Tight global oil and gas supply will continue to bolster strong across-the-board performance of major oilfield service and equipment providers in 2023, the companies’ top executives said during January earnings calls.

International operations are expected to thrive as countries reinvest in fossil fuel production to replace imports from Russia. Offshore, in particular, which accounts for a large share of international activity, will drive much of that growth.

“There is a greater sense of urgency around energy security,” Olivier Le Peuch, SLB’s CEO, told analysts on Jan. 20. “This is resulting in new investment in capacity expansion and diversity of supply. You will see this reflected in the number of new projects sanctioned, gas supply agreements signed and the return of offshore exploration, all at a pace unforeseen just 18 months ago.”

The heads of Baker Hughes, Halliburton and SLB all discussed plans to return high levels of their free cash flow (FCF) to shareholders during the calls.

RELATED

Halliburton Notches 21% Earnings Jump, Plans to Hike Free Cash Flow Returns to Shareholders

Baker Hughes Q4 Earnings Soar, But Miss Analyst Expectations

SLB Beats Expectations with Strong Q4 Earnings

Baker Hughes, SLB CEOs Talk ‘New Energy’

Bright international scenarios

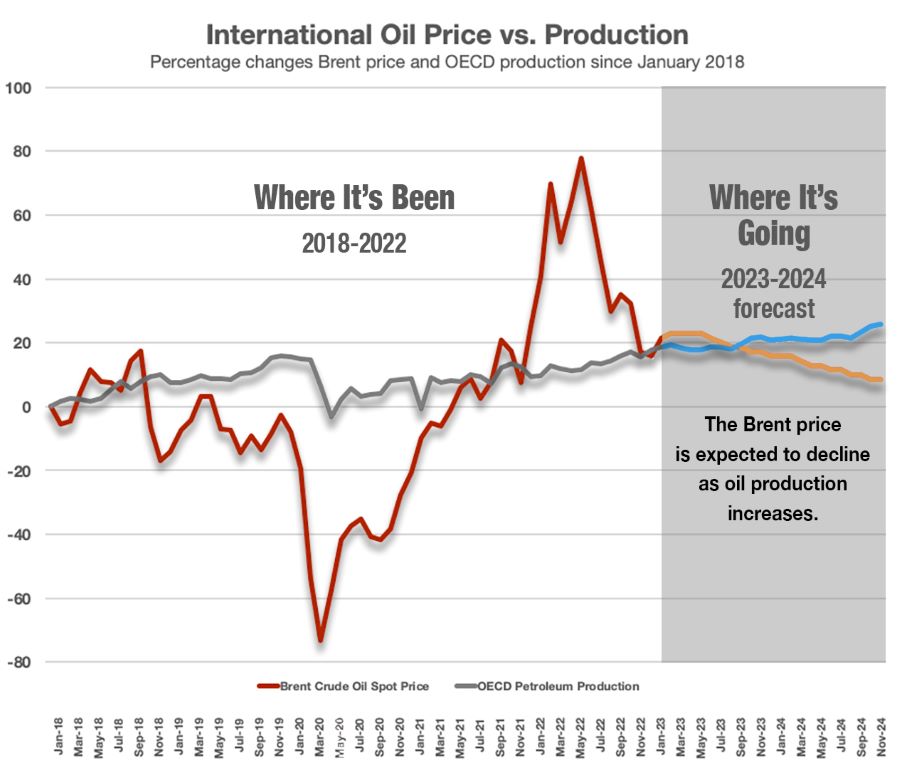

The companies’ bet on international growth is supported by the U.S. Energy Information Administration (EIA). OECD production is forecast grow about 8% from 32.3 MMbbl/d in 2022 to 34.9 MMbbl/d in 2024. Non-OECD production is expected to be flat and total world production is expected to rise about 2.9%.

SLB’s international revenues accounted for $6.19 billion, or 79%, of its fourth-quarter total of $7.88 billion. That constituted a 5% sequential and 26% yoy increase. Full-year international revenues totaled $21.9 billion, or 20% higher than 2021. Adjusted EBITDA came to $5.43 billion, or a 24.8% margin, compared to 24.3% in 2021.

To analysts, the numbers were encouraging.

“While some might take the small increase as a negative, we actually believe it’s a positive,” Piper Sandler senior research analyst Luke Lemoine wrote. “It shows international margins still have a considerable amount of room to expand as the more profitable areas of the Middle East and offshore are just inflecting and should drive a meaningful increase in margins over the next few years.”

For Matt Murphy of TPH Energy Research, international potential overcame other reservations about SLB.

“Despite trimmed near-term FCF and shareholder returns projections, we continue to like the story as a play on the constructive international growth backdrop,” he wrote.

Analysts liked the approach taken by the other major oilfield service companies as well.

“Halliburton’s vision of the future of the oilfield aligns with our own—an industry that is lower cost/higher margin, less capital intense, more internationally focused and digital—with an enhanced return profile,” wrote James West, senior managing director at Evercore ISI. “The industry is in the beginning of a global upcycle for E&P spending, especially internationally and offshore, which coupled with limited oil service capacity, will drive significant top line and earnings growth as it unfolds.”

The strengthened international positioning, West wrote, “will continue to drive significant earnings upside in this multi-year upcycle and as NOCs [national oil companies] rebuild production capacity globally.”

International business accounted for 52.7% of Halliburton’s full-year revenues of $20.3 billion. International revenue for the year increased 20% to $10.7 billion.

Noting that Halliburton expected its North American spending to rise 15% in 2023, Lemoine said “international is expected to be up 15%+ as well, and it wouldn’t shock us to see this be up ~20% year-over-year, driven by the Middle East and Latin America. Roughly one-third of the broader international market is resetting every year, and the market could be in a position where it grows 15%+ for the next few years.”

Baker Hughes reported a 4.7% increase in yoy international revenue for the fourth quarter to $2.55 billion. The company is primed for growth to continue.

“For the full year 2023, we expect another strong year of market growth internationally, spread across virtually all geographic regions, led by the Middle East, Latin America and West Africa,” Baker Hughes CFO Nancy Buese told analysts. “Overall, we expect international D&C [drilling and completions] spending to likely increase in the middle double digits on a year-over-year basis.”

Free cash flow to shareholders

Halliburton reported FCF of $856 million in the fourth quarter and $1.43 billion for the year, up 4.5% over full-year 2021. The company announced it would seek to return at least 50% of FCF to shareholders.

“There’s nothing magic in the 50%, per se,” Halliburton CFO Eric Carre told analysts. “We think that it’s a number that gives some level of certainty in terms of what we’re going to return to shareholders while giving us a lot of optionality to continue to invest in our business, to continue to make bolt-on acquisitions or to make acquisitions that are complementary to our product line business. And also give us optionality over the next few years to continue to work on strengthening our balance sheet.”

Baker Hughes reported FCF in the quarter of $657 million, up 57.6% from the previous quarter. The company also aims to return 60% to 80% to shareholders. Baker Hughes returned $1.6 billion to shareholders in 2022.

“Based on the EBITDA guidance midpoint of $3.7 billion and the…FCF conversion, FCF should hover around $1.5 billion to $1.7 billion," Lemoine wrote. "Based on the current dividend rate along with the midpoints of FCF and FCF returns, there could be a few to several hundred million of share repurchases; however, dividend growth will be prioritized, and share repurchases will be used to fill in.”

SLB expects to distribute more than 50% of its FCF to shareholders. A 43% increase in the quarterly cash dividend brought it to $0.25/share.

“For 2023, we are targeting to return a total of $2 billion to our shareholders in the form of dividends and buybacks,” said Stephane Biguet, executive vice president and CFO.

Lemoine said he expected 2023 dividend payments to be in the neighborhood of $1.3 billion, leaving about $700 million for buybacks. SLB said it intends to repurchase at least $200 million in the first quarter.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.