(Source: Shutterstock.com)

Oil Search Ltd. is expanding its Alaska profile through a series of A&D transactions it recently entered into, including a $450 million acquisition to buy more of a massive North Slope discovery.

Also, part of the deal-making was a transaction with Spain’s Repsol SA. The transactions follow Oil Search’s entry into one of the largest U.S. oil discoveries in decades made jointly in 2017 by Repsol and Denver-based independent, Armstrong Oil and Gas Inc.

Initially, Oil Search agreed to acquire half of Armstrong’s interest in the Alaskan discovery—named Horseshoe—for $400 million, which the company closed in February 2018. However, the deal also included a provision to buy Armstrong’s remaining interests for $450 million.

Oil Search, Papa New Guinea’s largest company and investor, had until June 30 to exercise the option.

On June 29, just under the wire, Oil Search agreed to take the remaining Horseshoe interests. Oil Search said in a news release that the deal’s structure gave the company enough time “to develop a better understanding of the full Pikka Unit Nanushuk oil field potential and regional exploration opportunities.”

__________________________________________________________________________________________________

RELATED:

Natural Gas Player Oil Search Ltd. Talks Alaskan Oil

__________________________________________________________________________________________________

Discovered in March 2017, the Horseshoe Field is located in Alaska’s Nanushuk Formation. The 1.2 billion-barrel oil find was the result of exploration partnership between Armstrong and Repsol. The companies’ described the find as the “largest U.S. onshore conventional hydrocarbons discovery in 30 years.”

Since the initial acquisition last year, Oil Search has said the Horseshoe discovery has the potential to be even larger based on 2018 drilling results conducted by ConocoPhillips Co.

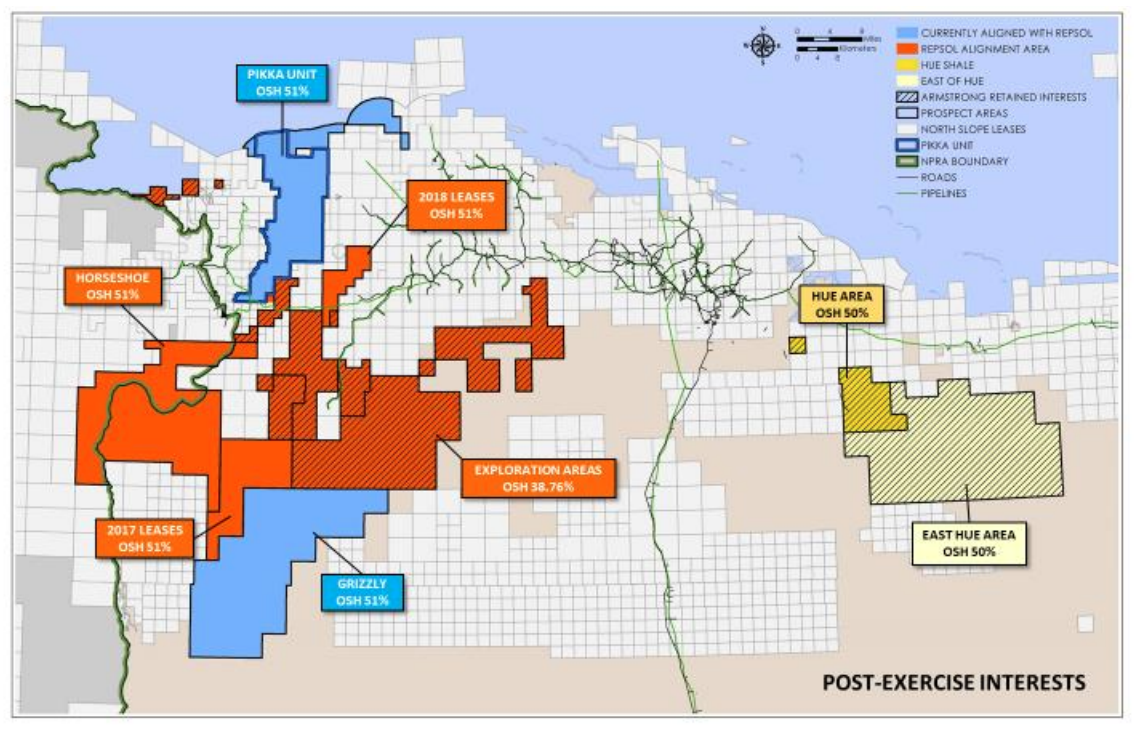

In total, the exercised option comprises Armstrong Energy LLC’s remaining 25.5% interest in the Pikka Unit and 37.5% interest in the Horseshoe area plus a further 37.5% interest in the Hue Shale leases and a 25.5% interest in other exploration areas in the Alaska North Slope.

Both transactions also include interest owned by GMT Exploration Co. LLC, another Denver-based independent.

“The acquisition of Armstrong/GMT’s remaining interests allows Oil Search to maintain operatorship of a world-class oil development close to existing infrastructure, with material appraisal and exploration growth potential,” Oil Search said June 29.

Oil Search said it will continue to work together with Armstrong in accordance with an area of mutual interest agreement that was entered as part of the original March 2018 acquisition. The pair plan to review opportunities on the North Slope of Alaska outside the Pikka and Horseshoe areas.

Additionally, Oil Search entered into an asset swap transaction with Repsol on June 29 to align ownership interests across their now shared Alaskan assets. The swap will result in a net payment of $64.3 million to Oil Search.

The company also plans to partially sell down its Alaskan assets and is looking to launch a formal divestment process of some of its interests. A sale is scheduled to conclude in first-half 2020, ahead of a final investment decision for the initial Pikka Unit Nanushuk development. Oil Search intends to retain a roughly 35% interest in its core assets.

Oil Search said the Armstrong option is scheduled to close in late August. The company will fund the acquisition from its existing corporate debt facilities, which are anticipated to total $1.2 billion.

Shearman & Sterling LLP advised Oil Search in connection with its exercise of the Armstrong option while concurrently transacting to align project interests with Repsol. The Shearman & Sterling team was led by partner R. Coleson Bruce, counsel Angie Bible and associates John Craven and Ryan Staine.

Gibson, Dunn & Crutcher LLP is advising Repsol E&P USA Inc. in its alignment transaction and project development arrangements with Oil Search. The Gibson Dunn transaction team is led by Houston partner Justin T. Stolte.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Evolution Petroleum Sees Progress on SCOOP/STACK, Chaveroo Operations

2024-03-11 - Evolution expects to participate in future development blocks, holding in aggregate over 70 additional horizontal well locations.