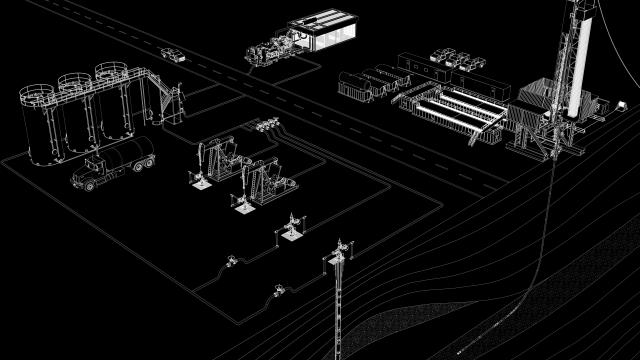

The use of digital modeling systems has led to improved designs in field infrastructure. (Source: Halliburton)

The oil and gas industry is not a technology-adverse industry, even though it may be late in fully embracing an enterprisewide digital transformation. However, unleashing the full economic power of a digital transformation across the E&P phase of the value chain will deliver a dramatic, sustained bottom line and top line value. Digital transformation will enable better exploration outcomes, safer operations and a better-utilized and engaged workforce.

The E&P industry needs a paradigm shift in how it adopts and deploys emerging technologies. An engagement model that adapts to the rapidly evolving and emerging technologies will be required. With that focus, the following are some of the critical steps the E&P industry needs to take first.

Digital journey

An oil and gas industry road map that is at par with the Industry 4.0 revolution is needed. The main thrust of Industry 4.0 is having smart factories, products and services for a continuous transformation of the business, thereby generating great economic value. Constant transformation is possible as the digital maturity of the organization and the industry increases and adopts the fundamentals of Business 4.0 to build the road map for Oil and Gas 4.0.

The oil and gas industry has the benefit of learning from the digital transformation journeys of other sectors, like the music industry with less complexity and the health care industry, which has a similar or higher risk profile as the oil and gas industry. The digitally mature industries understand that data provide a strong foundation to begin their digital journey. They democratize their data, embrace emerging digital technologies at an accelerated pace and enhance their digital maturity score continually. The digital maturity continues to grow due to “data-to-value” automation in near-real or real-time environments.

The upstream oil and gas industry started the digital journey almost 20 years ago, with the concept of digital oil fields, “IFields” or “SmartFields.” However, it is well known that significant progress has been limited because of many factors. The top four challenges, known as “FEAR,” have prevented or slowed the adoption of real digital transformation in the industry.

FEAR limiting transformation

F: First principles, science and an engineering-driven solution provide a strong starting point for the oil and gas industry. However, there are limitations in describing the observables of the industry that require actions. For example, after 80 years of drilling, the root cause and predictability of stuck pipe remain as elusive as when drilling started. While there are more than 700 research papers on this topic, the industry has failed to build a meaningful solution to address the challenge. A careful study of these papers will show that data were not fully exploited as they were stored in multiple silos.

Efficiently sharing cross-discipline data also is a challenge even today. There are other examples that have had similar fates, such as drilling performance or ROP. Data-driven innovation is to advance the oil and gas industry by leveraging sensors and smart data and augmenting the first principle-based foundation to enable future growth in the industry.

E: Emerging technology evolution is at a much faster pace than the speed of technology adoption of the oil and gas industry. The oil and gas industry giants are building Hadoop-based systems (a Big Data storage platform). However, most data-driven companies, outside of oil and gas, have already moved away from Hadoop in favor of Spark and other modern systems. While cloud computing has been adopted and deployed by many industries and there are some early adopters in oil and gas, there is still much dialogue in the oil and gas industry around the ownership of the data on the cloud. The overreliance of vendors lacking in-depth industry knowledge across domains and instead offering to solve problems with generic solutions is a significant problem. This creates confusion in the marketplace and a multifold of technical challenges as the vendor technology rarely encompasses the specific needs and domain expertise needed by the oil and gas industry. Generic industrial and Internet of Things software platforms will not perform or scale for the E&P industry’s advanced requirements. In the last few years, cognitive computing has been talked about aggressively. The industry lacks predictive and prescriptive computing for this to work in oil and gas. A cognitive system requires a recommendation from a prescriptive engine that in turn takes advantage of an ensemble of predictive scenarios. The first step is for the industry to mature in prescriptive and predictive computing.

A: An accomplishment of innovative culture in the past is no reason for the current era not to be even more creative. For example, artificial intelligence and machine learning have been used for many years now by the oil and gas industry. No one wants to challenge that every possible algorithm in the past was used. However, it is not the algorithm that provides answers; it is the integrated data that lead to insights. Innovative solutions also need new talent. The lack of using emerging technologies also will ultimately affect the rate and interest of young professionals considering oil and gas careers. If the industry fails to migrate to new technology, it will lose young professionals to those sectors embracing new technologies, furthering the loss of an agile and innovative culture.

R: Reactive addressing is more prevalent in the industry when it comes to increasing the efficiency and effectiveness across the life cycle. A classic example of this is in the area of artificial lift. Artificial lift experts are interested in the following question: “What is the mean time before failure of a given electric submersible pump (ESP)?” An operator may have thousands of ESPs in current or past use, yet it lacks the critical insights from the aggregate data. If the industry or operator had a predictive or prescriptive engine, such questions about mean time before failure should never arise. The reason the industry cannot answer these questions is there aren’t options to look at “data-at-scale” due to cultural and data silos that divided into an asset, or field, or well or department ownership function.

While it is good to acknowledge the rise of data-driven internet giants that create significant value for themselves by integrating data from diverse sources, perhaps it is time that the oil and gas industry starts to pipeline data at least within a company boundary, if not industry level. The oil and gas industry is a pipeline industry, but it has a fear of data pipelines. The industry needs to adopt, adapt and adhere to a smart vision for the continuous transformation to achieve real-time resource optimization in this digital era and overcome the FEAR aspects, as the energy landscape changes due to the mix of energy sources.

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.