An offshore rig worker checks a meter. (Source: Shutterstock.com)

With an activity slowdown looming in the U.S. shale sector as E&Ps carry out plans to spend less, oilfield service providers see a pickup in pace offshore.

Top executives with Halliburton and Schlumberger pointed to improved offshore activity ahead while delivering outlooks and second-quarter 2019 performance updates.

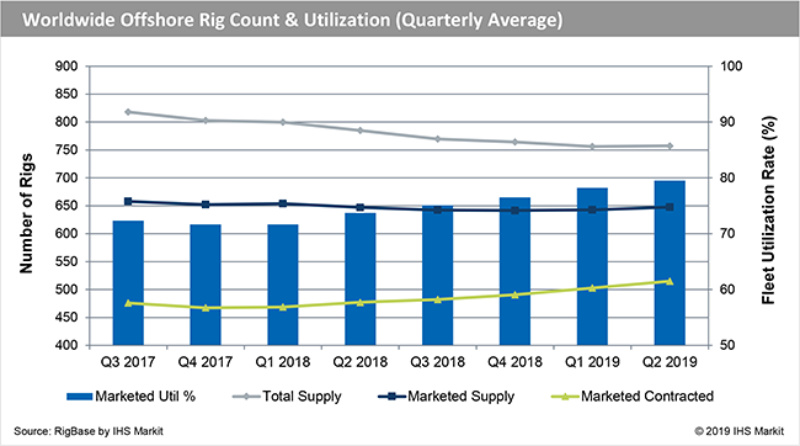

“We’ve seen enough signs to anticipate future growth,” Halliburton CEO Jeff Miller said on an earnings call July 22. “In June, the year-over-year change in offshore rig count was up for 12th consecutive month and appears to be gaining momentum.”

RELATED: Halliburton Profit Beats On International Demand

The market downturn ushered in better ways of operating for offshore companies, including those competing against nimble shale plays for spots in portfolios.

To become more efficient, offshore players have revamped development plans for expensive projects. They have embraced opportunities to use existing infrastructure, collaborate and utilize new technology, leading to project sanctioning with lower breakeven costs.

The recovery has been slow but steady.

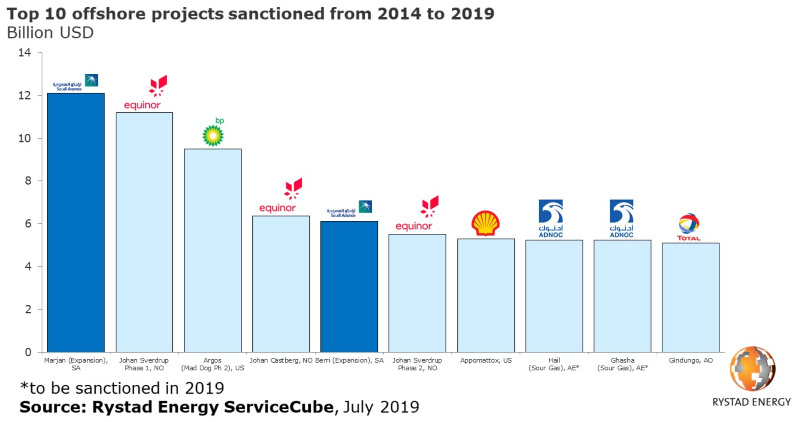

“With offshore free cash flows at nearly record highs, E&Ps are betting big on new projects,” Matthew Fitzsimmons, vice president of oilfield service research at Rystad Energy, said in a statement. “Offshore project sanctioning in 2019 looks ready to reach heights not seen since the $100 barrel of oil.”

The energy research firm said offshore project sanctioning has already passed $50 billion this year. The list includes Saudi Aramco’s Marjan and Berri expansion projects, Phase 2 of the Equnior-led Johan Sverdrup project in the North Sea, the Mero-2 FPSO offshore Brazil by the Libra consortium and the Exxon Mobil Corp.-led $6 billion Liza Phase 2 development offshore Guyana.

More financial investment decisions (FID) are expected by year-end.

All of the projects could translate into contracts for oilfield service providers.

“However, the majority of large offshore projects being sanctioned or awarded today have a 2020 or 2021 start date,” Miller said on the Halliburton call.

Oilfield service companies are already seeing an increase in business—both in shallow water and deepwater.

“As offshore momentum builds, shallow-water rig activity grew by 14% in the first half, and deepwater activity is strengthening as new projects are sanctioned,” Schlumberger COO Olivier Le Peuch said on the company’s earnings call July 19.

But Le Peuch, who will become the company’s CEO when Paal Kibsgaard retires Aug. 1, also noted that the offshore rig count has not increased significantly. Still, “customer interest is high, indicating stronger activity coming in the second half of the year,” he said.

He later added that deepwater is seeing less growth in rig activity, but FIDs expected in the third and fourth quarters “would translate in further growth and acceleration of deepwater” moving into next year.

The industry is experiencing a rebound in deepwater activity in West Africa, he said, calling shallow-water activity “very solid” in the Middle East and Asia.

“So, I feel a combination of this is very favorable,” Le Peuch said. Plus, “offshore exploration is up more than 30% year-over-year, year-to-date, and this benefits very much wireline.”

Schlumberger said its North America offshore revenue grew 10% sequentially during second-quarter 2019 on offshore exploration. The increase was driven by “strong WesternGeco multiclient license sales,” Le Peuch said.

Seismic sales were also behind the 12% sequentially increase in consolidated revenue growth in Latin America, while offshore activity led the way for a 19% sequential revenue growth in the Far East Asia and Australia GeoMarket.

Halliburton, which has been working to gain international market share by increasing its product service line presence, has been busy in the North Sea offshore Norway and the U.K., according to Miller.

“We have significantly increased our market share there by winning large tenders. Currently, we’re sold out of drilling and wireline tools in the North Sea,” he said. “As activity keeps ramping up, especially with independent operators taking over IOC assets in the U.K., supply and demand balance has significantly tightened for tools and I expect that incremental work will come with better pricing.”

The company also sees similar dynamics in the Asia-Pacific market, he added.

Baker Hughes, a GE company, is scheduled to discuss its second-quarter 2019 earnings on July 31.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Imperial Oil Shuts Down Fuel Pipeline in Central Canada

2024-03-18 - Supplies on the Winnipeg regional line will be rerouted for three months.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.