The industry downturn that began in the second half of 2014 forced oil and gas producers to cut spending and suspend, delay or cancel upstream development projects. This analysis reveals how much capital the industry has taken off the table, how much production has been deferred, and what are the revised spending and production outlooks for the next five years as oil prices recover.

The industry was on its way to spending $620 billion in 2014 with Brent staying above $100 per barrel well into the third quarter of the year. Initially, the price decline had little effect on spending as producers’ annual budgets were mostly set at the beginning of the year. The price-collapse impact was mostly felt by U.S. shale producers as their investment cycle is much shorter, thus shale investment is more sensitive to short-term commodity-price changes.

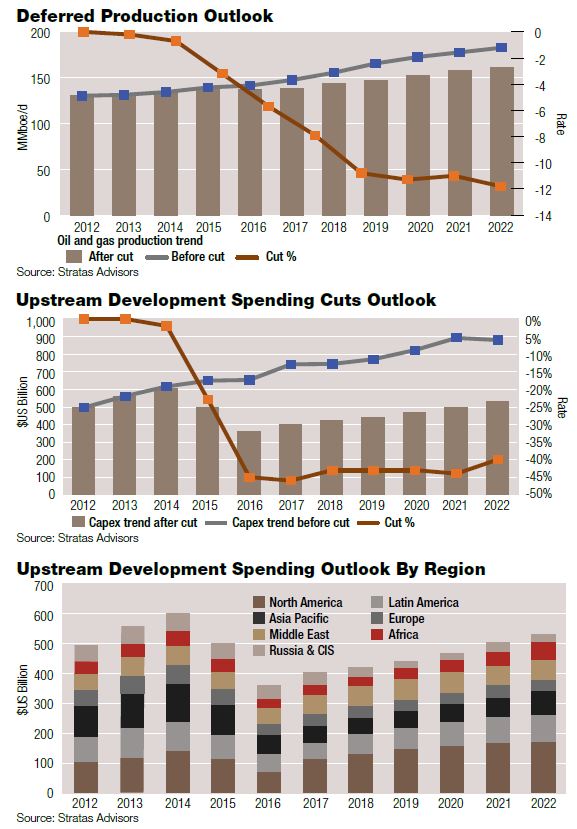

When Brent dropped below $50 in January 2015, producers started making significant budget cuts–totaling about 23%, or $150 billion, from a would-be $650-billion upstream development budget for the year. The situation in 2016 became worse as Brent bottomed below $30 in January 2016. Another $140 billion, or 45% of the would-be $650-billion budget, was cut to make the year’s spending at $360 billion.

Further cuts were finally over in 2017 as the industry welcomed the price recovery upon OPEC’s decision to curb supply. As a result, global development capital spending in 2017 increased to about $400 billion, mostly driven by recovered activity in U.S. shale. The accumulative total spending cuts on upstream field development reached more than $800 billion in a four-year period (2014-2017), and 2017 spending has been set as the new reference point as future spending is not expected to return to the 2014 level.

The cuts did not show an instant effect on production because of the long-term nature of the investment cycle for conventional developments. The short-term effect mainly sits on the slowdown of U.S. shale production. Stratas Advisors’ production forecast outlook scenarios before and after the spending cut show only a small amount of daily production was deferred in 2014--about 240,000 barrels of oil equivalent (boe) or about 0.2% of global production. The deferred production gap widened in time, first being felt by U.S. shale production and the OPEC cut, then by long-cycle investment projects, such as Canadian oil sands and global deepwater developments, which would be producing by 2019 if not for the downturn. By 2022, Stratas sees about 21 MMboe of daily production being chopped off--about 12% of global production.

North America will draw about one-third, or $800 billion, of total global investment in the next five years, driven by U.S. shale spending. The Middle East, Asia Pacific and Latin America will each draw about $340 billion--15% of total investment. Africa is the other high-growth region--from $35 billion in 2017 to $60 billion by 2022; it will take about 9% of the global total in the five-year period. Europe and Russia and CIS together will take about 12%.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.