The oilfield service firms credited higher activity, a tighter services market and targeted price increases in North America for their Q2 performance. (Source: Hart Energy)

Oilfield service companies Helmerich & Payne Inc. (H&P), NOV Inc. and Weatherford International Ltd. reported broadly successful second-quarter earnings dominated by improved revenues as renewed demand in the oil patch largely lifted the companies’ fortunes.

The firms credited higher activity, a tighter services market and targeted price increases in North America for their performance.

Oilfield ServiceCompany EarningsOverview($MM) |

|||

| Company | Operating income/MM | EBITDA | Revenue |

| H&P | $34 | $131.4 | $486 |

| Weatherford | $104 | $186 | $1,064 |

| NOV | $68 | $150 | $1,724 |

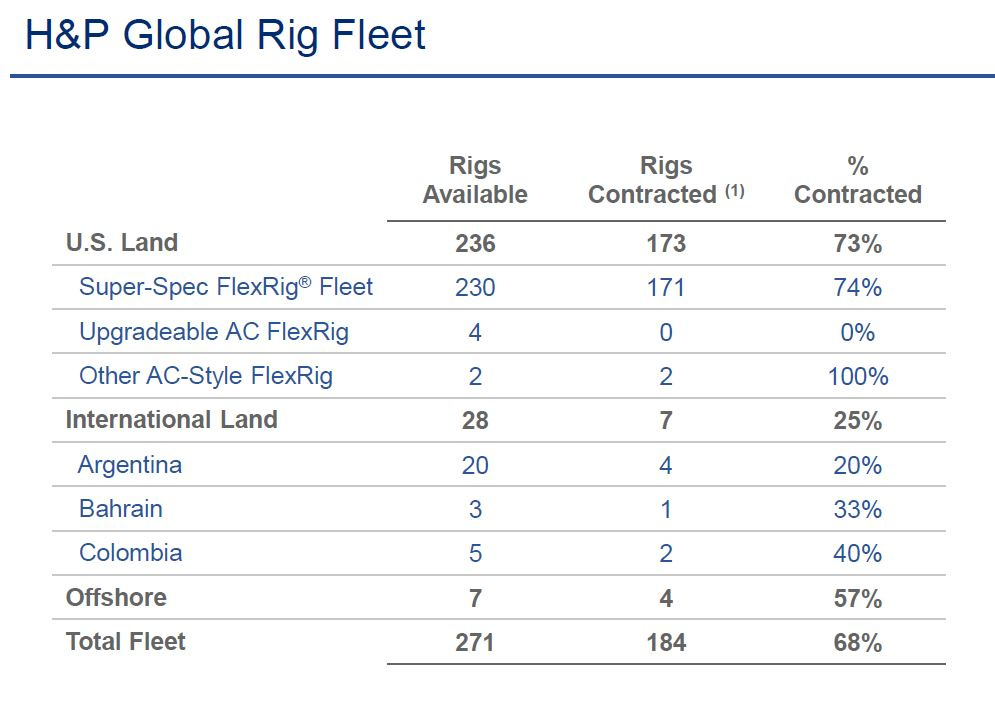

H&P reported that 173 of its 236 rigs (73%) were contracted in the U.S., including its super spec rigs. In the U.S. market, the company also reported a remarkable increase in operating income, rising to $57.4 million in the second quarter compared to $1.3 million in the previous quarter.

“The increase in operating income was primarily due to improving contract economics and modestly higher activity levels during the quarter,” the company’s earnings report said.

The company said it is targeting 50% direct margins in North America through increased pricing.

“We expect North America Solutions direct margins to be between $185-$205 million, which includes approximately $6 million in estimated reactivation costs,” the company said.

Goldman Sachs analyst Neil Mehta said H&P’s rig margin per day was $10,900 when adjusting for rig reactivation costs, 5% above Goldman’s estimates. H&P’s $131.4 million in EBITDA was 9% above its estimate of $120.4 million and 19% above FactSet consensus.

“The EBITDA beat was driven by stronger overall revenue and ~85 bps better EBITDA margin overall,” Mehta said.

H&P reported net income of $18 million from operating revenues of $550 million for the quarter compared to a net loss of $5 million in the first quarter. President and CEO John Lindsay said the company’s financial results are beginning to reflect the benefits of several strategic initiatives, “particularly those impacting pricing in our North America Solutions segment.”

“As expected, we ended the quarter at 175 rigs representing only a modest rig count growth during the quarter,” he said. “Fiscal discipline together with additional contractual churn allowed us to re-contract rigs without incurring additional reactivation costs and redeploy them at significantly higher rates.”

Lindsay said its rapidly improving contract economics are primarily driven by H&P’s value proposition to customers in a tight market for readily available super-spec rigs.

H&P guided to gross margin of $185 million-$205 million for its North America Solutions in fourth-quarter 2022, exiting the year with a U.S. land rig count exit rate of 176 rigs, Mehta said.

Energy underinvestment

NOV reported second-quarter revenues of $1.73 billion, a 12% increase from the first quarter and a 22% year-over-year improvement, according to its July 27 earnings report.

The company’s adjusted EBITDA for the quarter hit $150 million, 31% above Goldman’s estimates and 28% above FactSet consensus. That was $47 million more than the previous quarter and $46 million more than the same time last year.

Clay Williams, chairman, president and CEO, said the quarter’s results reflected improved execution, customer demand and pricing.

“Our team was better able to navigate through persistent global supply chain challenges, improving our ability to meet the rising demand for our critical product and technologies and resulting in significantly improved profitability,” Williams said in an earnings press release.

But he warned that the industry is struggling to ramp up following years of downsizing and underinvestment.

“The urgent need to rebuild oilfield service capabilities remains constrained by the limited availability, of certain critical components; freight and logistics challenges; tightness in many labor markets; inflationary pressures; and higher costs-of-capital for oilfield enterprises,” he said.

Tudor, Pickering, Holt & Co. analyst Matthew Murphy wrote on July 28 that NOV posted revenue and margin beats “across the board.”

“We expect the conversion of FCF to accelerate in” the second half of the year, Murphy said.

EBITDA up

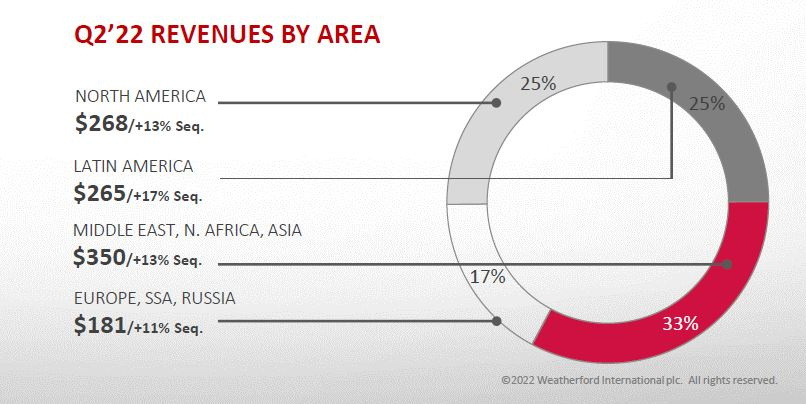

Weatherford similarly reported increases in revenues and operating income. The firm reported $1 billion in revenues for the quarter, a 13% increase sequentially and 18% year-over-year.

The company’s operating income was $104 million in the second quarter of 2022, compared to $25 million in the second quarter of 2021. Second-quarter 2022 net income was $6 million, compared to a net loss of $80 million in the first quarter of 2022 and a net loss of $78 million in the second quarter of 2021.

Girish Saligram, president and CEO, said Weatherford’s “market-leading offerings continued to gain commercial traction with solid fall-through on margins.”

“We continue to make progress on our commercial and operational paradigm changes and our second quarter adjusted EBITDA margins of 17.5% and free cash flow of $59 million demonstrate those improvements taking hold,” Saligram said.

Goldman Sach’s analyst Ati Modak said Weatherford’s $186 million EBITDA was 14.2% above the firm’s expectations, driven by better revenues and EBITDA margin.

“The stronger revenue was driven by Production and Intervention (+10%), Drilling and Evaluation (+5%), and Well Construction and Completions (+4%),” Modak wrote in a July 27 report. “EBITDA margin beat was driven by better margins in the Production and Intervention segment (+574 bps), Drilling and Evaluation (+172 bps), partially offset by softer margins in the Well Construction and Completions segment (-214 bps). Free cash flow for the quarter was $59 million vs, GS estimate of $28 million and consensus of $17 million.”

The company updated its full-year revenue guidance to an increase in the mid-teens range versus previous guidance of high single digits to low double digits.

Recommended Reading

Atlas Energy Solutions Declares Dividend

2024-02-09 - Atlas Energy’s dividend represents a 5% increase from the previous quarter’s dividend.

Mike Howard Joins Atlas Energy Solutions’ Board

2024-02-15 - Mike Howard brings more than 28 years of midstream energy experience to Atlas Energy Solutions’ board of directors.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.