the Northern Midland Basin.

“Located in some of the best rock in the Permian, these assets have demonstrated leading well performance and are a natural fit with our existing Martin County acreage,” he said. “The acquisition checks all the boxes on our disciplined durable returns strategy – it will be immediately and long-term accretive across all key financial metrics, the acreage is in an area where we have a competitive operating advantage, and it significantly increases our premium Permian well inventory.”

McCracken said the deal expands free cash flow per share and enhances the company’s ability to deliver durable returns to our shareholders. Ovintiv announced on April 3 that its base dividend would increase 20% per share, effective for the June 2023 record date.

Ovintiv's Permian land position is expected to increase to approximately 179,000 net acres, the company said. The acquired Midland acreage is 97% HBP with an average operated working interest of 82%.

Pro forma position and guidance

At closing, pro forma Permian oil and condensate production is expected to nearly double to approximately 125,000 bbl/d. The company expects to realize significant well cost savings across its combined Permian assets resulting from optimized operations and economies of scale, the company said in a press release.

Ovintiv expects its first-quarter 2023 capital to total approximately $610 million to $620 million, toward the low end of guidance. In the first quarter, Ovintiv also made additional bolt-on acquisitions valued at approximately $200 million of premium oil inventory additions.

“We are confident that – given our operational efficiency, culture of innovation and expertise and scale in the Permian Basin – Ovintiv is best positioned to convert this high-quality resource into tremendous value for our shareholders,” McCracken said.

The transaction was unanimously approved by Ovintiv's board, the company said. The deal is expected to close on June 30.

Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC, and TPH&Co., the energy business of Perella Weinberg Partners, are serving as financial advisers to Ovintiv. Gibson, Dunn & Crutcher LLP, Kirkland & Ellis LLP and Blake, Cassels & Graydon LLP are serving as Ovintiv's legal counsel.

Jefferies LLC is serving as financial advisor to EnCap in connection with the Northern Midland Basin transaction. Vinson & Elkins LLP is serving as EnCap's legal counsel.

Recommended Reading

Par Pacific Asset-based Revolving Credit Bumped Up by 55%

2024-03-25 - The amendment increases Par Pacific Holdings’ existing asset-based revolving credit facility to $1.4 billion from $900 million.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Baytex Prices Upsized Private Placement of Senior Notes

2024-03-15 - Baytex intends to use the proceeds to pay a portion of outstanding debt on its credit facilities and general corporate purposes.