Oil prices climbed for a fourth straight day and hit their highest in two and a half weeks on Dec. 22 with U.S. crude, heating oil and jet fuel stocks growing tighter just as a wintry blast hits the United States.

Brent crude futures gained $1.17, or 1.4%, to trade at $83.37 at 1235 GMT, extending gains of around 2.7% from the previous session.

U.S. WTI crude futures were up $1.11, or 1.4%, at $79.40 a barrel.

Both benchmark contracts jumped on Dec. 21 after government data showed U.S. crude inventories fell by much more than analysts had expected, posting a drop of 5.89 MMbbl for the week ending on Dec. 16.

Distillate stocks, which include heating oil and jet fuel, also declined, going against expectations for a build, in what PVM analyst Stephen Brennock called "an overwhelmingly price-supportive stock report from the EIA."

The falling stockpiles come as demand for heating oil is set to soar with a powerful winter storm hitting the United States, with sub-zero wind chills expected as far south as Texas and record-breaking lows forecast for Florida and eastern states.

Jet fuel consumption is also expected to pick up with a post-COVID boom in travel for the end-of-year holiday season, although transport fuel demand might be reduced if the storm keeps people from travelling.

Demand worries, however, stemming from China's COVID-19 surge and fears of a global recession may keep oil futures in check.

China may be struggling to keep an accurate count of COVID infections as it experiences a big spike in cases, a senior World Health Organization official said on Dec. 21 amid concerns about a lack of data from the country.

Recommended Reading

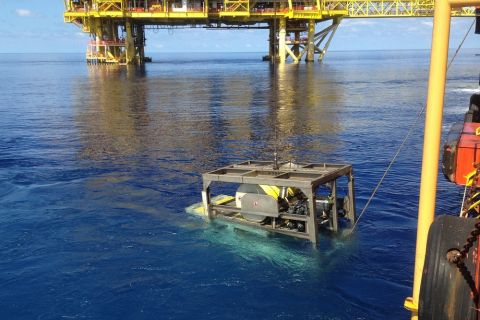

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

Sapura Acquires Exail Rovins’ Nano Inertial Navigation System

2024-02-01 - Exail Rovins’ Nano Inertial Navigation System is designed to enhance Sapura’s subsea installment capabilities.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

TGS Commences Multiclient 3D Seismic Project Offshore Malaysia

2024-04-03 - TGS said the Ramform Sovereign survey vessel was dispatched to the Penyu Basin in March.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.