Operating conditions are becoming increasingly difficult for shale drillers in the Permian Basin. At first glance, this may seem surprising, given that the region continues to break production records, and is forecast by the U.S. Energy Information Administration (EIA) to yield 4.21 million barrels per day (MMbbl/d) in August. At the same time, several factors are weighing on Permian drillers, and output growth is already thought to be slowing as a result.

Indeed, Permian production had previously been forecast by the EIA to hit 4.23 MMbbl/d in July, marking an increase of 55,000 bbl/d from June. However, the figure was revised downwards this month, with the agency now projecting that output will reach 4.17 MMbbl/d in July. Growth between July and August is predicted to slow to 34,000 bbl/d.

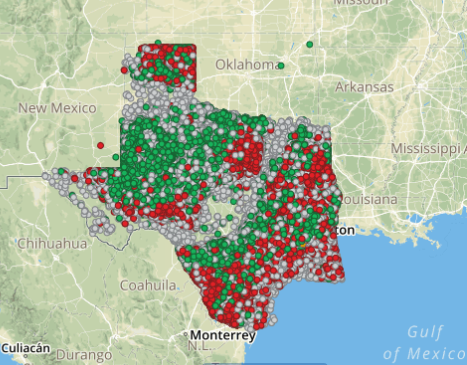

While the latest data from Baker Hughes, a GE company, LLC shows that active oil rig counts in the Permian Basin rose in the week up to July 19, they are still down to 440 from a recent high of 493, reached in November 2018.

Shale producers in recent years were frequently in the news as they snapped up more acreage and pushed the boundaries of what had previously been considered possible in oil and gas. Now, though, they have largely gone quiet, apart from a small number of major mergers and acquisitions (M&A). This comes as the combination of ongoing oil price volatility and shareholder pressure to generate returns starts to take its toll.

“The equity markets have become quite fickle,” IHS Markit’s director of research and analysis, Sven del Pozzo, told Hart Energy.

“They want growth, and they simultaneously want returns,” he added, noting that the two do not normally go hand-in-hand.

This is particularly challenging for smaller companies that have traditionally aimed to grow fast before being taken over by a bigger operator. And while supermajors have recently stepped up their unconventional activity, the U.S. shale industry still consists of a large number of smaller independents.

“Small and mid-size companies are faced with a terrible dilemma,” del Pozzo said. “Shareholders are clamoring for growth at a reasonable price, or some kind of a nice balance between returns and growth, but this is very difficult for them to realize because they aren’t set up to do that.”

Related Data:

This dynamic means the shale industry as a whole is suffering, because smaller players are traditionally the ones that have driven it forward, putting innovative ideas into practice and opening up new plays. Faced with shrinking access to capital markets, they have few options left open to them. While this could make small companies more keen to sell themselves to larger players, those have also become increasingly paralyzed by pressures from capital markets and shareholders.

“The small caps continue to be heavily discounted,” del Pozzo said. “If you’re looking for good assets and good people, you can get them now, but the large caps have not made a move, and neither have the majors. Now is the time to buy, but the capital markets are against it and they are beholden to the capital markets.”

There are some notable exceptions, such as Callon Petroleum’s move to buy Carrizo Oil & Gas Inc., announced on July 15. But a further wave of deals is unlikely to materialize in the shorter term, despite it being a good time to make acquisitions, and despite many larger companies in need of high-quality assets.

Transactions Database: Information of assets, buyers, sellers, deal values and more.

As the outlook turns increasingly negative for the Permian, second-quarter results are looming. Oilfield services provider Schlumberger Ltd. released its second-quarter results on July 19, and noted “weak hydraulic fracturing pricing and a general decrease in drilling activity” onshore North America. Exploration and production firms have yet to start releasing their results, but they are expected to reflect these trends.

However, a number of drillers had already committed to a certain amount of drilling in the first half of this year before crude prices fell abruptly at the end of 2018, having been steadily rising up to this point. This over-investment that had been based on a higher price environment—and involved rigs, services and completion crews being locked in—is in some cases only now being corrected.

“The investment community needs to recognize that you can’t suddenly change spending plans at the same time that the commodity price drops,” del Pozzo said. “There’s going to be a hangover from that drop in the commodity price, and I think it’s going to continue into the second quarter and I think that companies will be punished for it.”

Signs that companies are reining in spending are therefore more likely to come later in the year, as is a more apparent slowdown in production growth, though this is already starting to play out.

“The larger companies had made a commitment toward being more conservative with their capital before this price drop back in December,” del Pozzo said. “Smaller and mid-size companies, being more spot-market oriented and growth-oriented, they probably got surprised even more than the large companies by the drop in prices.”

One way shale drillers are responding to these operating conditions is by building up a growing inventory of drilled but uncompleted (DUC) wells. This is particularly apparent in the Permian, which accounts for the highest number of DUCs in the U.S., and is adding more of them while most other regions are seeing a drop in DUC counts. According to the latest EIA data, the Permian had 4,002 DUCs in June, up by 42 from May.

For small players saddled with debt, however, continuing to drill new wells or work down DUC inventories is necessary in order to make their interest payments. This further intensifies the pressure they currently find themselves under. Instead of the M&As smaller Permian players are hoping for, the industry could be hit by more bankruptcies over the coming months.

“What you want to look out for is companies spending from their revolvers, their credit facilities, and local banks as opposed to bonds,” del Pozzo said. “The banks actually have a claim on the assets,” he added, noting that the ability to still borrow made it particularly dangerous to have a growth-oriented strategy right now.

However, it would not be surprising if some companies still take this route because of the lack of options currently available to them. And further bankruptcies will only compound an increasingly bleak outlook for the Permian in the coming months despite the fact that the basin continues to dominate U.S. production.

Recommended Reading

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Aker BP’s Hanz Subsea Tieback Goes Onstream

2024-04-22 - AKER BP’s project marks the first time subsea production systems have been reused on the Norwegian Continental Shelf.